Sales Invoices: What You Need to Know to Get Paid on Time

Discover how to streamline the payment process, reduce customer inquiries, and enhance revenue lifecycle management.

You’ve made the sale, sent the invoice, and now… crickets. No payment. No response. Sound familiar? Delays aren’t always the customer’s fault. Sometimes, an unclear invoice could be the culprit.

Sales invoices might seem routine, but they’re essential for keeping your revenue on track. A well-structured invoice not only records sales but also ensures you get paid on time and improves cash flow.

Let’s take a closer look at how this simple document can make a big difference to your business.

Grow revenue faster with a single source of truth.

Discover how Sales Cloud uses data and AI to help you build relationships and close deals fast.

What you’ll learn:

- What is a sales invoice?

- Sales invoices vs. general invoices

- Sales invoices vs. service invoices

- The importance of sales invoices in business operations

- Key components of a sales invoice

- What are the different types of sales invoices?

- How to create a sales invoice

- Best practices for managing sales invoices

- Tips for getting invoices paid quickly

What is a sales invoice?

A sales invoice is a document issued by a seller to a buyer detailing the products provided, the amount the customer owes, the methods they can use to pay, and any other additional payment terms. In essence, it’s a way to formally request payment from a customer for a specific product.

Although sales invoices may seem similar to several other types of invoices, it’s important to know their differences. Understanding what makes sales invoices unique can help ensure smooth payments

Sales invoices vs. general invoices

A sales invoice records the purchase of products, detailing what was sold and the amount owed. On the other hand, a general invoice is a broader term that refers to any type of invoice, whether or not it involves the sale of goods.

The details of a general invoice vary depending on its purpose and is an umbrella term for all types of invoices. They may include sections similar to a sales invoice but don’t always list specific products.

Sales invoices vs. service invoices

A service invoice requests payment for a service performed by the seller. In contrast, a sales invoice asks for a tangible product’s payment.

For example, a service invoice may be used by a professional services firm to request payment for an engineering or architecture project completed by their experts. Other uses could include consulting for a cybersecurity company or a keynote speaker’s fee for a corporate event. This type of invoice often includes additional information detailing a description of services, milestones achieved, and number of hours worked. The payment terms also typically detail the agreed-upon fee structure (hourly or flat rate).

The importance of sales invoices in business operations

A sales invoice does more than just request payment — it builds trust and strengthens customer relationships. A clear and well-structured invoice ensures the buyer understands how to make payment, leading to a smoother transaction and a better overall experience.

Sales invoices are also key to maintaining accurate financial records by creating a permanent record for the company. Businesses typically use sales invoices to calculate financial earnings, quotas, and taxes after they are paid. They also offer insight into a customer’s history of purchases, making them the key to cross-selling and upselling products.

They are also a great space to share promotions with customers. For example, you could create a banner or infographic on the invoice with links to additional information.

Get the latest sales tips delivered to your inbox.

Sign up for the Salesblazer Highlights newsletter to get the latest sales news, insights, and best practices selected just for you.

