Cyber Week Impact on Email Delivery: What Marketers Need to Know Now

We examined how increases in campaign volumes impact overall email sender reputation. Here's what we learned.

Every year our customers gear up for what is typically their busiest sending season of the year: Black Friday and Cyber Monday (or as it has become known in recent years, Cyber Week). Last year was no exception. From November 21 through 27 our customers sent a record-breaking 54 billion messages on the Marketing Cloud platform. Our peak sending day on Black Friday saw double-digit growth at 12% year over year, surpassing 10.2 billion sends. But what was the Cyber Week impact – does all that extra volume translate into more engagement from subscribers?

The data suggests that there is a risk versus reward conversation to be had before heading into your peak sending season. Below we will take a look at some data in the eight weeks leading up to Cyber Week and compare that with what happened over Cyber Week itself.

We use six key metrics – volume, opens, clicks, bounces, unsubscribes and complaints – to piece together a view of the trends of our sample senders and how their sending reputation may have been impacted by increased volumes over Cyber Week. Then we give a few tips on how you can incorporate those learnings into the 2024 holiday season.

In this blog you’ll learn…

- A closer look at 2023 Cyber Week impact

- The Cyber Week impact of increased email volume

- How to plan for the 2024 holiday email sending season

A closer look at 2023 Cyber Week impact

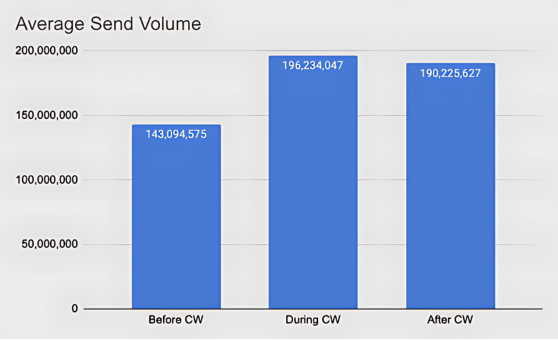

Last year, volume increased an average of 27% for Cyber Week when compared with the prior eight weeks’ averages. That is a lot of extra mail landing in subscriber’s inboxes. Unless your message is highly personalized and highly relevant, the odds of it standing out in the crowded inbox are slim.

So what should you do this fall? For your next peak sending season, consider targeted messaging to a smaller, highly engaged, audience instead of a “batch and blast” type of approach. The data supports the ROI doesn’t come from volume alone.

Email opens were down an average of 4.9% when compared with the eight weeks leading up to Cyber Week. This tells us the additional volume doesn’t actually help in driving engagement rates. With every retailer sending more mail, it’s easier to get lost in the inbox.

This comes back to the need to target your campaigns with a focus on highly engaged subscribers who are already interacting with your brand. Your odds of conversion increase drastically with highly personalized content that will stand out in the crowd.

Click rates were up an average of 2.3% over the eight weeks prior to Cyber Week. A 27% increase in volume netted a 2.3% gain in clicks. Note that this does not necessarily equal a conversion to a purchase. Your team should look deeper into the data for Cyber Week, specifically around conversions.

Did an increase in volume (which has added cost) equate to a large enough bump in sales to warrant the spend? This metric is ultimately what your company should be focused on when deciding on your 2024 Cyber Week plans. Specifically, does sending more emails bring in enough revenue to offset the cost, both monetary and reputation-related (more on that below).

Despite all the extra volume hitting the mailbox providers (MBPs), bounces and unsubscribe rates were down over Cyber Week last year. Bounce rates dropped 37% while unsubscribes were down 14%. While this seems like a positive statistic, the odds are high that an increased amount of mail was landing in the spam folder due to aggressive filtering on the MBP side.

MBPs have become reliant on algorithms to manage their inbound filtering.An increase in volume coupled with a decrease in open rates of nearly 5% likely sent a lot of mail to junk folders.

Weigh this into your 2024 planning: will a higher-volume campaign or multiple campaigns to the same audience result in the necessary engagement to keep your mail in the inbox, or does it make sense to cut back and focus on subscribers who are known to purchase/engage?

Complaints were up over Cyber Week, but ever so slightly at a 0.23% average. Again, this could be partially attributed to spam folder placement. Subscriber fatigue is another possible factor here as inboxes were inundated with mail, and subscribers potentially weren’t taking the time to mark mail as spam in favor of mass deletes.

