San Francisco — May 31, 2023 – Salesforce (NYSE: CRM), the global leader in CRM, today announced results for its first quarter fiscal 2024 ended April 30, 2023.

- First Quarter Revenue of $8.25 Billion, up 11% Year-Over-Year (“Y/Y”), up 13% Constant Currency (“CC”)

- First Quarter GAAP Operating Margin of 5.0% and Non-GAAP Operating Margin of 27.6%

- Current Remaining Performance Obligation of $24.1 Billion, up 12% Y/Y, 12% CC

- First Quarter GAAP Diluted Earnings per Share (“EPS”) of $0.20 and Non-GAAP Diluted EPS of $1.69

- Returned $2.1 Billion in First Quarter to Stockholders in the Form of Share Repurchases

- Initiates Second Quarter FY24 Revenue Guidance of $8.51 Billion to $8.53 Billion, up ~10% Y/Y

- Reiterates Full Year FY24 Revenue Guidance of $34.5 Billion to $34.7 Billion, up ~10% Y/Y

- Raises Full Year FY24 GAAP Operating Margin Guidance to ~11.4% and Non-GAAP Operating Margin Guidance to ~28.0%

“Salesforce significantly exceeded our non-GAAP margin target for the quarter — up 1,000 basis points year-over-year, and we are raising our FY24 non-GAAP operating margin guidance to a 550 basis point increase year-over-year,” said Marc Benioff, Chair and CEO of Salesforce. “At the same time, we are leading the next major revolution in CRM — infusing trusted, secure generative AI across our entire product portfolio. Salesforce’s generative AI ecosystem wields Einstein GPT, Slack GPT, and Tableau GPT, delivering trusted power across our product portfolio. Our Salesforce GPT Trust Layer will shield customer data, enabling productive automation and intelligent enterprise enhancements securely.”

At the same time, we are leading the next major revolution in CRM — infusing trusted, secure generative AI across our entire product portfolio. Salesforce’s generative AI ecosystem wields Einstein GPT, Slack GPT, and Tableau GPT, delivering trusted power across our product portfolio.

Marc Benioff, Chair and CEO of Salesforce

“Q1 represented another strong step forward as we accelerate our transformation and profitable growth strategy,” said Amy Weaver, President and CFO of Salesforce. “Our team delivered another double-digit growth quarter on the top and bottom line as we help customers increase productivity, drive efficiency, and become AI-first companies.”

Salesforce delivered the following results for its fiscal first quarter:

- Revenue: Total first quarter revenue was $8.25 billion, an increase of 11% Y/Y, and 13% CC. Subscription and support revenues were $7.64 billion, an increase of 11% Y/Y. Professional services and other revenues were $0.61 billion, an increase of 9% Y/Y.

- Operating Margin: First quarter GAAP operating margin was 5.0%. First quarter non-GAAP operating margin was 27.6%. Restructuring impacted first quarter GAAP operating margin by (860) bps.

- Earnings per Share: First quarter GAAP diluted earnings per share was $0.20, and non-GAAP diluted EPS was $1.69. Losses on the Company’s strategic investments negatively impacted GAAP diluted earnings per share by $(0.11) based on a U.S. tax rate of 25% and non-GAAP diluted EPS by $(0.11) based on a non-GAAP tax rate of 23.5%. Restructuring impacted first quarter GAAP diluted earnings per share by (72) cents.

- Cash Flow: Cash generated from operations for the first quarter was $4.49 billion, an increase of 22% Y/Y. Free cash flow was $4.25 billion, an increase of 21% Y/Y. Restructuring impacted first quarter operating cash flow growth by (910) bps.

- Remaining Performance Obligation: Remaining performance obligation ended the first quarter at $46.7 billion, an increase of 11% Y/Y. Current remaining performance obligation ended at $24.1 billion, an increase of 12% Y/Y, and 12% CC.

