When times get tough, people get entrepreneurial. It’s true — recessions in the United States are typically marked by increases in entrepreneurial activity. Even still, last year was special. In 2024, the United States averaged 430,000 new business applications per month, breaking records and proving that entrepreneurship is alive and well. That’s a 50% jump from 2019 and shows just how much innovation is thriving.

Why is everyone jumping into business? For some, it’s about solving a problem they’ve spotted. For others, it’s about finally becoming their own boss. And with all the digital tools at your fingertips, starting a business has never been easier. Let’s dive into what’s fueling this wave of entrepreneurship and how you can ride it too.

What you’ll learn:

- Why economic challenges inspire entrepreneurship

- Six lessons from the startup surge

- The role of AI in shaping small businesses today

- Navigating economic uncertainty with confidence

Why economic challenges inspire entrepreneurship

History shows that tough times often push people to think outside the box. During the Great Depression, for example, innovative companies like Disney and HP were born out of necessity and ambition. Similarly, the 2008 financial crisis saw a wave of small and medium-sized businesses (SMBs) emerge as people turned job losses into opportunities to create something new.

Fast forward to recent years, and you’ll see this trend repeating itself. Over the past four years, the U.S. has seen a historic small business boom, with more than 21 million new business applications. Many of these entrepreneurs started because they wanted more control over their lives or saw a gap in the market they knew they could fill. What’s interesting is how accessible starting a business has become, with digital tools and platforms making it easier than ever to reach customers and grow.

Government and community support also play a huge role in helping small businesses survive tough times. Many SMB leaders say support from their community has been critical to their success. Whether it’s loyal customers, local partnerships, or online followers cheering them on, entrepreneurs are finding ways to thrive even when the economy is unpredictable.

AI Tools for Small Business

Six lessons from the startup surge

We surveyed entrepreneurs to find out what it was like being an entrepreneur during tough economic times. What they said points to optimism, self-reliance, and a digital-first mindset. Whether you’re dreaming of starting your own business or just curious about what’s driving this wave of innovation, these six takeaways paint a clear picture.

1. Creativity is critical

We asked respondents to list the three most important qualities an entrepreneur needed during the economic downturn. Creativity was number one by a landslide, cited by 57% of those surveyed. It’s easy to see why: with workplaces closed, and in-person business put on hold, people had to get creative.

Some launched businesses from their kitchens, turning family recipes into thriving brands. Others tapped into social media, using platforms like Instagram and TikTok to showcase their products with a personal touch. Creative thinking went beyond products. It was used in marketing, operations, and customer engagement. For example, local coffee shops survived by creating subscription boxes for their beans, and small gyms introduced pay-as-you-go virtual classes. These changes helped businesses stay afloat and created new ways to earn money.

2. Being your own boss is the ultimate inspiration

The freedom to call the shots is a huge motivator for entrepreneurs. Starting your own business means setting your own hours, pursuing your passions, and building something meaningful. During the startup surge, this sense of autonomy drove countless people to take the leap. This held true as more than half (57%) of those we surveyed cited being in charge as the main inspiration for starting a business.

3. Economic shifts accelerate plans

Entrepreneurs from this era often said they’d been planning their businesses for years but only made the move when they saw an opportunity. Although just over a quarter (25.1%) of the entrepreneurs we surveyed said they’d been laid-off as a result of the economic shift, and needed income, most of them started their business for other reasons. When the world shifted to remote work, people spotted opportunities to solve new problems. Delivery services exploded as consumers sought convenience. Health-focused startups thrived as people prioritized wellness. The rise of freelancing and gig work offered new pathways to entrepreneurship.

