With the final few days of holiday shopping ahead and shipping cutoff dates rapidly approaching, the focus for retailers now is how to get items to consumers on time and in a convenient and safe way.

Based on the activity of over one billion global shoppers across more than 40 countries powered by Commerce Cloud, here’s what Salesforce is seeing in the final weeks of the holiday shopping season:

Key December Holiday Insights

- Digital sales up 45% post-Cyber Week: Total digital sales for December 1 – December 14 hit $181 billion globally (up 45% year-over-year) and $39 billion in the U.S. (up 36% year-over-year). Global digital orders continued to grow post-Cyber Week, peaking to 71% growth year-over-year on December 5th before slowing down on December 7th.

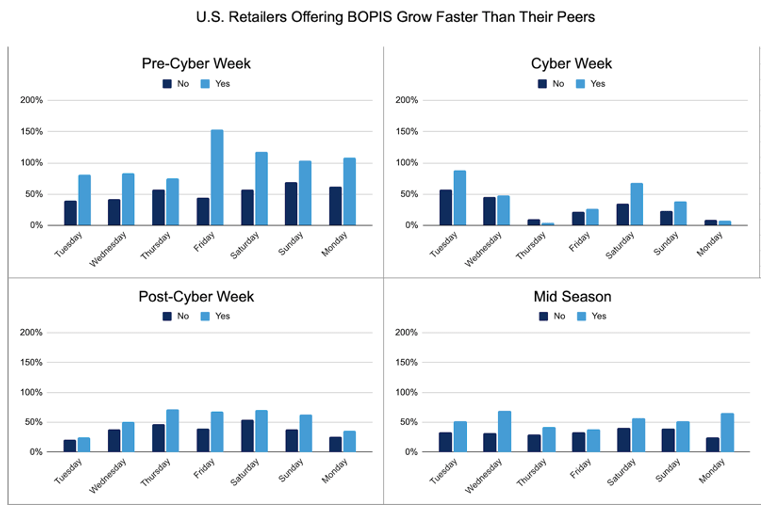

- Consumers prioritize retailers with curbside pickup: Post-Cyber Week digital sales (December 1 – December 14) grew 52% for retailers that offered curbside, drive-through and in-store pickup options year-over year, compared to 36% for retailers without those options in the U.S. Retailers offering these options are also experiencing the most growth over the weekends as U.S. shoppers pick up their orders when they likely have the most free time. The takeaway — beat the lines and curbside traffic by picking up orders on a weekday when it’s less busy.

- Consumers finance holiday purchases: As consumers shop online this holiday season, they are embracing new digital and flexible payment options. The fastest growing payment options from the start of Cyber Week to December 14th were buy now, pay later financing options (90% year-over-year growth) and Apple Pay (85% year-over-year growth) as consumers look to pay for big ticket holiday gifts in installments and complete purchases from their phones and other electronic devices.

- Holiday discounts drop by 10% post-Cyber Week: Shoppers who missed out on deals during Cyber Week can still snag holiday promotions while they last, although discounts are not as steep as the ones offered during Cyber Week. The global average discount rate has dropped down to 18% on average for the first two weeks of December, which is similar to the discount rates offered in early November and is down from the 28% average global discount rate offered on Cyber Monday.

Stay tuned for our final 2020 holiday insights in early January and check out our Holiday Insights Hub and Cyber Week recap for additional Salesforce data.

2020 Salesforce Holiday Insights and Predictions Methodology

To help retailers and brands benchmark holiday performance, Salesforce combined data and holiday insights on the activity of over one billion global shoppers across more than 40 countries powered by Commerce Cloud, billions of consumer engagements and millions of public social media conversations through Marketing Cloud, and customer service data powered by Service Cloud. Several factors are subsequently applied to extrapolate projections and actuals for the broader retail industry.

To qualify for inclusion in the analysis set, a digital commerce site must have transacted throughout the analysis period, in this case July 1, 2018 through December 14, 2020, and meet a monthly minimum visit threshold. Additional data hygiene factors are applied to help ensure consistent metric calculation.

The Salesforce holiday predictions are not indicative of the operational performance of Salesforce or its reported financial metrics including GMV growth and comparable customer GMV growth.