This year brought many twists and turns, upending the way we live, work, and shop, and the implications for businesses across sectors and geographies were, and continue to be, massive. Salesforce Research, a team dedicated to investigating and reporting on the latest trends impacting the relationships between businesses and their customers, doubled down on its mission this year. The team surveyed nearly 80,000 consumers, business buyers, and decision makers across the globe — more than twice as many as it did last year — to understand how the pandemic is reshaping customer behavior and how businesses are responding.

Here are the top 10 data points we collected that encapsulate the impacts of 2020 on customer engagement, digital transformation, and more.

60% of customer interactions now take place online

The shift to digital-first customer engagement was well underway before the onset of COVID-19, but the global pandemic has accelerated this fundamental pivot as people across the globe spent less time in stores and more time in front of their screens. This summer, global consumers and business buyers surveyed for our annual State of the Connected Customer reported that six in ten of their interactions with companies were digital, compared to 42% in 2019, with no anticipated dip in 2021.

A separate study conducted earlier in the summer found significant portions of the population spending increased time browsing the internet (54%), using social media (45%), and watching streaming videos (45%), offering a clue of both the established and emerging channels where this digital engagement took place.

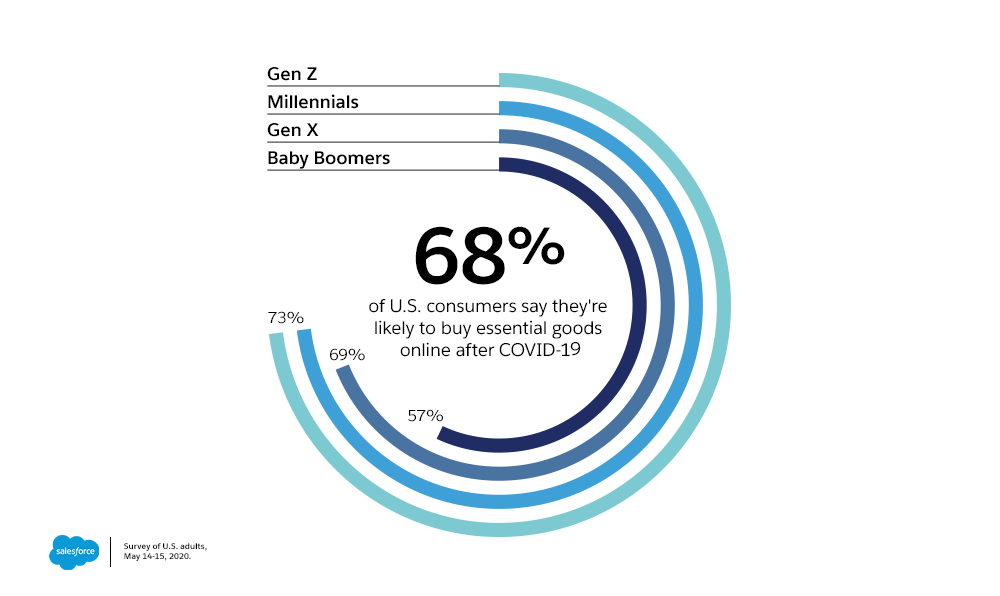

68% of consumers expect to buy essential goods online after COVID-19

It’s no secret that 2020 was a banner year for ecommerce. In fact, Salesforce’s Q2 Shopping Index, based on an analysis of more than one billion shoppers on Commerce Cloud, saw a 71% year-over-year surge in digital sales revenue. But as shelter in place orders proliferated and social distancing practices became the norm, the types of items sought by online shoppers evolved, too. For example, our Shopping Index found that digital spend on essential goods such as food, personal items, and other grocery store staples rose 154%.

A survey of global shoppers found that over two-thirds expect the practice of buying groceries online to persist when the pandemic is over, foreshadowing what could be yet another upheaval in the retail industry. These purchases won’t necessarily be delivered, however, as the Shopping Index saw 127% growth in curbside pick up purchase revenue.