4. Direct-to-consumer businesses dominate

Direct-to-consumer (D2C) models became the backbone of the startup surge. According to our data, roughly 80% of these businesses sell directly to consumers. Why? Because they cut out the middleman and connect businesses directly with their customers. Brands have built strong followings by focusing on what customers truly want and delivering it in a personalized way. New entrepreneurs used this model to sell:

- Handmade goods on digital storefronts

- Subscription boxes with personalized products

- Digital services like fitness coaching and tutoring

If you’re planning a business, think about how you can connect directly with your audience. Social media, email marketing, and your website are powerful tools to engage with customers and keep them coming back.

5. Starting small is feasible

There’s still some truth to the old adage, “It takes money to make money.” But it might not take as much as it used to. Over half (52%) of our new small business owners launched their new companies with less than $10,000 in funding — and nearly half of that group had less than $5,000 on hand on opening day. An overwhelming majority (nearly 80%) of founders drew from their own bank accounts to get things going, while roughly one-third received friends and family investments.

Here’s how entrepreneurs managed to start lean:

- Affordable tools: Platforms like Canva, Wix, and Starter Suite made branding and websites accessible.

- Micro-funding: Crowdfunding sites like Kickstarter helped raise initial capital.

- Small-scale operations: Many entrepreneurs began in their homes, minimizing overhead costs.

6. Digital-first is the new normal

One reason so many new businesses could be born on small budgets is that they’re small — 59% of the businesses surveyed employ five or fewer people. Another reason? They’re digital-first, mostly requiring nothing in the way of physical space or equipment beyond a computer or even just a phone. Seventy percent of those surveyed said their new business was born out of technology or tech-focused from day one.