Key components of a sales invoice

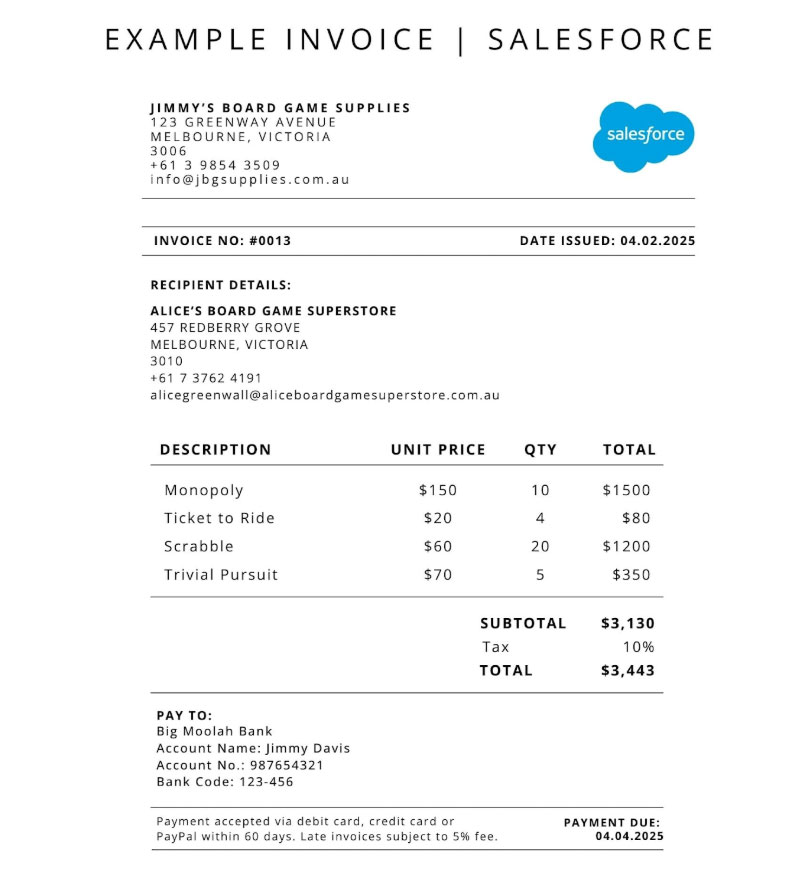

A clear, well-structured invoice makes payments easy for customers and for your business. Below are a few examples of what you should include in a modern sales invoice.

1. Invoice date

The date the invoice was produced officially starts the clock for collecting it. For example, if an invoice is issued on January 1st and the customer has 30 days to pay, the due date is January 30th, based on the invoice date. Some businesses date invoices 3–5 days ahead for internal processing.

2. Invoice number

Including an invoice number helps you quickly identify each sales invoice. This can be helpful for customer service representatives who need to locate invoices quickly when a customer calls with questions. Government clients also use the invoice number to record tax liabilities and process payments.

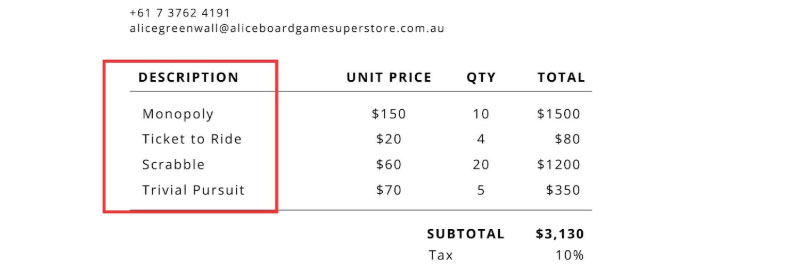

3. An itemised list of products

This section details the products the invoice covers, including product numbers and a brief description. While this is relatively straightforward with physical products, subscription models are slightly more complex. Subscription invoices should specify the billing period, subscription tier, and any usage-based charges for clarity.

Sales invoices must clearly state what the customer is being charged for and whether the amount is prorated. For example, if a customer signed up late in the month, the bill may only be for 15 days of that first month.

Additionally, if you sold a usage-based product, the sales invoice should specify how many units the customer consumed.

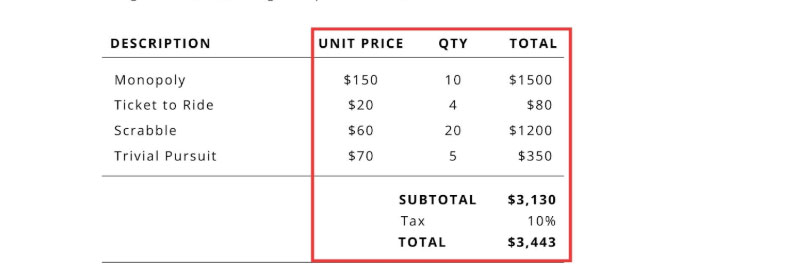

4. Pricing (or amount due)

The pricing on a sales invoice is simple — it reflects the agreed-upon amount between buyer and seller. With a usage-based product, the invoice should also include the price per unit. If the price changes based on the amount consumed, then the amount consumed at each price level should be detailed on the invoice.

