New Research: How Consumers Engage with Marketing Differently During the Pandemic

Every two weeks, Salesforce Research is surveying the general population to learn how consumers and the workforce are navigating the COVID-19 pandemic. We’re posting our insights from the survey and tips on what businesses can do in response.

Click here to explore data across demographics and geographies.

The recent State of Marketing report revealed how marketers’ pre-pandemic priorities and investments laid the foundation for the empathetic, digital-first engagement our current environment demands. Yet ongoing crises mean standards of engagement are shifting constantly. Asking customers directly about which tactics, channels, and messages resonate as they adapt to change— along with the values they expect brands to demonstrate — provides valuable insight to marketers.

Here are some key takeaways from our most recent survey of consumers.

Millennials crave personalized offers

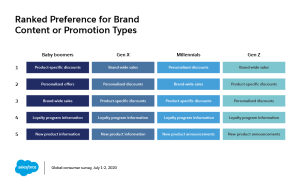

Discounts are of interest to a consumer base whose economic outlooks are uncertain, with such content preferred over information about loyalty programs and new products. As a whole, consumers prefer tailored offers and recommendations based on their unique needs and circumstances over those broadcast to a wider audience — particularly among millennials, who now constitute the largest generation in key markets.

Gen Z consumers, who came of age amid heightened attention to improper use of personal data, differ from their elders in their preference for brand-wide or product-specific discounts.

Differences in content preferences vary across geographies as well, with consumers in Brazil, France, and the U.K. particularly fond of personalized offers and those in Australia and Germany most interested in brand-wide sales.

Social media and thought leadership grab consumer interest

With consumers spending more time in front of their devices, increased interest in digital channels and content is to be expected. Yet this interest is not evenly distributed across various media.

Social media is the clear winner of consumer attention, with 65% of consumers indicating interest. Other channels with notable interest include video content (such as webinars and on-demand sources like YouTube) and virtual experiences (like digital stores). On the other side of the spectrum, blogs and podcasts are less popular, with fewer than half of respondents claiming interest.

Across the board, younger generations are more interested in brand content regardless of the medium. Indeed, another wave of our survey found that Gen Z consumers place particular importance on the availability of a variety of channels. Conversely, brands seeking to reach baby boomers have an uphill battle but are most likely to pique their interests over social media.

Regardless of the channel, brands have an opportunity to showcase their thought leadership credentials as consumers navigate uncharted territory. 60% of consumers are interested in instructional digital content from brands, such as a PDF or web page that provides tips and guidance on matters they care about.

Social media, video, TV ads, and thought leadership grab attention

Interest in a given channel doesn’t necessarily indicate effectiveness. In the case of social media, however, the interest and effectiveness go hand in hand. 54% of consumers say they notice brand content on social media always or frequently — a higher figure than any other channel. Email marketing is also particularly visible — 53% of consumers say they notice it always or frequently.

TV advertising, which has seen sluggish investment in recent years as media consumption habits changed — may warrant a renaissance given our increased time spent at home. 53% of consumers say they notice TV ads always or frequently.

The most noticed content channels vary significantly across countries. Though social media claims the top spot in four of the six markets surveyed, TV ads are the most noticed channel in Australia and the U.K.. Digital video channels such as YouTube and Prime Video get more attention from consumers in Brazil and the U.K. than elsewhere, and display ads perform particularly well in Brazil and France.

Brands face perplexing messaging expectations as the pandemic persists

Knowing when, where, and how to convey messages — let alone what those messages should be in the first place — is challenging in normal times, and even more so now. Customer expectations for messaging and promotions aren’t making it any easier.

59% of consumers believe the cadence of messages should be decreased, while 58% say the variety of those messages should be increased. Nearly three-quarters (73%) believe messages should focus on products rather than brand messages.

Regardless of their opinions on cadence, variety, and content, a strong majority of consumers agree that our current environment warrants anything but business-as-usual. 76% of consumers say brands should adapt their messages and promotions to changing circumstances, versus just 24% who believe brands should revert to previous practices.

Consumers put workers’ interests over their own

Despite their focus on discounts and offers, the majority of consumers are willing to forego deals if it means their fellow citizens retain their jobs. 58% of consumers say brands should reduce customer discounts in order to retain staff.

Salesforce conducted a double-blind survey of adults in the United States, United Kingdom, France, Germany, Brazil, and Australia. Data was collected on July 1 and July 2, 2020 and yielded 3,566 responses. Data is weighted to accurately represent the general population. Click here to explore data across demographics and geographies.