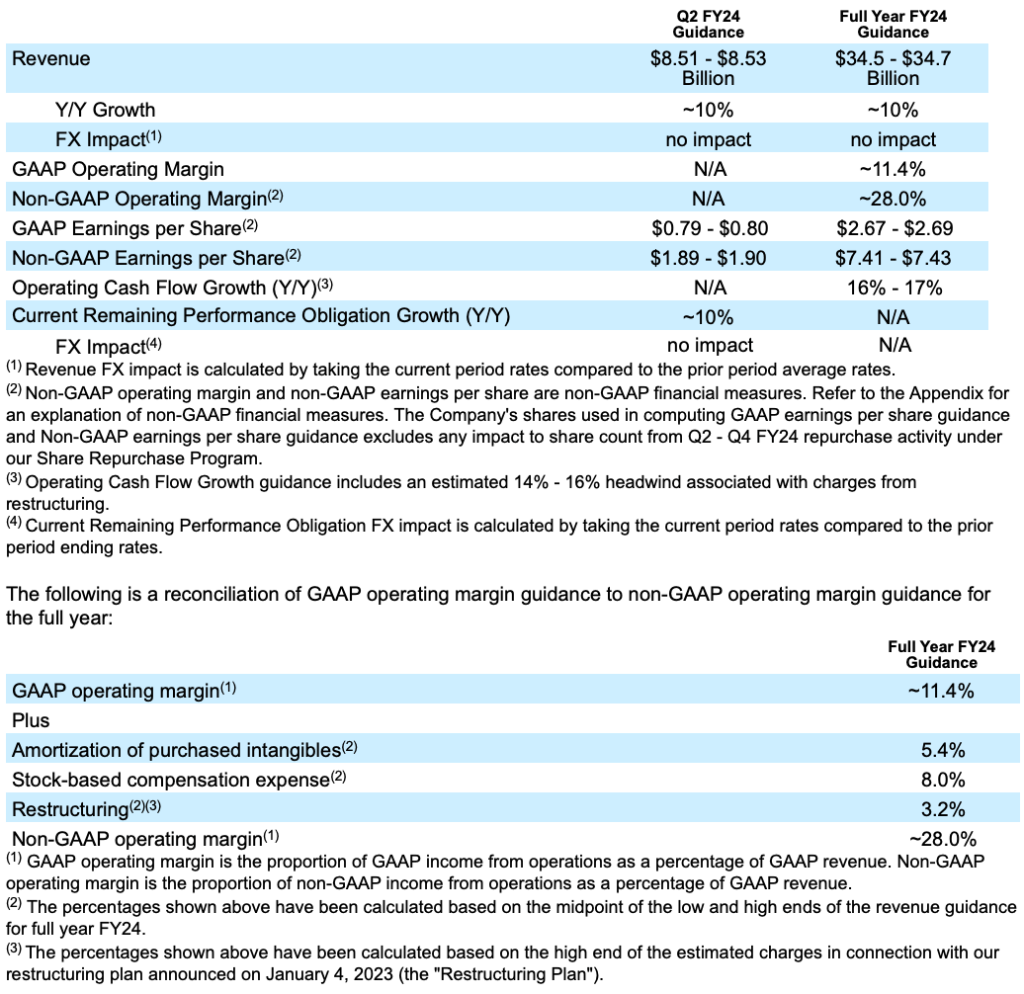

Forward Looking Guidance

As of May 31, 2023, the Company is initiating its second quarter GAAP and non-GAAP EPS guidance, current remaining performance obligation growth guidance, and revenue guidance. The Company is reiterating its full year FY24 revenue guidance and updating its GAAP and non-GAAP EPS guidance, GAAP and non-GAAP operating margin guidance, and operating cash flow guidance.

Our guidance assumes no change to the value of the Company’s strategic investment portfolio as it is not possible to forecast future gains and losses. In addition, the guidance below is based on estimated GAAP tax rates that reflect the Company’s currently available information, and excludes forecasted discrete tax items such as the tax effects of stock-based compensation. The GAAP tax rates may fluctuate due to discrete tax items and related effects in conjunction with certain provisions in the Tax Cuts and Jobs Act, future acquisitions or other transactions.

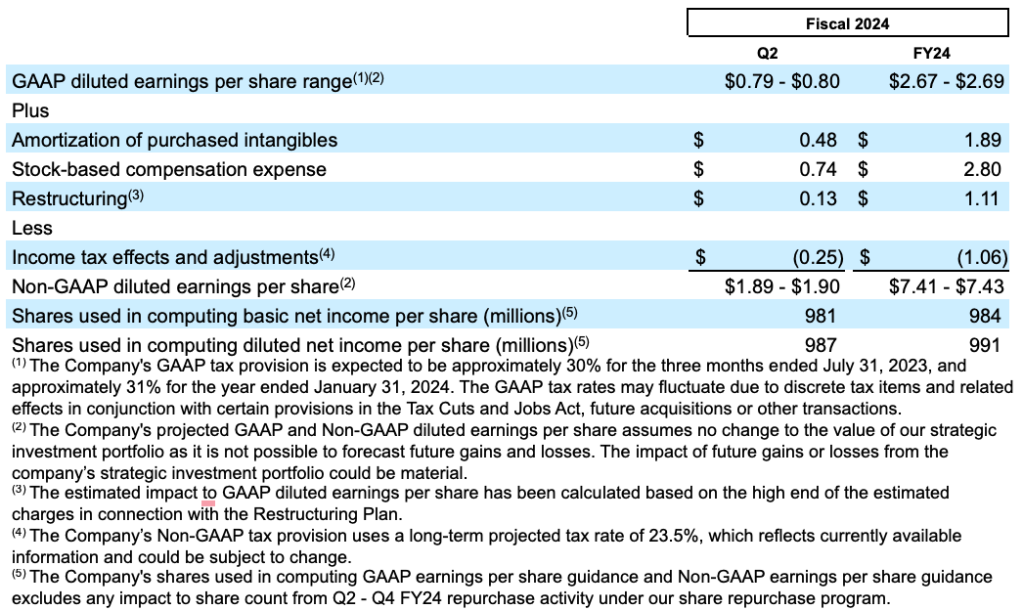

The following is a per share reconciliation of GAAP diluted earnings per share to non-GAAP diluted earnings per share guidance for the next quarter and the full year:

For additional information regarding non-GAAP financial measures see the reconciliation of results and related explanations below.

Management will provide further commentary around these guidance assumptions on its earnings call.

Product Releases and Enhancements

Three times a year Salesforce delivers new product releases, services, or enhancements to current products and services. These releases are a result of significant research and development investments made over multiple years, designed to help customers drive cost savings, boost efficiency, and build trust.

To view our major product releases and other highlights as part of the Spring’23 Product Release, visit: www.salesforce.com/products/innovation/spring-23-release/

Quarterly Conference Call

Salesforce plans to host a conference call at 2:00 p.m. (PT) / 5:00 p.m. (ET) to discuss its financial results with the investment community. A live webcast and replay details of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor.

About Salesforce

Salesforce empowers companies of every size and industry to connect with their customers through the power of data + AI + CRM + trust. For more information about Salesforce (NYSE: CRM), visit: www.salesforce.com/in