Today we are excited to announce new Financial Services Cloud innovations that unify the mortgage experience for borrowers, lenders and partners. This includes guided loan applications to simplify and accelerate the mortgage process, streamlined document tracking and approvals, and a new mortgage data model for lenders to build deeper, more complete relationships with each borrower.

Borrowers find that applying for a mortgage is the most complicated and time-consuming task they experience when engaging with a financial services institution. In fact, it takes an average of 46 days to close on a mortgage, due to data and archaic processes that are fragmented across many different siloes and stakeholders. This experience is not acceptable for anyone, let alone younger, digital-first buyers, who make up 37% of the home-buyer market (and growing).

And with the increasing competition from fintech disruptors and independent brokers, mortgage companies are under more pressure than ever to make the lending experience seamless and borrower-centric.

Introducing Mortgage Innovation for Financial Services Cloud

The latest innovations for Financial Services Cloud, available today, are specifically designed to simplify and accelerate the mortgage application process:

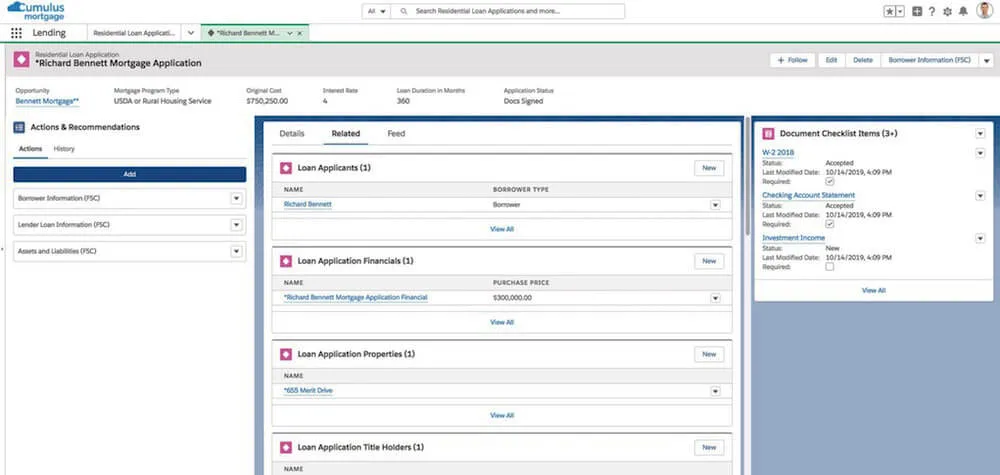

- Guided Residential Loan Application takes borrowers and loan officers on a seamless journey through a residential loan application by guiding users through pre-built, step-by-step actions and recommendations to capture relevant data. Previously, loan officers would have to manually upload data and documentation about the borrower throughout the loan process, which is error-prone and leaves room for critical documentation to be overlooked–creating a lengthier approval process for the borrower. With Salesforce, applications are smoother for all parties, loans close quicker and borrowers get the keys to their dream home even faster.

- Mortgage Data Model delivers 13 pre-built mortgage objects that make it easier to capture information such as the applicant’s address, income and employment, enabling loan officers to view these details in context with a borrower’s household relationships, goals and other financial accounts. Given that customers are required to provide more information during the mortgage process than at any other touchpoint, capturing this data also creates opportunities for lenders to use Financial Services Cloud to generate needs-based referrals to other lines of business. With these pre-built objects for data capture, loan officers are able to ensure consistency and streamline the overall mortgage application process in one place.

- Document Tracking and Approvals provides simplified document collection with templatized checklists and automated approval management. For example, a loan officer and borrower can collaborate by following the checklist and ensuring no document or task falls through the cracks. If a document such as a W-2 is missing, borrowers can easily upload these files through a secure portal.

Delivering End-to-End Mortgage Transformation with the Customer 360 Platform

Financial Services Cloud is just one piece of the broader Salesforce Customer 360 Platform for the mortgage industry, which transforms the mortgage process from pre-application to post-close across marketing, sales, servicing, integration, application development and analytics. With Salesforce, lenders can engage borrowers earlier in the home buying process through intelligent marketing, and the best leads can be surfaced automatically for loan officer outreach. Throughout the application process, lenders, borrowers and partners can collaborate from any device through digital portals that support document collection, embedded business processes and a knowledge base for support.

And that’s not all. AppExchange partners such as nCino, Blend and Roostify integrate directly with Financial Services Cloud so data can be passed easily and securely between point-of-sale systems, Salesforce and loan origination systems. With the Customer 360 Platform fully integrated into these systems, lenders can create a single view of the borrower, unlock intelligent insights for maximizing productivity and deepen borrower relationships.

With the MuleSoft Anypoint Platform, financial services providers can dramatically accelerate the mortgage application process by integrating disconnected legacy systems that are used to evaluate and engage with borrowers. With an API-led approach to integration, lenders can create a clear view of each customer’s borrowing history and automate key mortgage processes including underwriting, loan onboarding and loan servicing. Data captured in Financial Services Cloud can securely generate a loan file in the loan origination system when connected via MuleSoft APIs. In fact, Tic:Toc, a MuleSoft customer, has transformed their business and accelerated the home loan application process to just 22 minutes.

Customer and Partner Comments on the New Mortgage Innovation for Financial Services Cloud

- “Land Home Financial Services (LHFS) is working to incorporate the new mortgage capabilities into its Salesforce-powered retail lending platform,” said Howard Sackson, vice president of business and technology strategy at Land Home Financial Services. “Land Home is quickly deploying a new online mobile responsive 1003 mortgage application form and borrower portal on Financial Services Cloud. The addition of these new mortgage innovations, paired with the insurance innovations and LHFS customer solutions will provide the company’s loan officers with a true 360-degree view of every customer.”

- “PwC has been closely partnering with Salesforce on the launch of its new mortgage innovation for Financial Services Cloud. It has witnessed the tremendous sector-specific value being built into the platform, which addresses key modern capabilities necessary to keep up with today’s changing environment. Working with some of the nation’s top lenders, we are incredibly excited to bring this innovation to market together with Salesforce, helping our clients engage with their customers in a new and differentiated way,” said Derek Santana, global financial services advisory leader at PwC.

More Information

We’re excited to bring this new innovation to the mortgage industry and partner with lenders around the world to improve how they engage with their borrowers. For more information on mortgage innovation for Financial Services Cloud, click here.