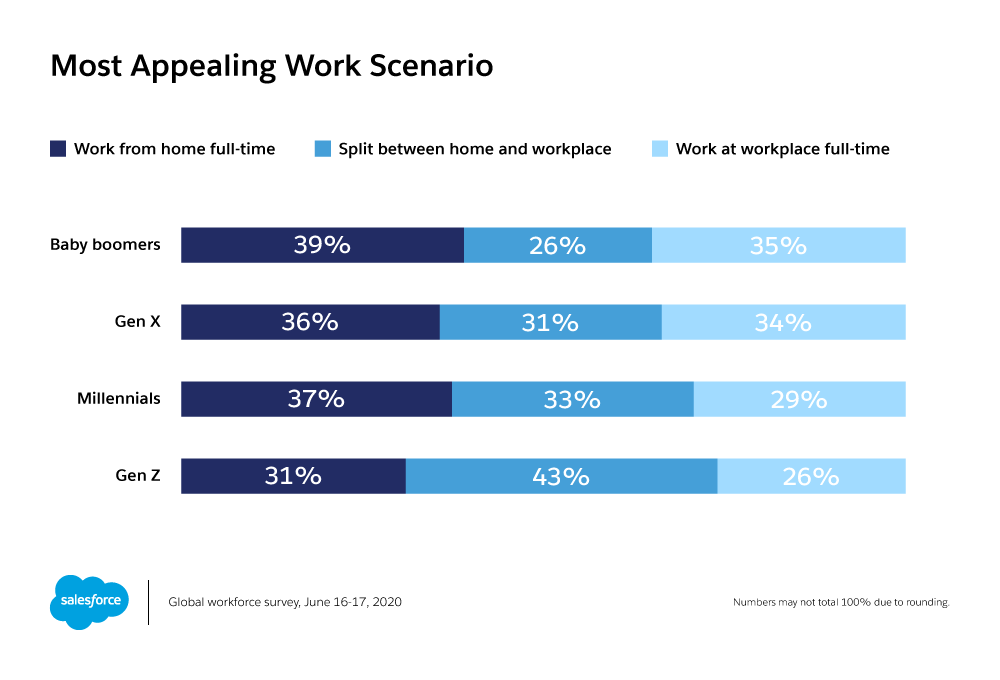

67% of the workforce is interested in working remotely for the long term

Of course, shopping was far from the only digital upheaval of 2020. For those fortunate enough to have the option, home offices became the default workplace. In fact, 62% of full-time workers surveyed in May said they were working remotely — 80% of whom had started doing so due to the pandemic. Two-thirds of these workers enjoyed such arrangements enough to wonder if they could be permanent.

The sudden shift to working from anywhere doesn’t mean offices are a thing of the past. In a follow-up survey conducted in June, only 37% of the workforce viewed full-time remote work as the most appealing long-term scenario. The most popular arrangement — especially for the fledgling Gen Z workforce — is a hybrid approach in which a given work week is spent in part at home and in part in the office.

88% of customers expect companies to accelerate digital initiatives

60% of consumers and business buyers surveyed in August stated that COVID-19 has change their relationship with technology. Even more — nearly nine in ten — expect this years’ crises to shorten the timelines for digitization of business, commerce, and more. A mere 2% of those surveyed believed there was no need for businesses to improve their technology.

The companies that use this moment to understand not just how to digitize their existing businesses, but how technology can drive new, innovative experiences that set them apart will prove more resilient as we move into the next normal.