For example, if an email marketing program costs $100 monthly for 10,000 email addresses, with an extra charge for emails beyond that limit, the invoice should break down the number of emails at each price tier.

5. Payment terms

This section explains how and when the customer is due to pay the invoice. Many sales invoices say the payment terms are Net 30, meaning the customer has 30 days from the invoice date to pay the amount due.

However, some sales invoices offer a discount in this section for early payment. Including a payment link on the sales invoice makes it easier for customers to pay promptly. Additionally, sellers should provide information about late fees, including when they begin occurring and the amount.

6. Contact information

Buyers need to know who to contact with questions about the invoice. By including the name, phone number, address, and email on the invoice, sellers can quickly get customers the answers they need. This will reduce frustration and minimise your Days Sales Outstanding (DSO).

What are the different types of sales invoices?

Here are the four broad subtypes of sales invoices you should know about.

1. Standard invoice

This is the type of invoice you’ll be most familiar with. It’s a simple request for payment for goods provided, including details like product descriptions, quantity, price, payment terms, and your company’s name, address, and phone number.

2. Commercial invoice

A commercial invoice is an invoice specifically for international trade. It includes all the essential information you’d expect but also extra details such as the reason for export, tracking numbers, countries of origin, and trade terms. It’s primarily used to calculate VAT and duty fees on imported and exported goods.

3. Proforma invoice

This is a preliminary invoice sent before the goods or services are delivered. Unlike a standard sales invoice, it isn’t a formal, legally binding demand for payment. A proforma invoice serves as an estimate of expected costs to help the buyer prepare their budget.

4. Recurring invoice

These invoices are sent regularly, such as every week, month, or quarter. They’re handy for businesses that use a subscription model or buyers who need the same stock every month

How to create a sales invoice

Manual invoicing can be time-consuming, but automation makes it easy and saves your business valuable hours. With Revenue Cloud, you can streamline the process by integrating all sales channels into your CRM and using the built-in invoice scheduler.

The subscription manager helps you manage usage-based products, while the consolidated invoicing feature simplifies charge capture across every sales channel. Plus, Revenue Cloud automatically tailors each invoice for the customer, eliminating the need for manual personalisation.

Here are five steps to follow:

- Automatically generate invoices: Use your invoicing software tool to create invoices based on the order, saving your business countless hours of double entry. This method ensures consistent sales invoices, free from manual errors. You can also customise your invoice with a logo to build your brand image.

- Track usage-based products automatically: Set up the software to automatically track usage-based products and calculate the amount due based on the pricing structure. This feature is particularly useful for subscription-based businesses or those with fluctuating usage levels.

- Personalise invoices for customers: This might include adding a thank-you note or tailoring the format to suit the client’s needs. Small touches can strengthen customer relationships and help retain clients.

- Review for errors: Use the software to scan invoices for discrepancies, such as unusual charges, incorrect calculations, or missing details. This extra layer of verification minimises the risk of billing errors, ensures compliance with client agreements, and helps prevent disputes or delayed payments.

- Deliver invoices to the customer: Promptly deliver invoices in the format your customers prefer, whether by email, mail, or an online portal. Sending the invoice in a way your consumers prefer increases the likelihood of on-time payments.

Join the Salesblazer Community.

Best practices for managing sales invoices

Managing sales invoices can be simple, but if not well-organised, the process can quickly become frustrating for buyers.

Here are 6 tips to ensure your business follows invoicing best practices.

