Today, Salesforce launched Personalized Financial Engagement, a new solution to help financial institutions use AI, real-time data and CRM to manage customers’ financial plans and deliver intelligent, personalized financial insights at scale. And with Financial Services Cloud, Marketing GPT and Data Cloud, marketers at financial institutions can now deliver automated, personalized customer experiences powered by generative AI and trusted first-party data.

Why it’s relevant: Company data is often dispersed across multiple disconnected systems, making it difficult to provide the personalized experiences that financial services customers expect. In a new Salesforce survey, 62% of customers said they would switch financial services providers if they felt treated as a number, not a person, and 73% expect companies to understand their unique needs and expectations. Data from another Salesforce study shows 76% of financial services employees believe generative AI will help them better serve their customers.

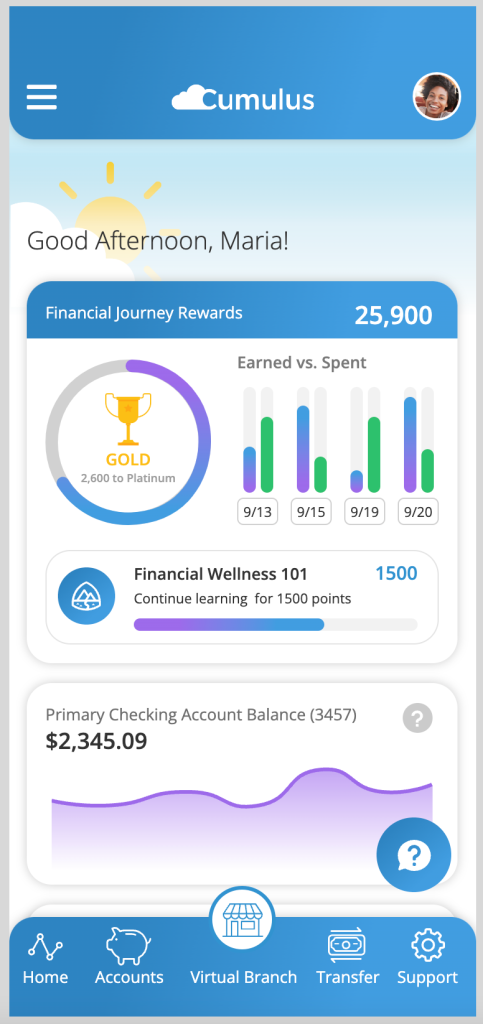

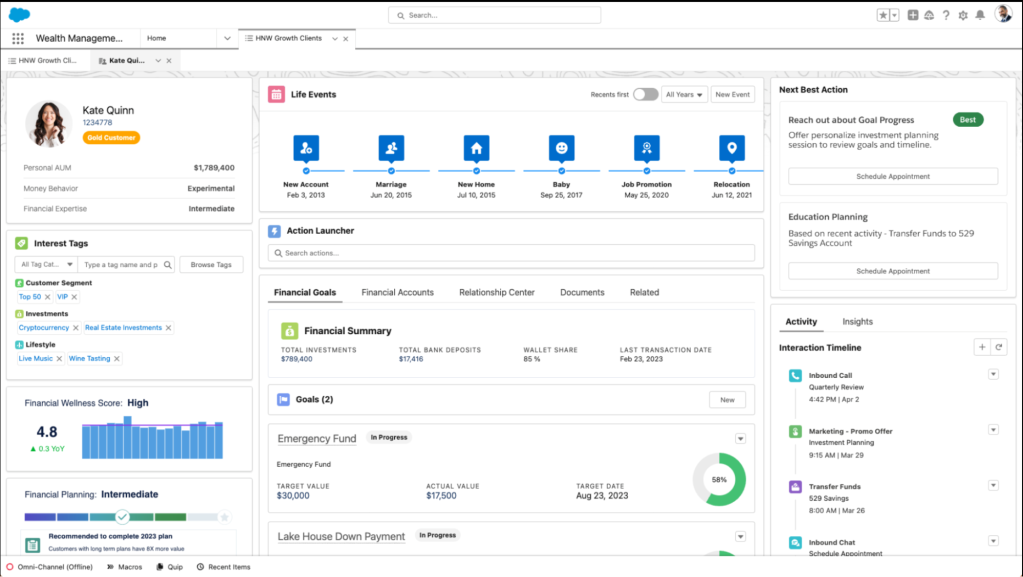

Personalized Financial Engagement enables financial institutions to connect disparate data systems by creating a unified profile of each customer and delivering more automated and intelligent customer journeys at scale with generative AI.

Innovation in action: Salesforce’s new Personalized Financial Engagement solution draws upon the full power of the Salesforce Customer 360 and includes:

- Data Cloud for Financial Services connects and integrates customer data, such as interaction, behavioral, and transactional data across systems to give financial institutions a unified profile of each customer and real-time insights. For example, a banker can be alerted if a prospective customer has a loan with a different financial institution so they can proactively reach out to offer a better loan term.