Brian Solis, Global Innovation Evangelist, Salesforce

Use of artificial intelligence by marketers surged 186%

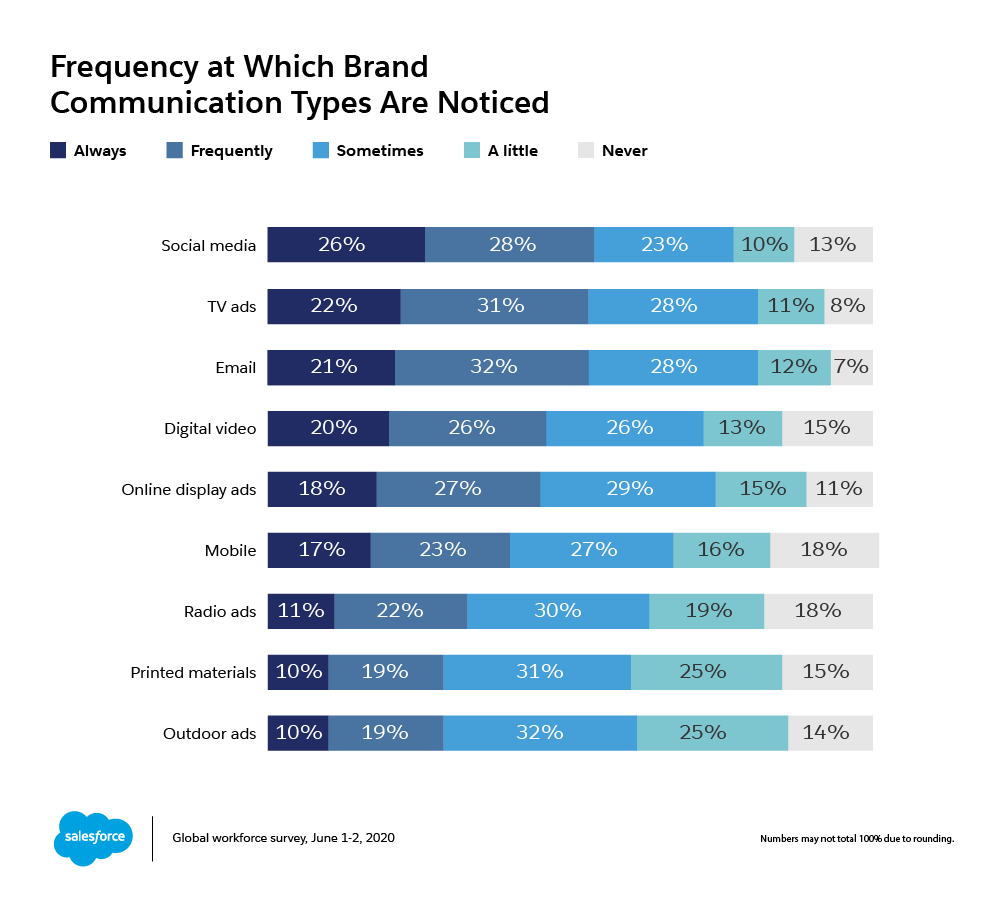

Given their outsized role in engaging increasingly online customers, marketers are increasingly leaning into digital transformation. The near-tripling of the share of marketers reporting that their organization uses AI from 2018 to 2020 is just one example. Marketers are also increasingly leveraging digital channels such as mobile apps (up 34% since 2018), mobile messaging like SMS and push notifications (up 31%), and streaming video (up 21%).

During the course of the pandemic, customers indicated that social media was the most effective medium for brands to reach them, with TV ads, email, and digital video following closely behind.

