- Salesforce’s 2022 Future of Financial Services white paper explores trends across banking, insurance, and wealth management during a period of economic and global turmoil.

- Key findings signal what customers want most: for financial services institutions to anticipate their financial needs and support their financial wellbeing with more intuitive digital experiences and greater transparency.

What happens when customer demand outpaces a business’ ability to keep up? That’s the question financial service institutions (FSIs) are wrestling with as the world continues its march towards a digital-first future.

FSI customers are increasingly choosing digital options for everyday activities like deposits and payments. And, almost 70% of customers say COVID-19 elevated their expectation of companies’ digital capabilities, demonstrating that shifts to digital made during the pandemic are here to stay. However, according to survey findings, banking, insurance, and wealth management customers were light on praise for how well their financial needs are understood.

These and other insights from Salesforce’s 2022 Future of Financial Services white paper are detailed below, including how automation can play a role in FSI digital success.

In a digital economy, customers prize ease of use and transparency

Customers increasingly prefer to go online to transact. Banking is leading the way over insurance and wealth management institutions, with 78% of customers establishing a first connection with a bank via a website or app. Banking customers are early digital adopters, but even in sectors with more complex offerings, the number of customers who prefer online services is growing. In insurance, 44% of respondents now start their connections online, and in wealth management, 42% of customers do.

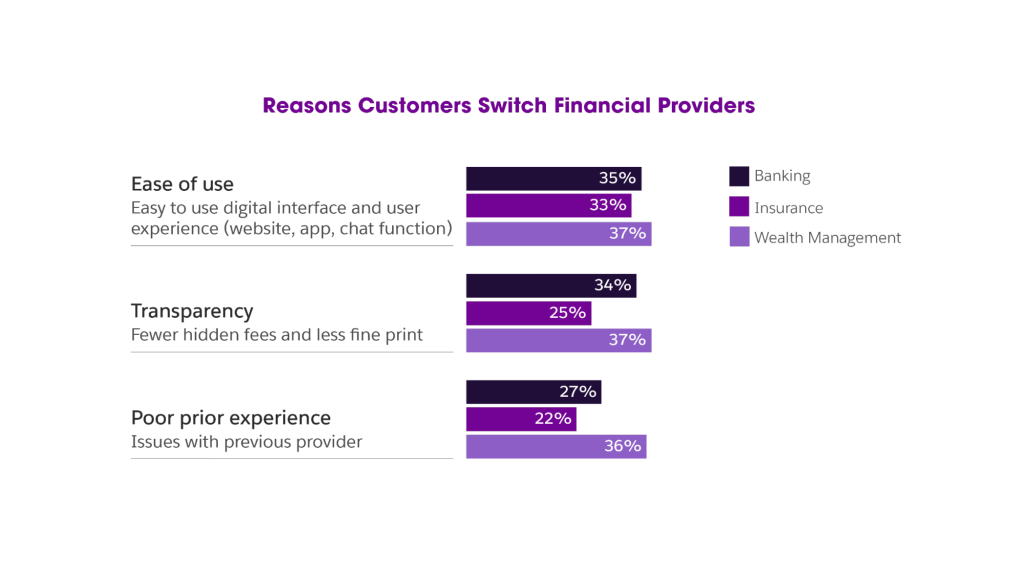

These digital experiences must deliver the service that customers need and want today. On average, 1 in 3 customers across all three verticals reported a readiness to switch institutions if their experience falls short of expectations.

The good news? FSIs offering easy-to-manage and transparent services (with no baffling fine print) are winning customers over. Roughly one third of customers will switch to an institution that can offer intuitive experiences and more transparency.

