How To Remove Data Silos: A 5-Step Checklist for Financial Services

Learn the steps to become an AI enterprise for your financial services organization.

It’s easy to get swept up in the hype of artificial intelligence (AI) and all the amazing things it can do. But is your organization ready to tap into its capabilities?

You’ve heard AI can create personalized customer experiences that speak directly to their individual financial needs, but that’s hard to do when there isn’t a unified customer record and the customer’s name shows up as “John Doe” in one system and “J. Doe” in another. The complexity only increases if John Doe is nested within a household or as a beneficiary of a trust.

You want to be there in moments that matter, proactively addressing your policyholders’ sensitive life events with empathy and trust, but that’s tough when you’re distracted by having to manually look up information in too many places.

As a fiduciary, you want to act in the best interest of your client and offer the most suitable advice to engender confidence in your services. Your clients look to you to help them create a plan for generational wealth, but that’s nearly impossible if you don’t even have access to their goals and plans.

As you can see, data is at the root of it all.

Before you can really take advantage of all the goodness AI has to offer, you need to have your data house in order. So let’s discuss data as the foundation for AI and the challenges presented by data for financial services institutions (FSIs).

We’ll cover data challenges like inaccuracy, access issues, and separation that prevents departments or employees from collaboration and information sharing — a.k.a, the dreaded term known as “silos.” Then, you can use our checklist to evaluate the state of your data to get you started on the path to becoming an AI enterprise.

Included in this blog:

Data: The foundation of the AI enterprise

The challenge of data silos in financial services

Five-step checklist to gauge data maturity in financial services

Embracing a data-driven future in financial services

Data: The foundation of the AI enterprise

The path to becoming an AI enterprise starts with data. The journey begins by understanding the current state of your data, including your client data. Is it accurate? Is it consistent? Is it accessible?

AI uses your data to train and learn — if you’re feeding it inconsistent, outdated or inaccurate data, the output will reflect that. We refer to this as “garbage in, garbage out.” Data fidelity is paramount.

Let’s take it to the next level.

- Is your data secure?

- Are you following industry regulatory standards with how you handle and use data?

- Are there legal implications you need to keep in mind?

Then, the big questions become: Do you know where your data is? Does each team within your organization have access to all the data they need, or do you struggle to find everything you need to do your job? With 72% of IT leaders saying their company’s applications are disconnected, we’d argue it’s the latter.

For AI to be successful within your organization, you need to be able to answer “yes” to all these questions. You should be confident in not only the data itself, but also where it resides and how to access it. This is where data silos in banking, insurance, and wealth and asset management create a barrier.

The challenge of data silos in financial services

The Mulesoft Connectivity Benchmark reports that 81% of IT leaders in the financial services industry think that data silos are hindering their digital transformation efforts.

Disconnected data spread across multiple systems seems to be the norm, with banks alone having more than 500 applications. With so many sources for data, you might find yourself having to move between systems to find the right data at the right time. Clicking through different windows to help answer a customer’s question isn’t an effective use of your time.

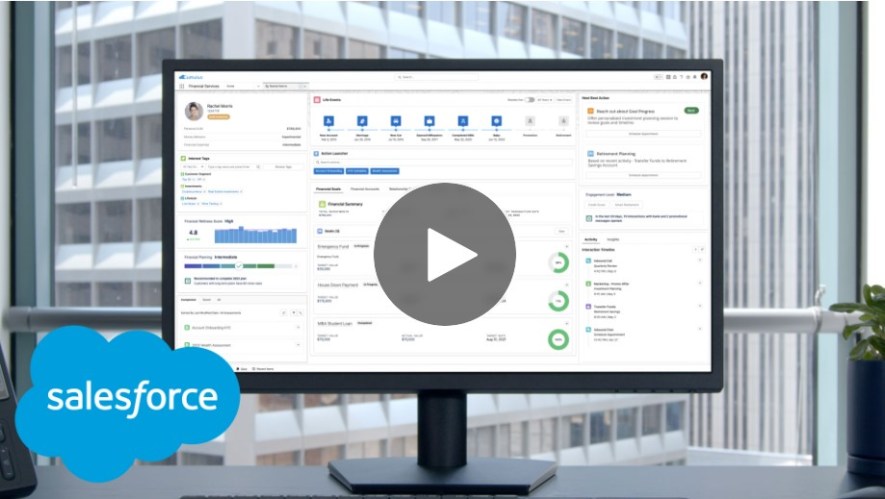

It doesn’t have to be this way. Think of how much better you could help your clients if you had a complete view of all your client data, all in one single pane — no more swivel chairs or clicking to various screens.