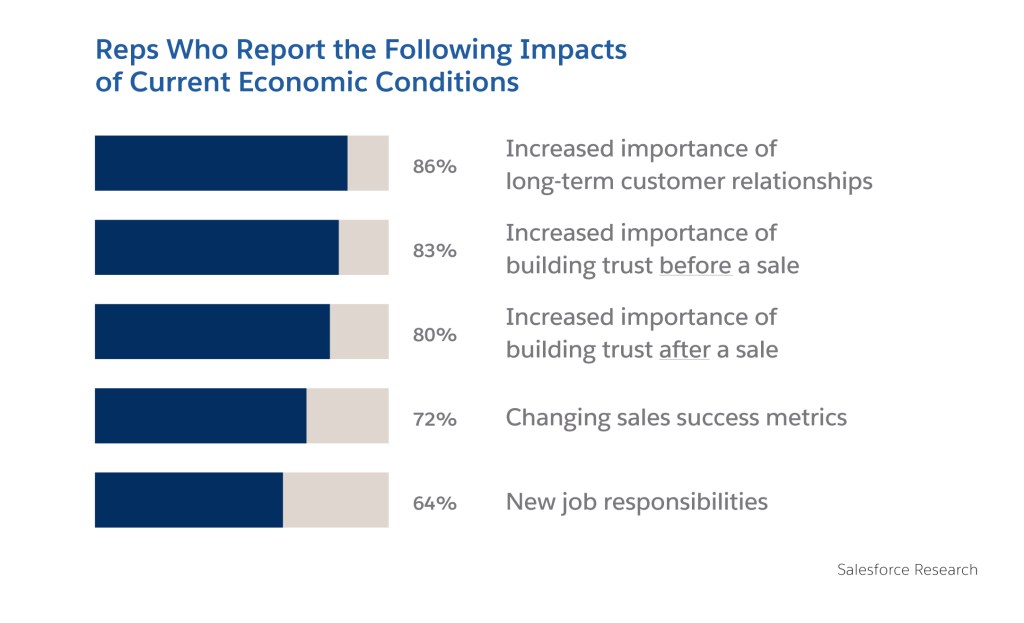

58% of sales representatives expect their role to change permanently

Sales representatives faced changes this year that extend far beyond their home offices. Having operated for years amid the longest running economic expansion in history, public health restrictions and the sudden crash in business and consumer demand prompted teams to reevaluate their value propositions and growth projections.

Sales professionals surveyed for the latest State of Sales report underscored the importance of customer and prospect relationships in their new realities, with interpersonal qualities like empathy becoming an increasingly critical element of representatives’ skill sets.

As Salesforce Global Growth Evangelist Tiffani Bova noted in a recent interview, outside sales representatives face a particularly transformative moment as they pivot to selling virtually for the foreseeable future. Our study found that 54% of outside sales representatives felt confident in their ability to close deals in the current environment, compared with 71% of inside sales representatives.

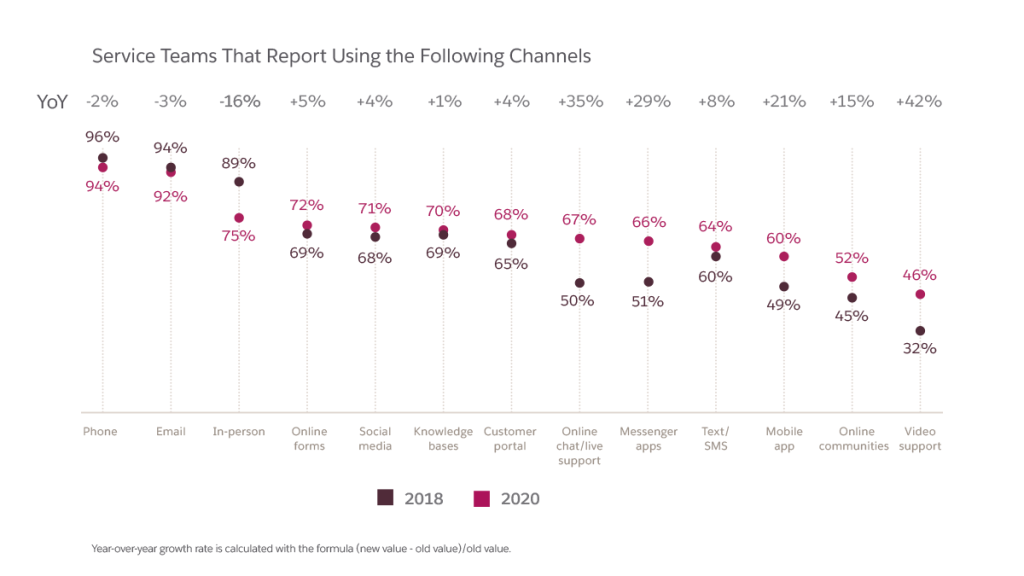

Use of video-based customer support rose 42%

It’s only natural that video would experience the highest rate of growth among customer service channels in a year when Zoom meetings became a part of so many daily schedules. Yet other digital service channels such as online chat and messenger apps such as WhatsApp or Facebook Messenger also saw significant uptake. In fact, the thousands of service and support professionals surveyed for the latest State of Service reported decreased use of just one channel: in-person.

Other digital service capabilities such as chatbots also saw double digital year-over-year growth, yet much like their colleagues in sales, service agents were increasingly challenged to demonstrate empathy for customers’ unique needs. In response, 83% of service organizations report having changed policies to provide more flexibility to customers during the pandemic.

72% of small business leaders remain optimistic about the future

Salesforce conducted two surveys of small business leaders — one in March as the pandemic was beginning its spread across the globe and a second in August when its long-term implications were clear. Despite a downright dismal environment of operational restrictions and reduced demand, many entrepreneurs maintained bright outlooks. 80% of small business leaders were optimistic about their futures, a figure that dropped only slightly to 72% by August.

