Closing the Customer Experience Gap

Analytic Services Research Report, Sponsored by Salesforce

Chapter 3: Increasing the Return on Customer Data

“THE TECHNOLOGY POWERING THE DASHBOARD MUST BE CAPABLE OF ELEGANTLY WEAVING TOGETHER DISPARATE DATA SOURCES”

Leaders, however, are more likely to use data for predictive and personalized customer experiences and to create cohesive customer experiences across channels. Indeed, the business leaders interviewed for this report were mapping customer journeys and reorganizing around the customer experience to create more seamless omnichannel interactions. They were analyzing customer data to create more personalized and anticipatory customer service, sales, and product development processes. As the online retail performance marketing leader said, one of the biggest customer experience priorities is “anything that helps us with personalization, because we are moving toward a one-to-one approach to customer experience.”

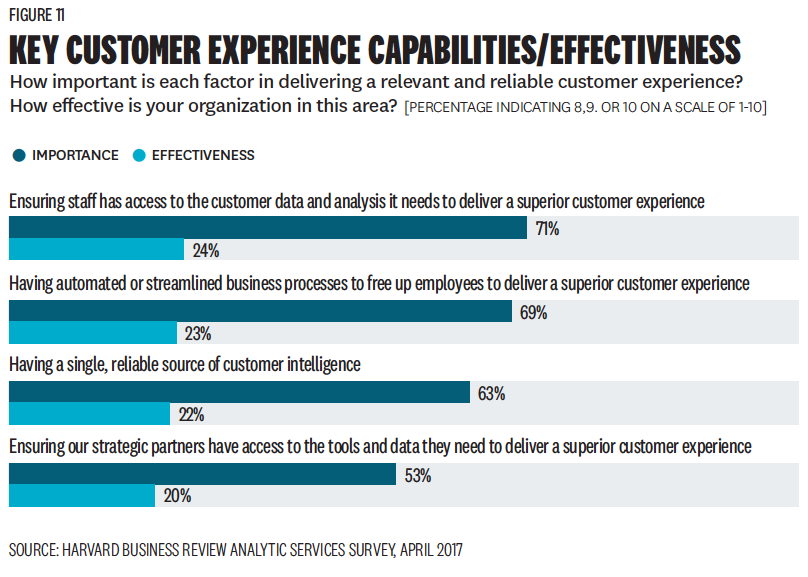

One reason more companies are not yet prioritizing personal, predictive, and omnichannel customer experiences may be the disconnect between the capabilities required to deliver those kinds of singular customer experiences and their level of mastery in those areas. Ensuring that employees and partners have access to the customer data and analysis, creating automated or streamlined business processes, and having a single and reliable source of customer intelligence were all deemed critical, yet less than a quarter of companies rated themselves as effective in those areas.

For those with the right technology architecture in place, providing customer intelligence to employees and partners can be a more straightforward exercise than it is for those still struggling with disparate customer data and systems. But even then, there must be clarity around how to act on that insight. “Information needs to be both robust and actionable,” said the senior vice president of strategic analytics for a marketing services provider. “[Even] more important than giving staff access to customer data or presenting analysis is prescribing rules or means to make smarter decisions via those data and the derived intelligence.”

Customer experience excellence requires “giving the right person the right data at the right time,” said the credit union CEO. “Too much data is useless, and trying to match what I might need now and what I have access to can be difficult.” The credit union has made significant progress identifying and highlighting the next best action for call centers to take with an individual customer, for example. “Keeping a consistent look and feel of the platform allows team members to continue to focus on using the solution to generate insights rather than focusing on the tools,” adds the vice president of IT for the software solutions provider. “The key technology skills involve managing the integration of multiple data sources, obfuscating the complexity from the customer experience managers.”

Automating and streamlining as much a possible to free up employees and partners to engage more effectively with customers is also crucial. “We try to automate as much as we can, from sales to delivery and all the way to our long-term support service,” says the vice president of customer experience at the software development firm. “It’s very important because that enables us to provide excellent customer experience at an effective cost.”

The Age of the Customer-Centric CIO

overview

Chapter 1

Chapter 2

Chapter 3

Chapter 4

Want to read the full report?

Questions? We’ll put you on the right path.