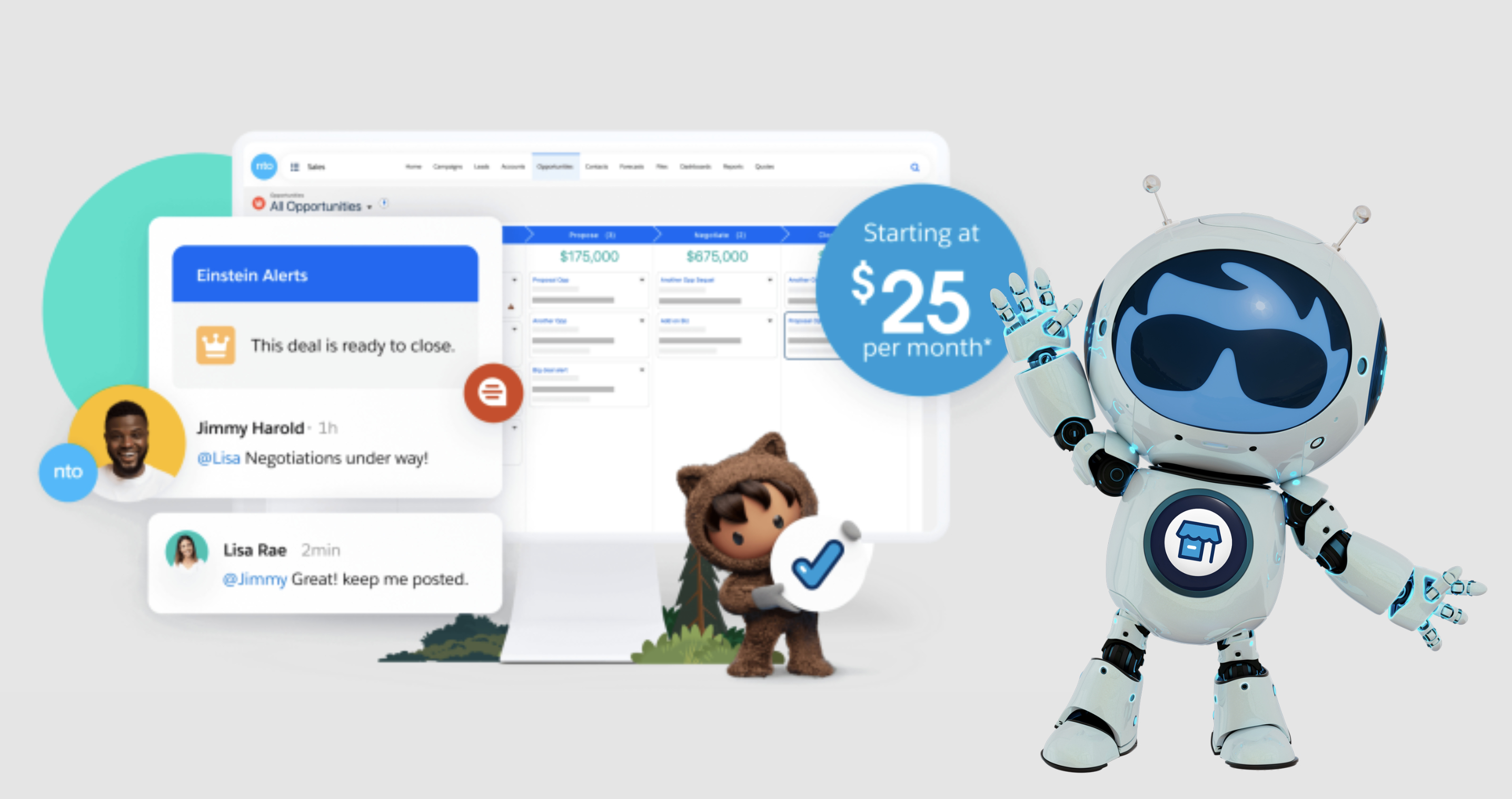

Investing in the right technology is key to this success. 76% of SMBs are spending more on technology this year, with 88% of growing businesses making it a priority. When choosing tools, SMBs focus on artificial intelligence (AI) capabilities, ease of use, and affordability. For example, customer relationship management (CRM) tools are becoming more important as they help businesses manage leads, close deals, and build strong relationships with customers, all without needing a lot of infrastructure.

The role of AI in shaping small businesses today

AI is helping small businesses do more with less effort. Humans with AI drive success together, we’re seeing. Today, 75% of SMBs are investing in AI, and the results are clear. Businesses using AI report a 91% boost in revenue, with 90% saying it makes their operations more efficient. What’s exciting is how AI levels the playing field for small businesses. You don’t need a big budget to compete with larger companies anymore. Even starting small can make a big difference.

But what is AI really doing? It all starts with getting your data together across sales, marketing, service, and commerce. A CRM (like Starter Suite) makes this possible by organizing your customer information in one place. Add AI to the mix, and you can automate routine tasks like sending follow-up emails or qualifying sales leads.

But with an AI CRM (like Foundations and Enterprise), imagine AI managing bookings, modifications, and cancellations for dining, hotels, travel, and events. Or providing upsell opportunities by analyzing customer history and boosting sales. Sounds amazing, right? Agentforce does all of that.

With Agentforce, you can build and customize AI agents tailored to your unique business needs. Whether you’re streamlining customer service with AI chat or driving sales with personalized insights, Agentforce adapts to your needs. And because Agentforce operates within your CRM, it ensures all your customer data is unified and actionable.

The numbers back it up too. Small businesses that use AI see real results:

- 85% of SMBs with AI report a return on investment

- 87% say AI helps them scale faster

- 82% of SMBs say it will restructure their operations

Check it out for yourself at Salesforce Foundations.

Navigating economic uncertainty with confidence

Economic uncertainty brings challenges, but it also creates opportunities for those ready to adapt. Starting and growing a business doesn’t have to be complicated. With the right tools, you can streamline operations and stay organized even in tough times. Salesforce makes it easy to manage your leads, track deals, and build lasting relationships with your customers. It’s an all-in-one CRM platform designed to save you time, boost productivity, and help your business scale faster.

Start your journey with a free trial of Starter today. Looking for more customization? Explore Pro Suite. Already a Salesforce customer? Activate Foundations today to try out Agentforce.

AI supported the writers and editors of this article.