You can see everything from previous financial transactions and service interactions to individual financial goals and plans. This allows you to easily support service requests ranging from account onboarding to transaction disputes from end customers or chargeback disputes from merchants. You can simplify underwriting processes and tailor policies for each client’s unique situation.

Blending transactional data with behavioral data (think website traffic, content consumption, and sentiment analysis, among other data points) creates a more three-dimensional customer view. This allows you to deliver even more personalized experiences that your clients and policyholders expect.

62% of customers

would switch FSIs if they felt treated like a number, not a person. Read more in The Connected Financial Services Report.

With a single source for all your customer data, AI can really shine. It can use data to offer recommendations and alerts to meet your client’s specific financial needs. It can also help you do your job better because you’ll have all the information you need to answer support questions or handle issues faster.

Five-step checklist to gauge data maturity in financial services

Data maturity is the foundation for any AI enterprise, and removing data silos is just one piece of that. Is your data in a state that puts your organization on track to successfully use AI? Go through this checklist to see where you stand.

❑ Your organization has clearly defined goals.

Your FSI knows what you want to achieve. You have clear objectives that are specific, measurable, achievable, relevant, and time-bound (SMART goals) to your firm, agency, or brokerage business and customer service needs. These goals align with your organization’s strategic objectives around data maturity and AI implementation.

❑ Your technology stack is simple and automated.

You’re able to check this box if you have already identified and eliminated manual processes that rely on multiple disconnected data sources. Your organization uses automation and integration solutions to simplify data collection and processing for claim or transaction disputes. You have a single source of truth for all client or member data. You don’t need to remove data silos because you don’t have any.

❑ You have solid governance and due diligence policies in place.

You have strong data governance policies and procedures to keep your data accurate, secure, and compliant with industry regulations like the Sarbanes-Oxley Act (SOX) and General Data Protection Regulation (GDPR). Your organization regularly checks data quality and validates processes to maintain the integrity of your data. You conduct regular audits to assess and monitor your data management practices.

❑ Your organization uses intelligent insights to inform the business.

Your organization has data analytics and business intelligence tools in place to gain valuable insights from your data. Then, you use these insights to identify trends, patterns, and opportunities for improvement. Internally, the insights can show how to reduce time-to-market for new financial products and how to enhance customer experience during account onboarding. For clients, you can use these insights to improve loan approval rates or predict future market trends and customer behavior. Your leaders use these insights to make better, more informed decisions.

❑ You use data insights to lead digital transformation.

Your firm is far down the path of digital transformation. Employees use data to improve your products, processes, and services, like claims processing in insurance, risk management in banking, or personalized financial planning in wealth management. You thrive on a data-driven culture that helps you stay ahead of the curve.

Embracing a data-driven future in financial services

If you weren’t able to check each box above, we understand. And, we’re here to help.

Getting AI right is a massive undertaking, and it can seem overwhelming. That’s why it’s important to take a step back and evaluate the key components of data maturity that will help you, your team, and your entire organization achieve AI success.

At the same time, there are actions you can take now to increase productivity and revenue. There are jobs to be done where you can start small with AI with the data you already have. For example, you can use AI to transcribe notes from a wealth advisor and her client, then send a follow-up communication with action items from the call. Or you can simplify first notice of loss (FNOL) with auto-fill based on first and third-party data to better triage insurance claims and facilitate straight-through processing, increasing productivity and lowering cost to serve.

When you remove data silos and have a single source of truth for all your client data, you’ll be in a better place to take advantage of all the benefits of AI.

Is your FSI ready to take a data-centric approach to thrive and succeed in the newest digital age? Get your copy of The Financial Services Playbook for Effective Data Maturity to get started on the path to becoming an AI enterprise.