The fourth edition of the Small and Medium Business Trends Report analyses the responses of more than 2,300 small and medium-sized business owners and leaders. Chris Yio, Regional Vice President leading the Small and Medium Business (SMB) segment in Asia, shares some key report insights.

Business as usual has been anything but “usual” over the past six months.

In early 2020, as the global economy thrived, most small- and medium-sized business (SMB) leaders were focused on how to win new customers and access capital. But, the onset of COVID-19 brought new challenges, including a health and economic crisis. As a result, SMB leaders have had to adapt, but a surprising number remain optimistic about the future of their businesses while navigating uncertainty.

Today we released the fourth edition of the Small and Medium Business Trends Report. The report looks at how 2,300+ global SMBs are evolving in the midst of so much change. These include SMBs from the Philippines, Singapore and Thailand. We had the unique opportunity to survey these business leaders in March 2020 and again in August 2020. Obviously, a lot has happened during those months.

The report shows how much SMBs have shifted their business operations over the past six months. These insights can help SMB leaders adapt and prepare for the next normal as the business landscape continues to deal with the pandemic.

Here’s a look at what’s changed for SMBs between March and August:

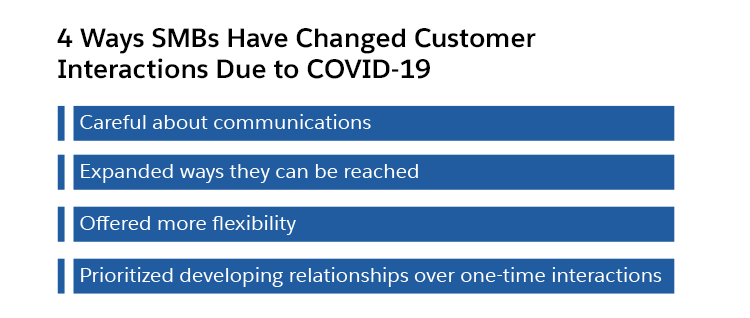

Businesses are doubling down on customer communications

It’s more challenging than ever to meet customer expectations. All businesses have to worry more about safety and clean work environments, meeting local health mandates, and offering contactless service. Implementing these measures is one thing, but making customers aware of them is another. So, it’s no surprise that 55% of the SMB businesses surveyed are more careful about how they communicate with customers — and almost half have expanded the ways customers can get in touch with them.

Unsurprisingly, SMBs are leaning into technology to keep customers close. Over half of growing SMBs say tech drives their customer interactions or customer base growth. Really, businesses are meeting customers where they’re most comfortable: 63% of millennial consumers — and 61% of Gen Z consumers — surveyed in July 2020 say they’re more likely to support small businesses with a digital presence.

SMBs now lean into customer-focused tech in all kinds of ways, from offering online ordering for curbside pickup or delivery, to putting more focus on email and social media messaging. We also see a continued embrace of business technologies like customer relationship management (CRM). SMB leaders who use CRM cited delivering better and faster customer service as the technology’s biggest benefit.

Malaysia-based property development company Myra is using CRM technology to improve customer interactions. Managing complex customer journeys was difficult with the company’s cumbersome paper-based CRM. Ken Goh, Head of Marketing at Myra, knew that digital transformation was the way forward.

“With Salesforce, we are now able to act more as a consultant than a standard property developer,” he says. “We can provide advice and support throughout the entire customer journey — from finance to interior design. That has helped to reduce our drop-off rate from 6.7% to 1.45%, while achieving a 65% to 70% reduction in the cost per lead.”

Growing SMBs are accelerating their use of technology, but use fewer apps

We mentioned SMBs use technology to keep customers close as they figure out how and when in-person business can happen safely. The pandemic is also driving those able to invest, to consider ways tech can help shape their future for the better. Growing SMBs, in particular, focus on three key areas where technology can help: customer interactions, workflows, and internal communications.

What’s really interesting is businesses are using fewer apps to get more done — and they’d love to use even fewer. The average number of apps SMBs use to run their business dropped over the past year. This coincides with a 24% increase since 2019 in SMBs’ use of a CRM system — CRMs are now used in more than half of SMBs and offer centralised systems for sales, service, and marketing within the same app. The technology (68%), consumer products (68%), and manufacturing (64%) industries are the biggest users of CRM systems.

Insurance company g&m, which is based in Singapore, is using Salesforce to overcome that challenge.

When CEO Douglas Chia took over the company from his father in 2013, he wanted to simplify insurance. This meant offering straightforward protection for the things his customers care most about. To achieve this vision, he needed a trusted and user-friendly CRM solution.

“We looked at a few different CRM vendors, but they were too complex,” he says. “Then we found Salesforce. We could use it straight out of the box for a simple deployment, and the intuitive user interface enabled fast adoption. Our move to Salesforce delivered a revenue gain of 30 to 40 per cent.”

Learn how SMBs are navigating the present and preparing for the future, by downloading and reading our latest Small & Medium Business Trends Report. Plus, find out the new technology trends reshaping the business world and see how they can help set up your business for growth.

Want to learn more?

Salesforce helps you find more customers, win their business, and keep them happy so you can succeed. Learn more about our small business CRM solutions today.

This post originally appeared in the U.S.-version of the Salesforce blog.