The Cyber Week impact of increased email volume

The data suggests that increased frequency of campaigns or a larger audience won’t necessarily equate to increased revenue, especially when you factor the additional costs of the campaigns themselves. From a reputation perspective, we were curious about the after-effects of increased volume sent over Cyber Week. Taking a look at the sending for the week following Cyber Week, here’s what the data tells us:

Volume started to trend back down (-3.16% compared to Cyber Week totals), but still remained up (+23.8%) over the 8 weeks prior to Cyber Week.

Open rates were still down, but starting to rebound with a 0.8% increase over Cyber Week.

Click rates fell back under pre-Cyber Week averages -2.71%. This is likely due to subscriber fatigue and many having their holiday shopping complete.

“This decline in clicks also signifies likely spam folder placement that was triggered on some senders as their Cyber week mailings lowered their overall reputation,” says Brad Van der Woerd, head of deliverability at Inbox Monster, a Salesforce AppExchange Partner.

“Mailbox providers are not only measuring spam complaint rates these days but also how many of your recipients are ignoring the email within their inbox altogether. A higher volume of email coupled with high ignored email rates can trigger spam filtering at major MBPs like Gmail, Microsoft and Yahoo. This can drastically affect click rates and ultimately conversions.”

Last year bounce rates increased 70% over Cyber Week rates and were more than double the pre-Cyber Week average. The most likely factor here is that senders who increased volumes but didn’t see engagement rates climb at the same rate have found themselves blocked at various MBPs. Blocks can be temporary and many resolve within 24-48 hours, but some require manual mitigation requests to be filed with the MBPs.

There is also potential that subscribers were using temporary addresses for Cyber Week shopping deals and had since closed them out. This was also the week that Gmail initiated their inactive account policy, which could factor in if older data segments were being mailed to.

Unsubscribe requests were up 11.46% over pre-Cyber Week averages, again, likely driven by fatigue and customers having completed expected purchases. More mail reaching the inbox as opposed to spam folders as volumes start to decline means more opportunity to unsubscribe.

“It’s important to spend some time reviewing which subscribers you are losing with unsubscribes post-holiday,” says Van der Woerd.

“Are these long-time subscribers that are suddenly losing interest or tired of your email program? Or are these recently signed up subscribers who likely intended on only capturing Cyber Week emails anyway before unsubscribing? Looking at this data a bit closer helps you to understand what your audience is telling you with their unsubscribes.”

How to plan for the 2024 holiday email sending season

The data tells us that the potential Cyber Week impact to a sender’s reputation and ongoing ability to reach the inbox does not warrant the risk of increasing volume/frequency for Cyber Week sending. Open rates were down in Cyber Week last year and remained down the following week while bounce rates increased drastically.

Many subscribers were opting out of ongoing campaigns as they caught up with their flooded inboxes, and click rates that saw a modest bump over Cyber Week had fallen under the prior eight week averages the following week.

When building out your 2024 strategy, keep personalization and highly targeted content at the forefront. An engaged audience will provide better results than a “batch and blast” approach to subscribers who may not remember your brand, may no longer be interested, or may no longer be behind that email address.

The complaints and bounces that come from sends of this nature impact your reputation as a sender and can prove impactful long after the dust settles from Cyber Week. Think about how to keep your subscribers engaged for the long-term, as opposed to focusing on potential temporary gains of a large Cyber Week send.

“Having a clear understanding of your current sender reputation and deliverability history with the major MBPs during the weeks leading up to Cyber week gives you a great opportunity to make the right decisions and ensure that, whatever you do for Cyber Week, you are not posing high risk to your deliverability rates,” says Van der Woerd.

“Any sender with a positive reputation should be able to make moderate increases to send volume during a holiday week and maintain high inbox placement rates, provided it’s done gradually and in line with all of the sender best practices the MBPs publish.”

Methodology

Data was aggregated from a sample of 50 customers across all of our geographical data environments. Criteria for the data sample was email volume, specifically, top five senders by volume in the eight weeks leading up to Cyber Week for each of our data environments (also known as stacks). Several factors are applied to extrapolate figures, and these results are not indicative of Salesforce performance.

Start your holiday planning now

Our guide will help ensure your business is prepared for email success this Cyber Week and beyond.