Providing high-quality customer service is key to retaining customer trust and loyalty in the financial services industry. But when customers face complex issues that require more than the general expertise of a contact center, the cost of service delivery can quickly climb.

While self-service options are a desired approach for simple service inquiries, 77% of customers expect to interact with someone immediately when they contact a company for issues that can’t be resolved through self-service channels. This high bar presents a real challenge for financial services institutions (FSIs) aiming to deliver service that is both cost-effective and efficient.

How can you deliver the best customer service while keeping costs at bay? Automation in financial services may be the answer, with 83% of decision makers saying they plan to increase investments in automation over the next year.

While a lot has been written about the benefits of artificial intelligence (AI) and automation for frontline FSI service agents, in this blog we’ll explore the potential of these technologies to transform middle- and back office operations. We’ll discuss how automation can help deliver a complete service experience across your entire FSI service organization.

What you’ll learn:

Automation in financial services starts with knowledge

What FSI service processes can be automated?

Start your automation for financial services journey with Salesforce

Automation in financial services begins with understanding

To achieve seamless middle and back office operations for your FSI’s service organization, start by deeply understanding your processes.

FSIs typically have hundreds of service processes, requiring associates and managers to access information across departments and applications. Fragmented knowledge can harm customer experience, as 77% of customers expect consistent interactions across departments.

Consolidating information into a single source of truth gives service associates the tools and the need for quick and accurate responses. This approach increases customer satisfaction and reduces errors, which helps build trust and loyalty with your customers.

What FSI service processes can be automated?

Let’s pull back the curtain on your middle- and back office operations and see what automation can do for your FSI’s service organization.

Onboarding

Automation can play a significant role in simplifying onboarding. While this can benefit banks and wealth and asset management firms, let’s take a look at an insurance example to see the value of automating onboarding tasks.

As an insurance company offering enrollment in a group benefits plan, you can leverage the power of automation for financial services. By automating this process, you provide users with a simple and efficient tool to navigate and select the benefits they desire, along with the corresponding deductions.

Document verification is another aspect of onboarding that can create friction for future policyholders. Having an automated system that houses all relevant documents and checking checklists for necessary documents means you only have to get information from your customers once. Those documents can then be used to auto-fill required forms throughout the onboarding process.

You can also verify coverage and see if the customer already has an active policy and the associated coverage amounts.

With an automated system that offers pre-configured questions and low code/no code tools help business users better manage the onboarding process. It can offer templates and drag-and-drop questions for specific use cases rather than having to draft large documents and manually write in details for each customer. You can easily configure applications to request the right information from customers, ensuring accuracy and clarity. This process helps increase efficiency and productivity and cuts customer onboarding time, which increases the customer experience.

Complaints management

Automation can greatly improve complaints management. Financial services customers expect quick and seamless resolution, but that can be challenging if data is scattered across departments.

Regulatory reporting requirements from agencies like the Consumer Financial Protection Bureau add another layer of complexity. This is why tracking complaints and resolving them promptly is crucial.

Automation for financial services can help simplify this process. A centralized complaints management tool streamlines workflows, ensuring consistent and accurate complaint resolution. AI-generated case notes save time, and dashboards provide faster reporting.

This type of automated system reduces “swivel-chair processes” for service associates and helps them restore customer trust by resolving complaints efficiently. A positive resolution experience can overshadow the initial negative situation.

Transaction disputes

Automation can also transform your transaction dispute management, allowing you to track and monitor disputes submitted in real time.

Disputes come in multiple forms – think fraudulent activity, disagreements with purchases, or unauthorized charges. As the number of digital transactions rises, FSIs service operations associates are overwhelmed with cases.

Resolving transaction disputes can prove costly, too — for every $100 in chargeback fraud disputes, merchants spend $35 for dispute management.

This process is complex because multiple steps and stakeholders are involved. From intake to settlement, there are many communications between the bank, the merchant, and the customer.

Another challenge with transaction disputes is that most bank or credit card account statements lack full merchant information. This results in an influx of calls and disputes on legitimate charges that weren’t identifiable from vague statements. Integrations that offer enriched transaction data can enhance automation by providing the right information directly to the customer and agent, deflecting both calls and cases from call centers.

With automation such as pre-configured rules, disputes that fail to meet specific criteria, like those submitted after the deadline or below a certain amount, can be automatically disqualified and excluded from a claims processor’s queue.

If a charge is identified as truly unauthorized and hasn’t yet been posted to an account, an automated alert can let the merchant know right away. This way, they can stop the charge before it becomes a formal chargeback.

Automation and AI can draft personalized emails to update customers on their dispute status. This builds trust and transparency and saves agents valuable time.

Other FSI service processes that can be automated

We’ve talked about some of the larger, more costly FSI service processes that benefit from automation, but we’d be remiss if we didn’t acknowledge other, smaller processes that can benefit from automation in financial services as well:

- Fee reversals — Automate reversing incorrect charges to a customer’s account, like late fees or insufficient funds fees.

- Reporting lost/stolen credit cards — Allow customers to easily report lost or stolen credit or debit cards and automate the approval and distribution of new cards.

- Account updates — Offer automated self-service options for customers to update mailing addresses or other contact information.

(Back to top.)

Start your automation for financial services journey with Salesforce

The foundation you need to bring this all together is a single, integrated system for your customer data providing a complete, real-time view of all customer interactions. A financial services customer relationship management (CRM) platform like Salesforce Financial Services Cloud helps you identify trends, patterns, and root causes, so you can proactively address issues and continuously improve your services. The result is a better customer experience, with every interaction tailored to the unique needs of your clients.

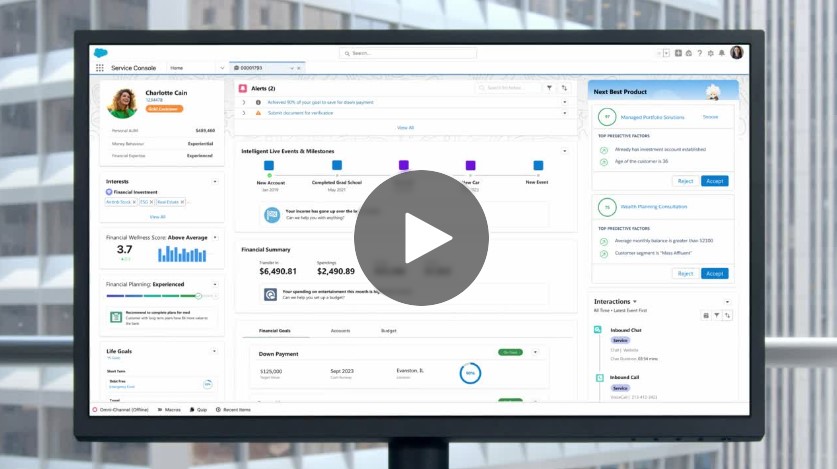

Salesforce Service Process Studio in Financial Services Cloud is designed to help you achieve operational excellence with an easy-to-use, code-free interface. With Service Process Studio, you can automate your middle and back office processes with clicks, not code.

This tool can simplify operations, centralize knowledge, and create customer experiences like never before. With automation that incorporates the integration of enriched data and AI, the system can take on repetitive, time-consuming tasks, freeing your FSI service operations associates to deliver enhanced customer service experiences.

Service Process Studio also offers flexibility and adaptability, so you can customize your automation strategies to meet your specific business needs. Only Salesforce offers this comprehensive suite of automated solutions, which can help you reduce costs while still delivering exceptional customer service.

Learn more about how you can scale customer service in financial services with automation and AI in your front and back office operations.