The insurance industry is filled with potential, but companies remain stuck in old ways, leaving customers unhappy and disconnected. One in three customers switched providers last year, due to unsatisfactory insurance customer experiences. At Salesforce, we ask, “What do people truly want when they interact with their insurance company?”

Extensive research shows that customers, both new and old, want more than just coverage and affordability. They seek understanding, simplicity, and empathy. Only 43% of customers say their insurer anticipates their needs, a disappointing statistic considering evolving expectations.

Let’s look at this through the lens of a typical customer. Meet Natalie, a physical therapist and mother, who’s budget-conscious, comfortable with technology, and who values human connection when engaging with businesses, no matter the size. We’ll trace her path to understand where she feels supported and, more importantly, where she feels lost while navigating her insurance journey.

Our goal is to examine how we might reimagine the insurance customer experience in a way that speaks to her core needs and desires, inspiring transformation along the way. Let’s begin.

See why the future of insurance is AI

We’ve surveyed over 6000 financial service customers to learn how the future of financial services can help you automate routine needs and personalise experiences when it matters. Learn how AI can drive efficiency and personalisation in insurance.

Stage 1: Searching for security

In this opening stage, Natalie feels anxious but hopeful as she begins evaluating her options for how to best protect her home and automobiles. Her discovery can either empower her with clarity and conviction or leave her feeling overwhelmed and uncertain. As a discerning consumer, Natalie has the grit to push past the noise to find the right solution, but insurance companies vying for her business must challenge themselves to deliver a helpful, seamless experience.

Today’s customer experience, with its numerous touchpoints and channels, can present several challenges for individuals like Natalie as they start to explore their options and evaluate potential solutions. A majority of insurers use three or more systems for client engagement, frustrating customers as they encounter repetitive tasks across different channels. This often leads to key data and information getting duplicated or lost in the shuffle. For the insurer, this puts an unnecessary administrative burden on their employees, who should be focused on building relationships and delivering value.

Tomorrow’s insurance customer experience:

At Salesforce, we’re helping design an entirely new insurance customer experience with intelligent systems and automation. As Natalie evaluates her options, her information and activity are discreetly monitored and used for context. This advantages both the end customer and the agent. It ensures a thoughtful experience by recalling Natalie’s journey and providing tailored guidance and reduced friction, while also helping agents know when to prioritise her for personal follow-up. Overall, the streamlined approach empowers agents to excel in relationship-building while also boosting productivity.

Stage 2: Getting to know the insurer

After choosing an insurer, Natalie enters the onboarding phase, where initial interactions set the tone of her relationship. Carefully designed onboarding can instill trust and reassurance. At this stage, insurance companies should lead with thoughtfulness around the reasons for which the policy was purchased, going beyond transaction talk. Onboarding is not a checkbox to be marked complete; it is an opportunity to demonstrate the company values while creating moments to understand what customers like Natalie expect from the insurer.

Insurance onboarding frequently amounts to a series of decontextualised emails, overwhelming new customers with policy minutiae, bundling promotions, add-on features, loyalty programs, and app downloads. The communications can feel impersonal and poorly timed – a missed opportunity and a significant shortcoming of today’s customer experience since the onboarding window is when Natalie will be most attentive and engaged.

Tomorrow’s insurance customer experience:

The future of onboarding will vastly improve. Insurers will simplify the process for customers like Natalie and provide only essential information. Onboarding that keeps customer needs at the core can help obtain meaningful consent and establish trust and transparency around data practices. This, coupled with the harmonisation of engagement, behavioural signals, and third-party data will help insurers anticipate Natalie’s needs, resulting in her feeling connected and supported in her interactions.

With a renewed understanding that onboarding is an ongoing practice, insurers will only introduce new offers and programs when the moment is right. If six months in, Natalie adds a new young driver to her policy, an insurer might seize the opportunity to promote a young driver discount program.

Activating a data-driven approach can create a trusted environment where customers like Natalie share more data because they feel heard, understood, and helped. By understanding this ‘trust’-oriented purpose behind the data model, insurers can make informed decisions about what data to collect and how to use it, ultimately leading to better outcomes for both the customer and the organisation.

