Rated as a leader by The Forrester Wave Report™: Financial Services CRM, Salesforce knows service — of any kind. CRMs for financial services are changing and so are the needs of customers. We weed through the noise to bring you exactly what features you need in a financial services CRM.

You’ll need a data-first dashboard, automation, and AI to thrive

Here are next-generation financial services CRM features that you need to bridge the gap between your team and your clients, increase efficiency, and build a future-proof customer experience.

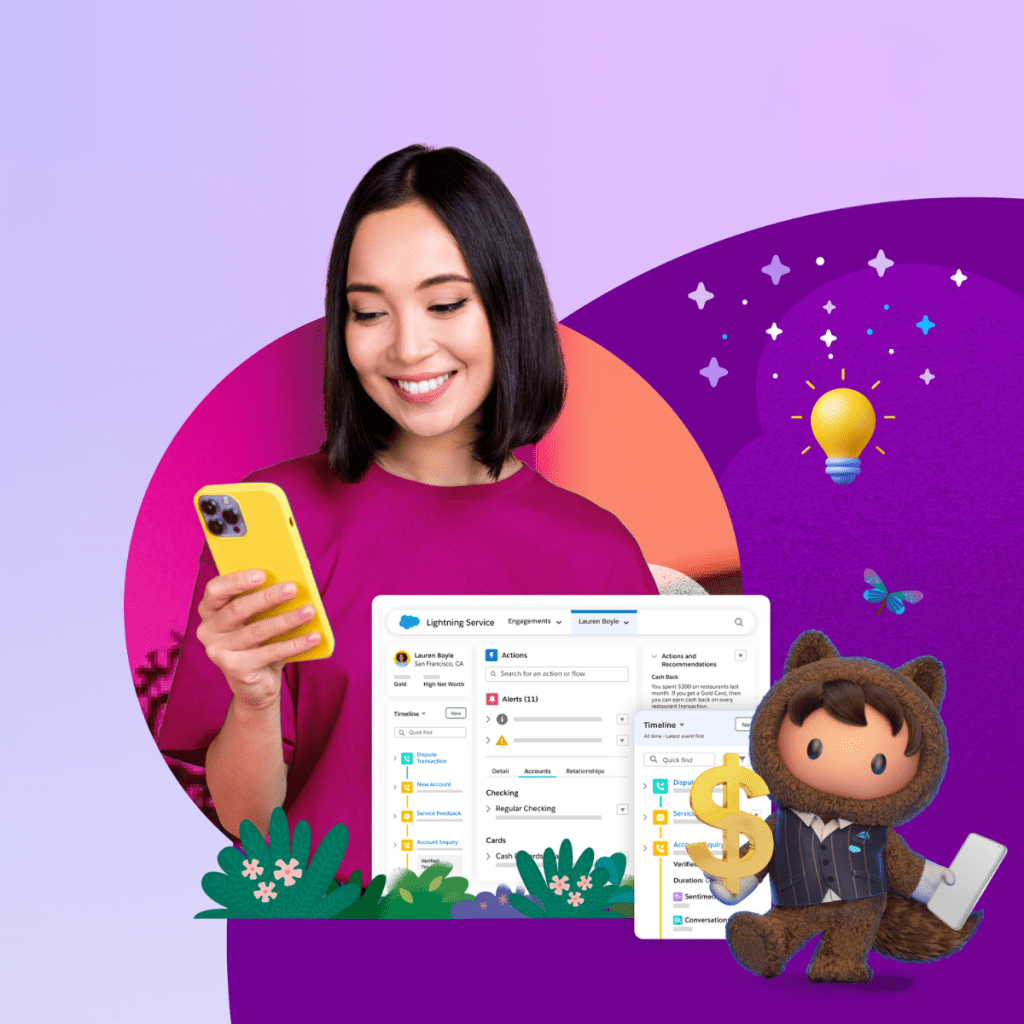

1. Pre-built CRM solutions tailored for financial services

70% of financial services executives don’t have the time or budget to build out client-centric solutions. Reducing build, delivery, and maintenance is top of mind for every financial services executive. Reducing their cost to serve hits the bottom line and the net interest income of every banker. They are looking to increase value in less time with minimal expense.

