The latter part of 2023 saw European shoppers start to loosen their purse strings, following a year of subdued spending. According to the Shopping Index, which is an analysis of the shopping activity of more than 1.5 billion global online shoppers, digital commerce grew 5% year-on-year (YoY) in Europe in 2023.

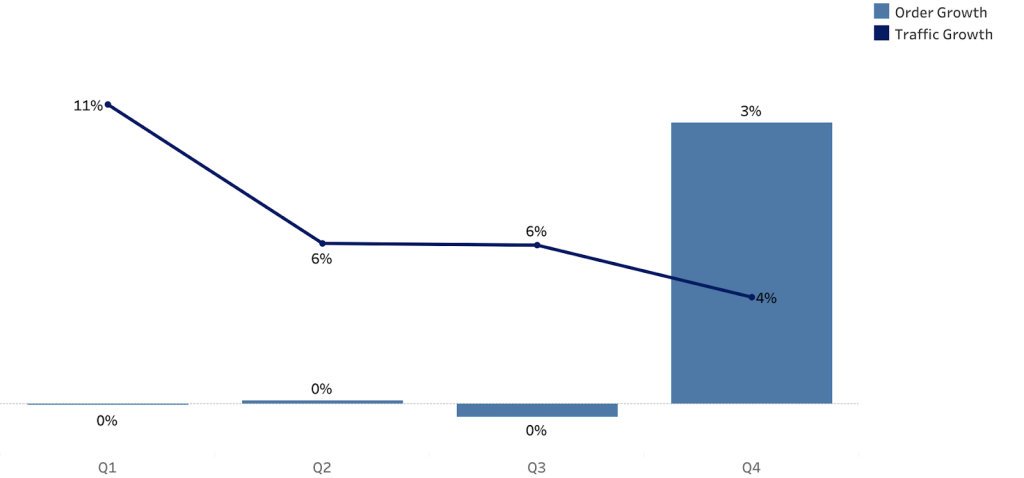

Much of the growth seen earlier in the year in Europe stemmed from higher prices, however, consumer demand picked up in the fourth quarter when retailers began to deliver attractive discounts. Overall, online traffic in Europe remained strong, growing at 6% YoY, and increased demand in Q4 meant that order volume nudged up slightly (+1%) in 2023.

So, what key insights did we glean from our data? Here are three top European shopping trends seen in 2023:

European Shoppers Boosted Global Online Peak Season Sales

Global online sales grew 3% YoY across the peak shopping season, which translated into $1.2 trillion in global online spend. Growth in the U.S. was essentially flat YoY, with online sales growing at 1% and order volume up by 2%. Meanwhile, APAC saw a 2% growth in online sales and a drop of 3% in order volume.

In Europe, on the other hand, online sales grew by 6%, with consumers having placed 3% more orders during the period, compared to the previous year. Within Europe, key markets such as France (+12%) and the U.K. (+5%) both saw good growth. However, leading the way in terms of the fastest growth were Eastern Europe and Spain.

Consumers in Eastern Europe spent more YoY during the season, despite retailers pulling back on discounts (3% drop in average discount rate). Order volume increased by a significant 14%, and units per transaction (UPT) grew by 10%. In other words, consumers in the region placed 14% more orders and bought 10% more items per transaction. All of this resulted in overall online sales growth of 17% in Eastern Europe during the peak shopping season.

In Spain, online sales also grew by 17% and order volume increased by 5%, with UPT having increased slightly. Consumers in the country, despite higher prices (+5% ASP), shopped more frequently compared to the year before.