Stage 3: Filing a claim

When the unexpected strikes, Natalie may need to submit a claim. How efficiently and compassionately her insurer handles this process can impact her overall satisfaction and trust in the company. A claim signals uncharted territory where Natalie feels vulnerable and relies on guidance. Now is the time for companies to demonstrate their values in action.

When an incident occurs today, Natalie will submit a claim amid stress and uncertainty – only to face disjointed, manual processes that exacerbate her challenges. While some insurance companies have modernised their claims experience, much of the industry lags, resulting in today’s fragmented experiences marked by delays, opacity, and eroded trust.

Purpose-driven insurers view claims as an opportunity to provide comfort and care when customers feel most vulnerable. They recognise that efficient claims fuel trust and loyalty more than marketing ever could. By leveraging existing data and new technologies, insurers can transform a traditionally tedious and anxiety-inducing process into a streamlined, personalised journey.

Tomorrow’s insurance customer experience:

Say Natalie previously enrolled in a usage-based auto insurance program to help manage costs and reward conscientious driving habits. The same telematics providing safe driving discounts can help expedite her claim. When an accident occurs, her location, speed, and impact data can be instantly shared, enabling insurers to proactively reach out, respond to the situation, and accelerate claim filing. For the policyholder, this means less stress during a difficult time and greater trust. The claims process, though rarely enjoyable, can at least be hassle-free.

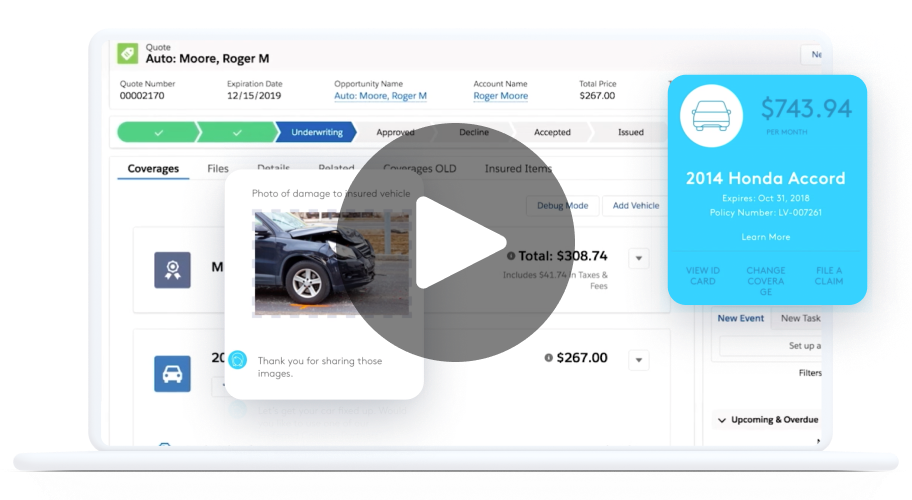

This future experience, which is already here for our customers at Salesforce, is a powerful convergence of AI, data, and trust, underpinned by a foundation of customer-centricity – all in one tool.

Stage 4: Ongoing assurance

Regular interactions with the insurance company can either deepen Natalie’s engagement and loyalty or leave her feeling detached and uninformed.

In today’s customer experience, it is not uncommon for policyholders to only hear from their insurers during significant milestones such as policy issuance, billing, or claims. These interactions are often transactional in nature, focusing on the functional aspects of the policy rather than building a relationship with the customer.

Tomorrow’s insurance customer experience:

Natalie’s future experience is proactive and emotionally intelligent. Say she lives in a climate hazard zone – subject to hurricanes, floods, or fires. Because her insurer has a firm grasp on the risk she faces, she consistently receives prevention guidance and personalised offers to enhance protection. When disaster strikes, outreach is immediate, empathetic, and supportive. Natalie knows her insurer has her back and that she can trust them as an advisor who delivers tailored recommendations, anticipatory guidance, and compassionate care.

The ingredients are all there: rich data, smart technology, and most importantly, human-centered strategy. Now insurers must combine them to design powerful insurance customer experiences that put people first.

How Salesforce deepens trust with insurance with prospects and customers

Learn how Salesforce helps insurance carriers, agencies, and brokerages put customers at the centre of every interaction while reducing operational expenses and increasing productivity.