Out-of-the-box CRM applications for financial services should come with pre-built, modern user experiences tailored to the job function of employees. For example, a banking service agent can serve a high net worth client faster with a complete 360 view of the client’s financial account, goals, life milestones, and account alerts. Pre-built CRM solutions allow the service agent to quickly view their customer’s portfolio holistically and provide personalised advice and guidance to their customers versus a legacy system lacking rich data.

Generative artificial intelligence (AI) can enhance this further with a digital assistant to the agent that can share pre-approved scripts, recommendations, relevant and suitable offers, and discussion summaries for follow-up or compliance.

Data and AI-powered next-generation CRM vendors that provide purpose-fit solutions with rich data relevant to banks, insurers, and investment and wealth management firms can support these priorities from the ground up and accelerate business process transformation.

Get top industry CRM insights

In the fast-paced world of financial services, adopting an industry CRM can be a game-changer. From reduced cost to improved ROI, get the latest report to learn why financial services are investing in tailored CRMs.

2. Industry partner value-adds

Financial services purpose-built CRM industry solutions should have large ecosystems of integrated software applications, implementation partners, marketplace add-ons, and packaged automation and integrations to meet your business needs.

Financial service firms rely on partners that have additive solutions for critical components (like insurance claims fraud detection, credit verification, or Know-Your-Customer identity checks). Banks, lenders, wealth managers, and insurance brokers, and carriers have complex multi-tenant environments. This makes partnering with the right software company — one that has a powerful and secure ecosystem — key to implementation and deployment success.

According to Accenture, 95% of IT leaders are prioritising automation to increase operational efficiencies. Understand how vendors and partners work together at different layers of the relationship — and if their optimisations are a good fit for you.

3. Value and ROI across the entire customer lifecycle

Next-gen AI-powered CRMs have evolved to do more than drive sales; the right solution helps you connect the dots across the customer lifecycle — in both human and digital interactions.

78% of customers use multiple channels to start and complete a transaction. Financial services CRM solutions should allow customers to use tools such as online banking for quick transactions like replacing a credit card but switch to a human when they have more complex needs, such as wanting financial advice.

This allows financial services teams to optimise customer value and ROI across the customer lifecycle — from lead generation to offer optimisation, product origination, journey orchestration, and intelligent insights and analytics. Look for a platform that allows you to develop complete omnichannel end-to-end processes for use cases like onboarding, account origination, account maintenance, and servicing.

4. Agile and adaptable business processes

A CRM provider that offers low or no-code tools allows financial services firms to create processes in a declarative manner and be more agile. When a regulation changes, a low or no-code CRM allows firms to meet company policies and adjust processes more efficiently.

For example, if an insurance provider wants to change their policy around fees, they should be able to do so by simply updating a few business rules. This is typically costly and requires development resources to have a legacy system, but using a modern financial services CRM a business analyst could take on this task easily.

Look for a vendor that has out-of-the-box capabilities, providing a powerful roadmap to innovate. Over time, these capabilities will allow you to adjust and tailor journeys using low-code or no-code tools to get you to market faster.

5. Embedded automation and AI

Intelligent automation and AI can improve the customer experience, increase revenue, and enhance security and compliance. However, 76% of executives struggle to deploy AI effectively — and 79% of financial services customers are unsure about trusting AI.

AI will be crucial in helping financial services institutions comply with changing regulations. However, the financial services industry reinforces strict regulatory complexities and compliance that can cause obstacles when embedding AI. When looking for a CRM, consider one with built-in regulatory considerations in their use of AI to reduce risk while building trust.

Prepare for the wave of the financial future

Despite economic uncertainties, financial services leaders are still determined to accelerate innovation. The good news is that a financial services CRM has what you need to innovate. A CRM built specifically for financial services can help optimise customer acquisition and engagement, drive customer self-service, and uncover insights into customers’ activity and behaviours. It’s essential for your firm to drive innovation — and a faster path to value.

UPCOMING WEBINAR

How to Drive Efficient Growth With Data, Automation and AI-Powered Customer Service

Join us on Thursday, 5 September, 2024 at 11:00 AM SGT for a valuable session on accelerating the evolution of your service processes, and how to transform your call centre into an efficiency hub.