Today’s customer wants both personalization and financial health advice

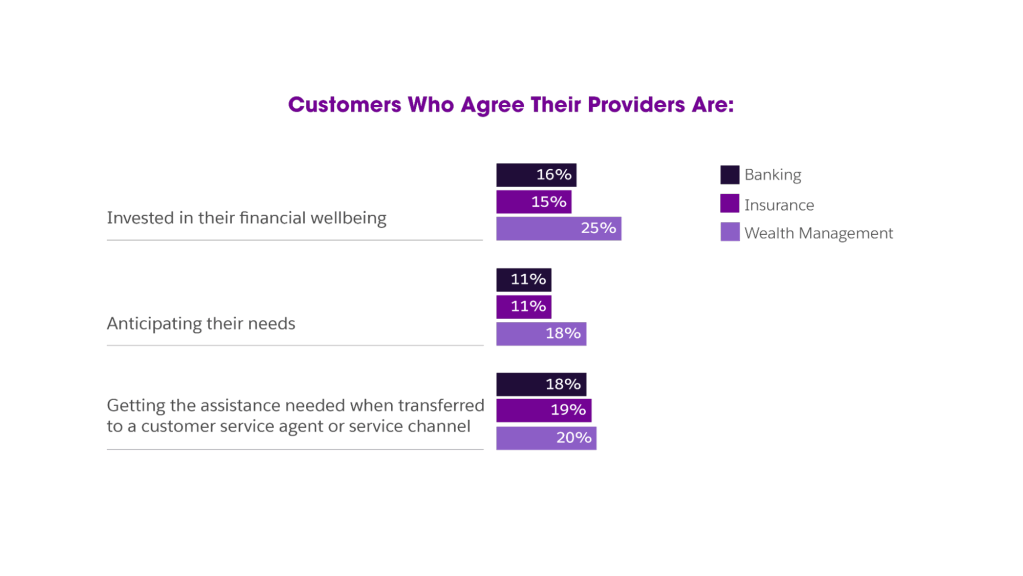

Banks, insurance, and wealth management institutions are facing big challenges when it comes to centralizing customer data to deliver personalized service. In fact, less than 15% of customers across banking, insurance, and wealth management “strongly agree” that their financial needs are being anticipated.

Today’s customer expects more, and personalization is key to increasing customer satisfaction and retention. Customers expect FSIs to go beyond just fulfilling their requests to anticipating and delivering what they will want or need next. In fact, the survey results showed that three out of the top five pain points customers faced in their experience all tied directly back to poor personalization.

Lack of personalization also feeds into the feeling that FSIs could improve their level of consideration for the financial wellbeing of their customers – something Salesforce’s panel of experts agree was critical for strong customer relationships. And customers agree, reporting that FSIs are falling short when it comes to prioritizing their financial wellbeing.

We have the spend data and insights to provide customers with so much more than just a list of their transactions. We can offer them sound and personalized financial advice. It’s a huge opportunity for the industry to prove to our customers that we care about their well-being while helping them build a better financial future.

CIO of a U.S.-based mid-sized wealth management firm

There’s also an opportunity for FSIs to increase customer satisfaction through technology that frees front-line employees to handle more complex cases. Currently, customers report low scores when asked whether they are getting the assistance they need when transferred to a customer service agent or channel. Virtual bots and other tools can help assuage these concerns.

Automation is a game-changer for customers and employees

Experts interviewed for this white paper see automation as key to streamlining the customer experience.

This is especially true for B2B institutions, where the customer needs – and resulting paperwork – are more complex. And, the most significant gains will likely come from middle office automation, where today customer information gets routed manually from department to department – a slow, cumbersome, and error-riddled process.

With automation, organizations can eliminate these types of data input errors, while dramatically accelerating the time it takes to process customer information. Better data integrity can lead to better interactions with clients.

Another bonus of automation? FSIs will be able to generate powerful reporting and insights to help them make informed, data-driven decisions and find new ways to optimize – perhaps in onboarding or claims management.

Partnerships are critical to filling service gaps

According to the in-depth interviews with a panel of financial services experts, FSIs should consider partnering with different categories of vendors to create better customer experiences. Some have already taken a page from the world of digital marketing and ecommerce, where customer experience has long been a focus.

To enable businesses to get closer to the experiences customers are looking for, the expert panel suggests that FSIs:

- Hire third-party attribution data vendors to enrich customer information and boost personalization.

- Tap UI/UX designers to create a well-designed digital experience, because often customers equate a good experience with greater security and trustworthiness.

- Use analytics partners to identify behavioral and engagement insights to remove friction points, such as why customers are dropping off in the customer journey or what questions they are asking a chatbot.

Focusing on key behavior metrics can help FSI leaders succeed

Revenue and margins still matter. But, Salesforce’s analysis makes it clear that FSIs need to track other key behavior metrics, such as logins, chatbot sessions, direct deposits, and others, to optimize their digital services.

They must answer questions like, “How far do customers get in their digital journeys?” “How can we build a journey for them to consider higher-margin products like lending?” and “Where are the friction points in our digital engagement?”

Answering these questions, while also tracking a range of activities, can help every FSI succeed in a digital-first world.

More information:

- Read Salesforce’s The Future of Financial Services: Better Customer Experiences Start with Automation and discover more top insights and recommendations stemming from the white paper here.

- To learn more about how Salesforce for Financial Services draws on the full power of the Client 360 to deliver relevant solutions for banking, insurance and wealth management institutions, go here.

- For more information about Virtual Assistant and how Prudential and PenFed Credit Union are increasing efficiency with chatbots and self-service tools, read more here.