San Francisco — November 29, 2023 — Salesforce (NYSE: CRM), the #1 AI CRM, today announced results for its third quarter fiscal 2024 ended October 31, 2023.

- Third Quarter Revenue of $8.72 Billion, up 11% Year-Over-Year (“Y/Y”), up 10% in Constant Currency (“CC”)

- Third Quarter GAAP Operating Margin of 17.2% and non-GAAP Operating Margin of 31.2%

- Current Remaining Performance Obligation of $23.9 Billion, up 14% Y/Y, 13% CC

- Third Quarter GAAP Diluted Earnings per Share (“EPS”) of $1.25 and non-GAAP Diluted EPS of $2.11

- Returned $1.9 Billion to Stockholders in the Third Quarter in the Form of Share Repurchases

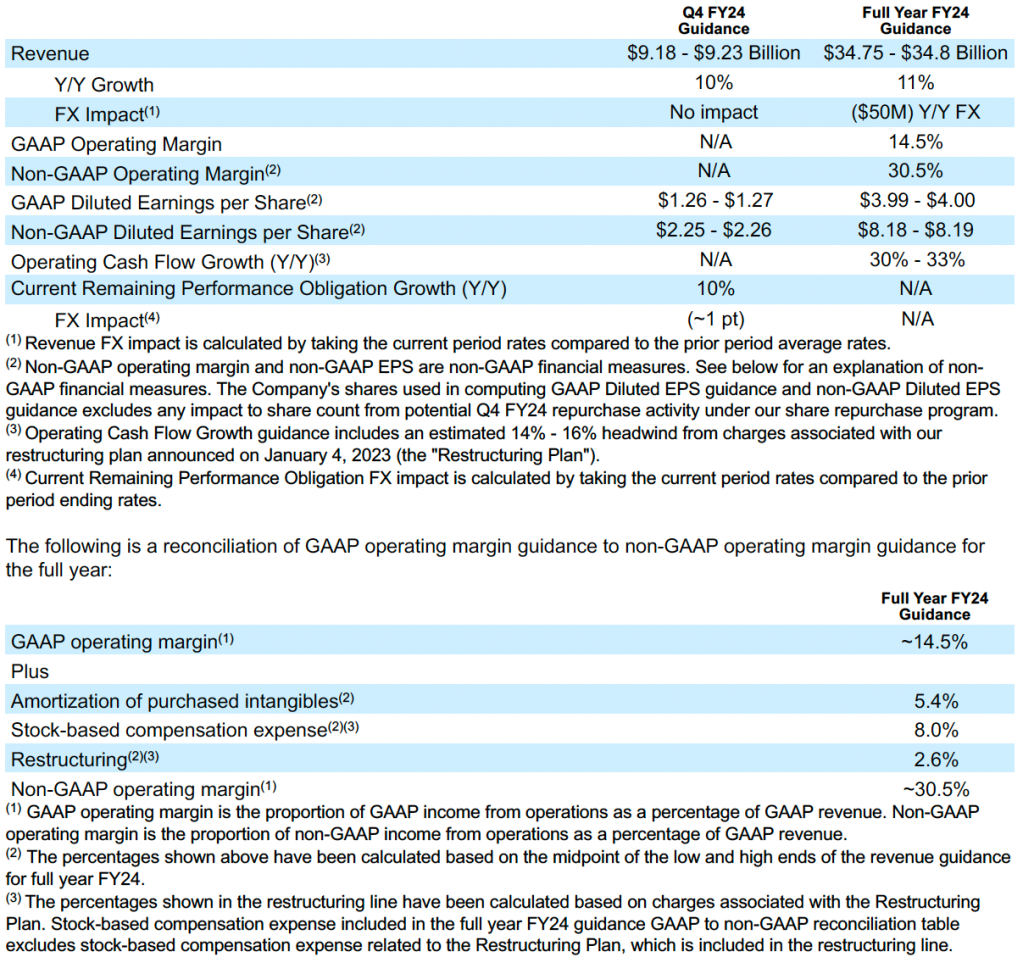

- Initiates Fourth Quarter FY24 Revenue Guidance of $9.18 Billion to $9.23 Billion, up 10% Y/Y

- Narrows Full Year FY24 Revenue Guidance to $34.75 Billion to $34.8 Billion, up 11% Y/Y

- Raises Full Year FY24 GAAP Operating Margin Guidance to 14.5% and non-GAAP Operating Margin Guidance to 30.5%

- Raises Full Year FY24 Operating Cash Flow Growth Guidance to 30% to 33% Y/Y

“We had another strong quarter of executing on our profitable growth plan we set in motion last year, delivering $8.7 billion in revenue and again raising our operating margin guidance for this fiscal year,” said Marc Benioff, Chair and CEO, Salesforce. “We’re now the third largest enterprise software company by revenue, the number one AI CRM and the number one enterprise apps company. Most importantly, we’re bringing CRM, data, AI and trust together in a single, integrated platform, leading our customers into a new era of incredible productivity and growth.”

Most importantly, we’re bringing CRM, data, AI and trust together in a single, integrated platform, leading our customers into a new era of incredible productivity and growth.

Marc Benioff, Chair and CEO, Salesforce

“Over the last year we have transformed the company, enabling us to deliver another quarter of strong profitable growth with GAAP operating margin of 17.2% and non-GAAP operating margin of 31.2%,” said Amy Weaver, President and CFO of Salesforce. “We remain focused on driving shareholder value as we deliver innovation to our customers as the #1 AI CRM.”