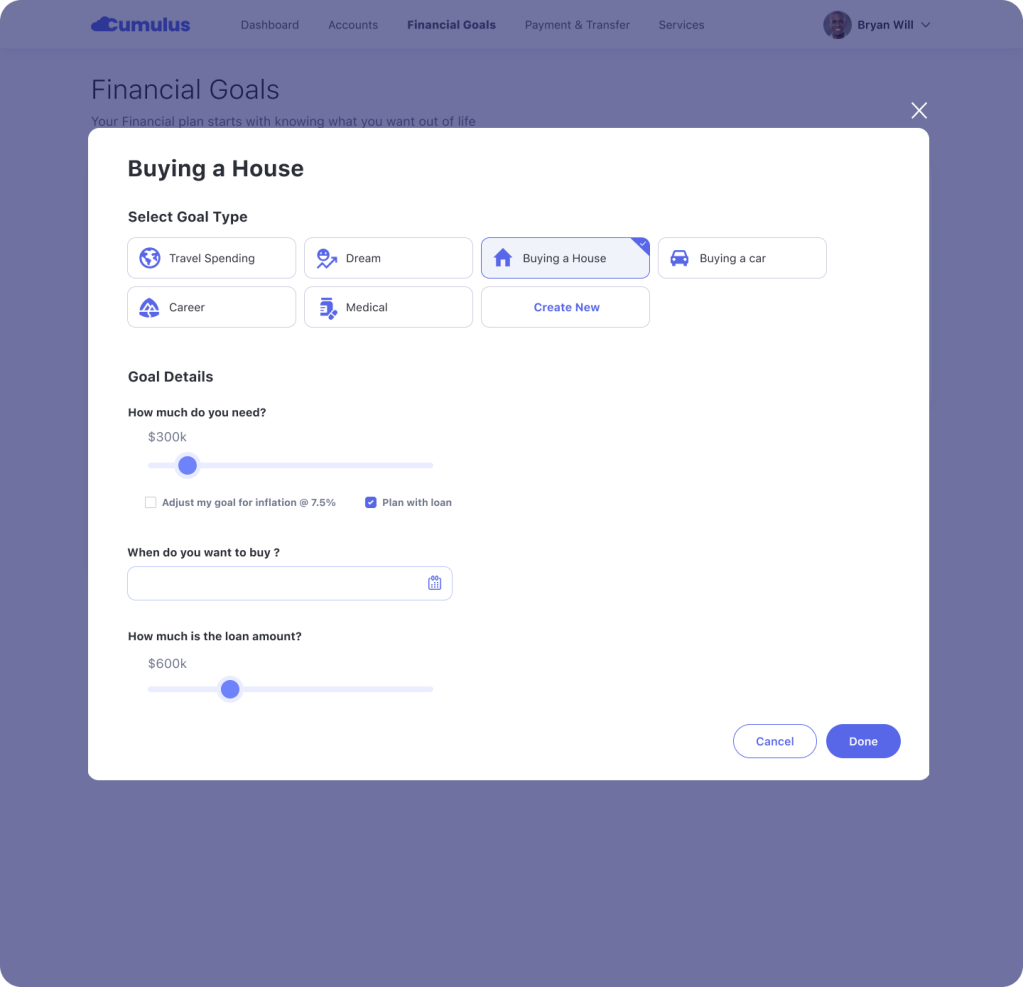

- Financial Plans and Goals uses data to help bankers and wealth advisors identify their customers’ financial goals and track progress. For example, a banker can be alerted when their customer is getting close to their goal of saving $50,000 for a house down payment. At that point, an automated message can be sent congratulating the customer on their milestone and connect them with the banker who can guide them through their home purchase journey.

- Marketing GPT for Financial Services uses generative AI and trusted first-party data from Data Cloud to automatically generate personalized emails and create audience segments quickly. Now, a marketer at a financial institution can put potential first-time home buyers into a specific segment based on their financial profile, then generate an email to the segment and engage them on a journey toward their first home purchase.

- Marketing Cloud Engagement for Financial Services provides a set of prebuilt templates that enables marketing teams to launch personalized journeys faster. For example, marketers can send a welcome email for a client who just opened a new checking account for their small business using a pre-built template.

- MuleSoft Direct for Financial Services Cloud provides banking standards-based integration templates to connect and access core banking data like customer and account addresses and customer balances and transactions, in days rather than months. Now, when a customer service representative needs to perform a transaction, like reversing a fee, all the information is in one place, eliminating the need to switch to another application.

Soundbite:

- “Our goal is to help our customers understand their customers better, and there is no better way to do this than with AI, real-time data and CRM. Personalized Financial Engagement is just one more way we’re helping our customers realize faster time to value, process their data at scale, and apply AI to help build more streamlined, automated and personalized client engagement experiences that drive better business outcomes.” – Eran Agrios, SVP & GM of Financial Services, Salesforce

