The holiday season is officially in full gear. After an incredibly successful early start to the digital shopping season, consumers were ready to put down the pumpkin pie and shop from the convenience of their homes to kick off the Cyber Weekend. We saw the biggest U.S. Black Friday yet, as shoppers proved buying confidence is strong despite market noise. Below we have outlined our top holiday trends for Black Friday.

Holiday insight #1: Black Friday is on track to be the digital shopping day of the year

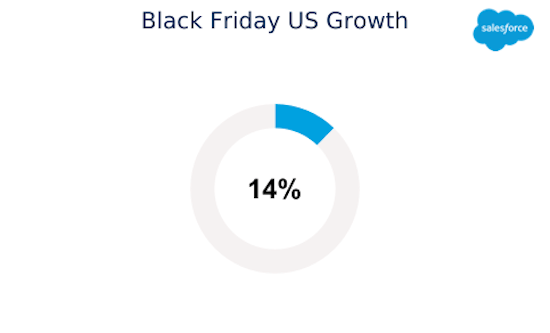

Shoppers lived up to early expectations this Black Friday as U.S. digital revenue hit record highs. Brands and retailers pulled in $7.2B in digital revenue on Friday, netting a 14% growth over last year.

Holiday insight #2: Marketers re-engage before the weekend

Marketers kept the steady drumbeat of engagement to promote their best deals and exclusive holiday merchandise leading into the weekend. The number of emails sent on Black Friday grew 17% from Thanksgiving Day and SMS (text messaging) also grew on Black Friday, up 22% from Thanksgiving and up 148% year over year.

Holiday insight #3: Black Friday shoppers score deep discounts

It wouldn’t be right if we didn’t talk about the biggest topic on shoppers’ minds: discounts. Early in the season, brands and retailers enticed early shoppers with deep discounts — with some outlying companies even offering 60% off merchandise value. But the discounts didn’t end there for holiday buyers. Black Friday shoppers scored big digital deals this year, with orders seeing an average discount of 28% off merchandise value, up from 27% on last year’s Black Friday.

But will shoppers who hold out for Cyber Monday miss the boat? The short answer is no. We predict Cyber Monday will still be the best day for digital discounts, so sit tight and hold on to your credit cards.

Holiday insight #4: Mobile and social buying warm-up

Shoppers turned to their mobile devices and social feeds for inspiration and purchased in record numbers. Seventy-three percent of all digital traffic came from a mobile device, marking yet another groundbreaking day for the device. But mobile orders were the real breakout star, as mobile buying reached 56%, solidifying the device’s position as a true driver of digital traffic and orders.

Social feeds were also strong, and not just for product inspiration. While 8% of all mobile traffic came from a social channel, 4.2% of mobile orders were sourced by a social referral. Social media’s influence will continue to grow as younger generations gain greater purchasing power. But what day saw the most purchases through social feeds? The Wednesday before Thanksgiving still held the title for the most social purchases, with 7% of all mobile purchases coming from a social channel.

Holiday insight #5: Shoppers choose when they shop

On previous Black Fridays, shoppers started early with digital purchases peaking at 10 a.m. and returned later in the evening (around 7 p.m.) to complete more digital shopping. But this year, as mobile provides increasing ease and access, shoppers not only chose how they shopped but when they shopped, too. Digital buying on Black Friday was more evenly spread throughout the day, with shoppers less inclined to take a break in the mid-afternoon, thanks to the convenience of their phones.

Holiday insight #6: Shoppers turn social

Social feeds were buzzing with shoppers sharing their latest scores. Below are the top five brands, retailers, and products with the most social callouts on November 29 from across the globe.

Want more Black Friday data? Access our holiday insights dashboard, and check out our Cyber Monday results.

2019 Salesforce holiday insights methodology

To help retailers and brands benchmark holiday performance, Salesforce combined data-based holiday insights on the activity of more than half a billion global shoppers across more than 30 countries powered by Commerce Cloud, billions of consumer engagements and millions of public social media conversations through Marketing Cloud, and customer service data powered by Service Cloud. These holiday flash reports are a derivative of the quarterly Shopping Index.