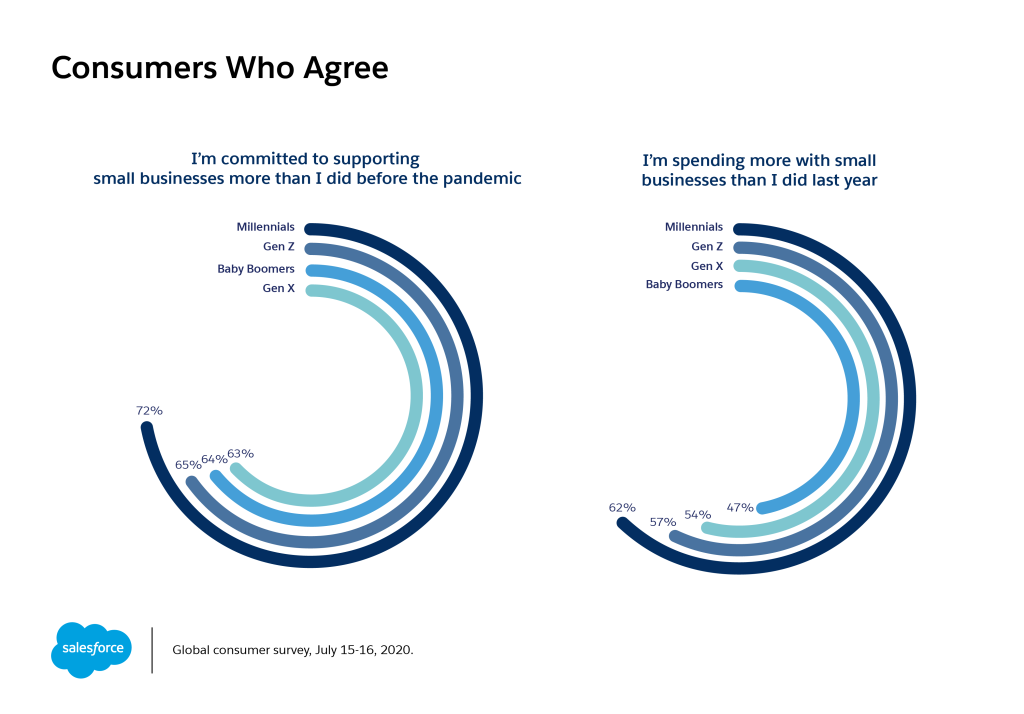

Small business optimism may be due in part to an outpouring of support from their communities. 56% of consumers surveyed in July said they were spending more at small businesses than they were before the pandemic, and 67% were bullish about supporting them in the future. These sentiments were particularly high among millennials, who now constitute the largest consumer segment.