- Integrate revenue management with your CRM: Your invoices and CRM data often overlap, and using separate systems means extra work and a higher risk of errors. By integrating invoicing with your CRM, you can integrate revenue management automatically, generate accurate invoices, and send them directly to customers.

- Send sales invoices in a timely fashion: Customers expect to receive an invoice on a regular basis. When a customer has to track down an invoice, you create a friction point in the process. At the same time, a late invoice means that your organisation does not have the payment for the product when it should, which can cause revenue management issues.

- Send digital invoices: Since paper invoices are costly and time-consuming, many organisations now send digital invoices. Companies that still mail paper invoices may be perceived as behind the times. Additionally, digital invoices make it possible to automate the process from creation to delivery.

- Ensure all data is accurate: Accuracy matters. A small mistake can cause your customers confusion, so double-check the details before sending your invoice. If you are concerned about the accuracy of an invoice, it’s better to delay sending it until you confirm that the details are correct.

- Review invoices for exceptions: The goal of the review process is complete automation. Your software should detect exceptions, like purchase prices exceeding a set threshold, and will flag those invoices for manual review.

- Use automated reminders for tracking payments: Your invoicing system can make it easier to know who has paid and whose bill is still outstanding. By having the system flag unpaid invoices, your team can focus on reaching out to these customers.

Tips for getting invoices paid quickly

Here are some quick tips for getting your invoices paid promptly.

- Strike while the iron is hot: Send your invoices promptly after you’ve delivered the goods or services. At this point, your product will still be fresh in your buyer’s mind, making it more likely that they’ll send a fast payment.

- Keep your invoice payment terms clear: Clearly state the unit price, the amount owed, sales tax, and when you need your buyer to pay. Also, make your late payment fees clear. This avoids ambiguity and speeds up the payment process.

- Offer several payment options: To give your buyer more options when deciding how to pay, offer a range of payment methods, such as cheque, credit card, and online payment.

- Set automated reminders: Use your invoicing software to schedule follow-up emails to inform clients of upcoming payment deadlines. Sometimes, all a buyer needs is a reminder.

- Build strong customer relationships: Build good rapport with your clients by delivering a great customer experience. You can also offer discounts for early payment as an incentive.

Summing up

A clear and accurate sales invoice helps make the payment process as painless as possible and reduces customer phone calls about invoices. By using sales invoicing software, your team can make the process accurate and efficient while also personalising many sections of the invoice to customer preferences.

A well-designed invoicing process benefits both the business and customers, improving your revenue management and customer satisfaction.

With Salesforce’s Revenue Cloud, you can take control of the entire revenue process from quote to cash. With our solution, you can automate the process of creating and sending invoices, reduce manual input errors, generate rapid quotes with AI, and much more.

Watch the demo today to learn how Revenue Cloud can help you save time and get paid faster.

FAQs

How often should I send a sales invoice during an ongoing service?

If you consistently provide a service to a client, it’s good practice to invoice weekly, monthly, quarterly, or at the end of a project milestone. This helps the client budget better for the cost and avoid surprises that could lead to non-payment.

What’s the difference between sales receipts and sales invoices?

A sales invoice is a document you send to log the transaction and formally request payment. By contrast, a sales receipt is the accounting document you send once you receive payment. It lets the buyer know that their payment has reached you, marking the end of the transaction.

What happens if I invoice the incorrect amount?

If the customer hasn’t paid the invoice yet, you can proactively inform them of the mistake and issue a corrected invoice. If the customer has already paid, you can easily resolve the issue by issuing a credit note or adjusting future invoices.

Do I need to follow a specific format for my sales invoices?

There is no rule stating that customer invoices must be structured in a specific way. As long as you clearly outline all the essential business details, you can format them however you like. That said, it’s best to use one invoice template for all your invoices. This looks professional and ensures that every invoice you send is accurate and consistent.