Beauty and Personal Care Were in Focus in 2023

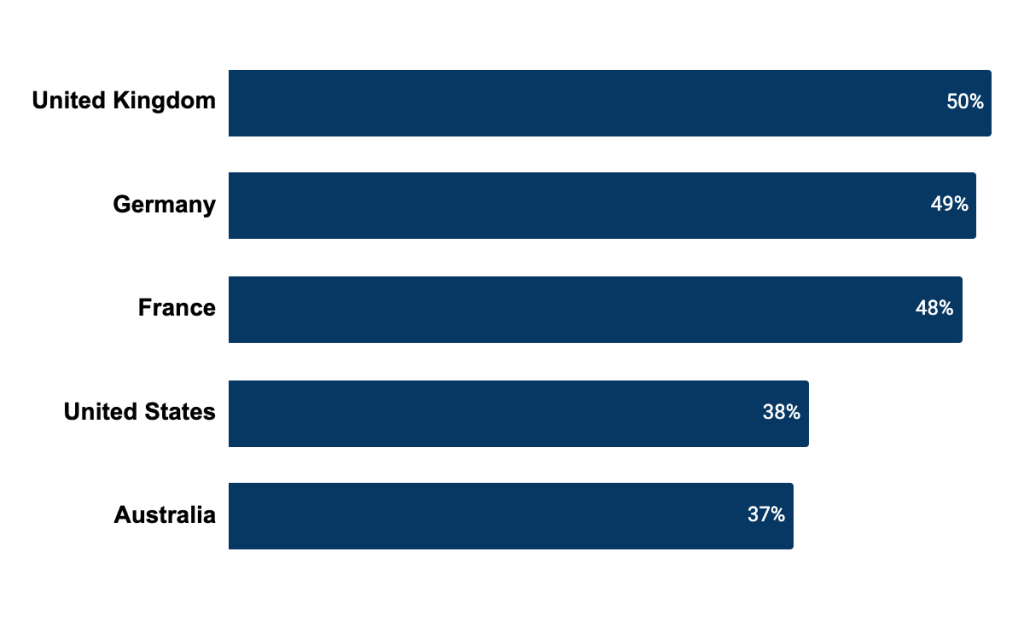

According to research from RetailX, European shoppers are more likely to buy beauty and personal care products online compared to other regions. With a large proportion (32%) of shoppers in that category aged between 25-34 years old.

Share of the population buying health and beauty products online, by region

With that in mind, alongside consumers’ increasing emphasis on beauty and wellness, it’s no surprise that beauty and personal care products were among the top performers, in terms of online sales, across Europe in 2023.

Our data shows that overall, online sales in the health & beauty category grew 21% YoY, making it the second-best-performing category in 2023, behind general footwear & handbags. Order volume in health & beauty grew by 7% YoY, despite a decrease in the average discount rate in that category (-7%).

European Shoppers Leaned Towards Mobile Wallets

The popularity of mobile wallets across Europe certainly remains unabated. Of course, usage varies by country, however, according to Visa, 72% of European shoppers actively engage with mobile wallets, and the expectation is that by 2025, digital wallets will account for just over half of all digital commerce transactions.

That’s not entirely surprising. Mobile wallets certainly help to streamline the payment process, making it easier and quicker for shoppers to buy with their mobile phones, and as consumers continue to rely heavily on their mobile devices, it makes sense that more and more of them are leaning towards that method of payment. Our data shows that the use of mobile wallets in Europe grew 58% YoY, making it the fastest-growing payment method used in 2023.

Looking Ahead

A recent survey by McKinsey shows that consumer confidence dropped in the last quarter of 2023, compared to the previous quarter. This sentiment — much like we saw throughout the year — translated into consumers remaining cautious about their spending, patiently waiting for the price drops that finally came during the peak shopping season.

Amid consumer caution around spending in the year ahead, here are some ways in which retailers can lean on data to personalise and remove friction from the shopping journey to help drive loyalty and grow revenue.

Methodology

Powered by Salesforce platform data, the Shopping Index uncovers the true shopping story. We look at the previous nine quarters to uncover a deep understanding of how consumer behaviour is evolving and how the market is moving. The Shopping Index analyses the activity and online shopping statistics of more than 1.5 billion unique global shoppers from more than 67 countries. This battery of benchmarks covers both the recent history and current state of digital commerce. Several factors are applied to extrapolate macroeconomic figures for the broader retail industry, and these results are not indicative of Salesforce performance.