Customer highlights:

- Mascoma Bank: “Through the exciting integration of Financial Services Cloud with Data Cloud, bankers will be able to see a customer’s entire relationship with the bank and understand activity surrounding the customer and their accounts. By leveraging Salesforce as our single system of record for all customer, account, and transaction data, bankers are now better equipped to help their clients reach their financial wellness goals.” – Samantha Pause, Chief Brand and Innovation Officer

By leveraging Salesforce as our single system of record for all customer, account, and transaction data, bankers are now better equipped to help their clients reach their financial wellness goals.

Samantha Pause, Chief Brand and Innovation Officer, Mascoma bank

- RBC Wealth Management U.S.: “With Salesforce Financial Service Cloud, Marketing Cloud, and MuleSoft, our advisors are using the power of the Customer 360 to bring all of the customer’s information together into a single unified profile to elevate client outreach and bring personalization to new heights. And by embedding Einstein AI into our CRM, we’re transforming the way our business interacts with its clients.” – Greg Beltzer, Head of Technology

Availability:

- Data Cloud for Financial Services is available now.

- Financial Plans and Goals will be generally available in winter 2024.

- Segment Creation for Marketing GPT will be in pilot this summer, and generally available in October 2023.

- Email Content Creation for Marketing GPT will be in pilot in October 2023, and generally available in February 2024.

- Marketing Cloud Engagement for Financial Services is available now.

- MuleSoft Direct for Financial Services Cloud is available now.

More information:

- Learn more about Personalized Financial Engagement from Salesforce here

- Read the Connected Financial Services Customer Report, which reveals emerging trends reshaping the sector here

Any unreleased services or features referenced here are not currently available and may not be delivered on time or at all. Customers should make their purchase decisions based upon features that are currently available.