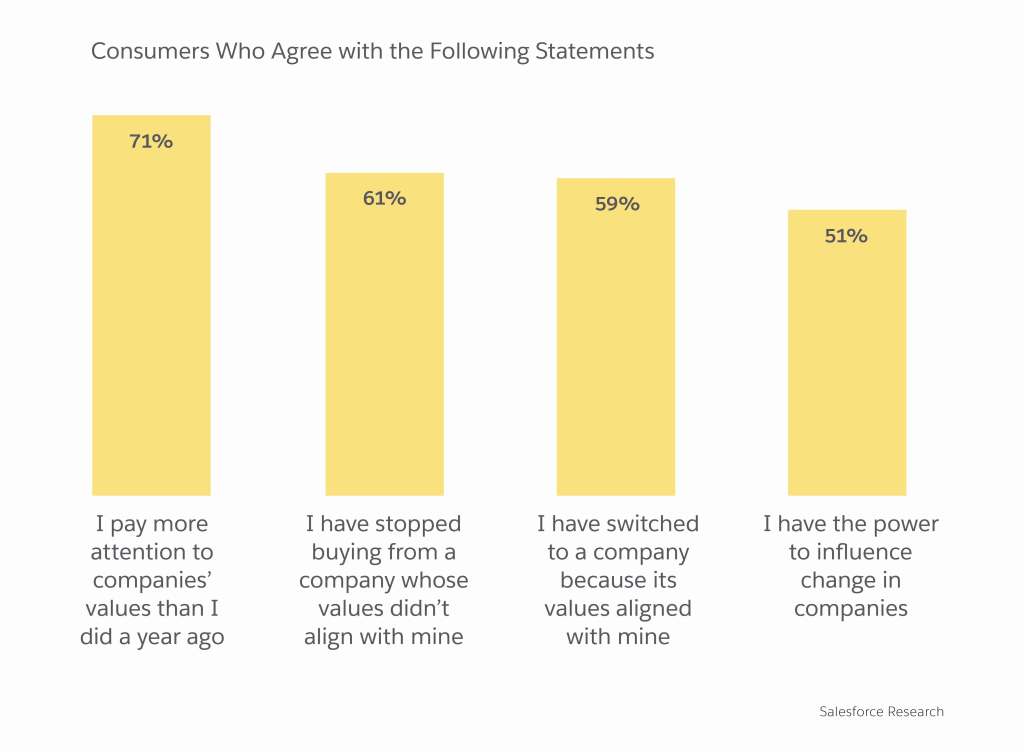

56% of customers have reevaluated the societal role of companies this year

As a crisis of leadership emerged amid the worst public health crisis in a century, global citizens increasingly looked to businesses to rethink how they serve all stakeholders. Global consumers and business buyers surveyed in August reported increased concern about the values of the companies they buy from, including their treatment of employees, communities, and the environment.

There’s evidence that this increased focus on corporate social responsibility is impacting companies’ bottom lines. For example, 61% of consumers say they’ve stopped buying from a company whose values didn’t align with theirs. Yet this phenomenon isn’t limited to B2C relationships; 75% of business buyers say a vendor’s ethics increasingly factors into their purchasing decisions.

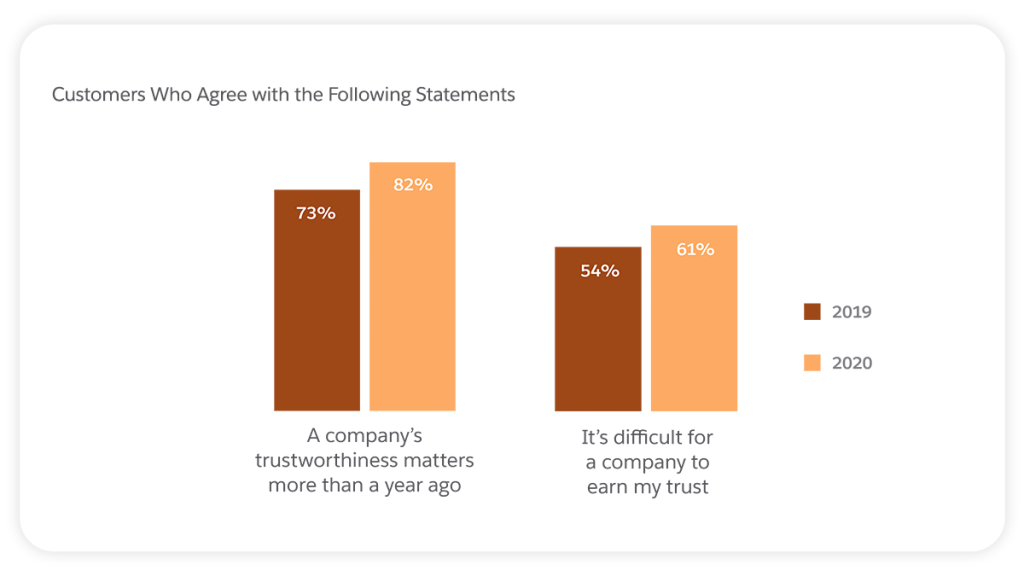

61% of consumers feel that they’ve lost control of their personal information

It’s no secret that today’s elevated standards of customer engagement require sophisticated use of customer data, and the wariness that some consumers feel about this dynamic has long been established. Yet as misinformation spreads and examples of unethical behavior on the part of companies mount, the crisis of trust is worsening.

We’re as glad as anyone to put 2020 in the rearview mirror, but as these data points show, there’s much work to be done as we enter a new year. We’ll be sure to keep our fingers on the pulse of progress.

For more trends in customer engagement, business transformation, and more, browse the full library of Salesforce Research reports or explore our interactive Tableau Public dashboards.