Salesforce delivered the following results for its fiscal third quarter:

Revenue: Total third quarter revenue was $8.72 billion, an increase of 11% Y/Y and 10% CC. Subscription and support revenues were $8.14 billion, an increase of 13% Y/Y. Professional services and other revenues were $0.58 billion, a decrease of (4)% Y/Y.

Operating Margin: Third quarter GAAP operating margin was 17.2%. Third quarter non-GAAP operating margin was 31.2%. Restructuring negatively impacted third quarter GAAP operating margin by (60) bps.

Earnings per Share: Third quarter GAAP diluted EPS was $1.25, and non-GAAP diluted EPS was $2.11. Losses on the Company’s strategic investments negatively impacted GAAP diluted EPS by $(0.06) based on a U.S. tax rate of 25% and non-GAAP diluted EPS by $(0.06) based on a non-GAAP tax rate of 23.5%. Restructuring negatively impacted third quarter GAAP diluted EPS by $(0.06).

Cash Flow: Cash generated from operations for the third quarter was $1.53 billion, an increase of 389% Y/Y. Free cash flow was $1.37 billion, an increase of 1088% Y/Y. Restructuring negatively impacted third quarter operating cash flow growth by (3,600) bps.

Remaining Performance Obligation: Remaining performance obligation ended the third quarter at $48.3 billion, an increase of 21% Y/Y. Current remaining performance obligation ended at $23.9 billion, an increase of 14% Y/Y, and 13% CC.

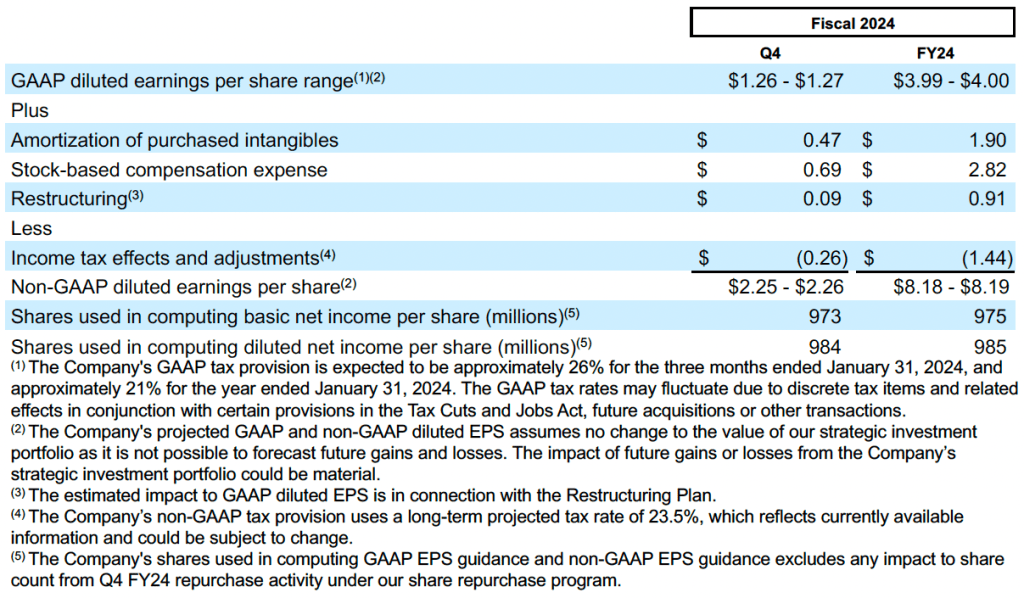

Forward Looking Guidance

As of November 29, 2023, the Company is initiating its fourth quarter GAAP and non-GAAP diluted EPS guidance, current remaining performance obligation growth guidance, and revenue guidance. The Company is updating its full year FY24 revenue guidance and raising its GAAP and non-GAAP diluted EPS guidance, GAAP and non-GAAP operating margin guidance, and operating cash flow growth guidance.

Our guidance assumes no change to the value of the Company’s strategic investment portfolio as it is not possible to forecast future gains and losses. In addition, the guidance below is based on estimated GAAP tax rates that reflect the Company’s currently available information, and excludes forecasted discrete tax items such as excess tax benefits from stock-based compensation. The GAAP tax rates may fluctuate due to discrete tax items and related effects in conjunction with certain provisions in the Tax Cuts and Jobs Act, future acquisitions or other transactions.

For additional information regarding non-GAAP financial measures see the reconciliation of results and related explanations below.

Management will provide further commentary around these guidance assumptions on its earnings call.

Product Releases and Enhancements

Three times a year Salesforce delivers new product releases, services, or enhancements to current products and services. These releases are a result of significant research and development investments made over multiple years, designed to help customers drive cost savings, boost efficiency, and build trust.

To view our major product releases and other highlights as part of the Winter 2024 Product Release, visit: www.salesforce.com/products/innovation/winter-24-release.

Quarterly Conference Call

Salesforce plans to host a conference call at 2:00 p.m. (PT) / 5:00 p.m. (ET) to discuss its financial results with the investment community. A live webcast and replay details of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor.

About Salesforce

Salesforce helps organizations of any size reimagine their business with AI. Agentforce — the first digital labor solution for enterprises — seamlessly integrates with Customer 360 applications, Data Cloud, and Einstein AI to create a limitless workforce, bringing humans and agents together to deliver customer success on a single, trusted platform.