For years, we’ve heard repeated warnings of a “retail apocalypse,” yet consumer spending has continued to rise. The true story of retail is one of transformation, rather than decline, as evidenced by findings in a newly released Salesforce Research study. (Click to Tweet)

The third Connected Shoppers Report, based on a survey of over 10,000 consumers across the world, highlights key trends changing shopper behavior and expectations, as well as insights on how the 2019 holiday shopping season will unfold. Some questions we set out to answer include:

- What are the value propositions of brands, retailers, and online marketplaces?

- Which new purchase points are gaining popularity?

- How is the role of the store changing?

- Are shoppers becoming more eco-conscious?

Here are some noteworthy findings:

Retailers, Brands, and Online Marketplaces are Battling for Wallet Share

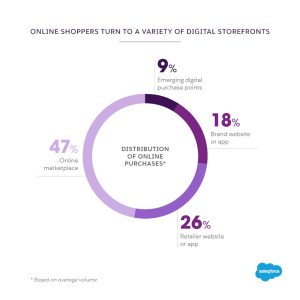

Amazon is the juggernaut in most discussions around retail disruption, and its influence is palpable – consumers say nearly half (47%) of their online purchases occur on online marketplaces like Amazon, eBay, and Alibaba. Yet with over a quarter (26%) of online purchases occurring on retailer websites and apps — as well as 18% across brand websites and apps as direct-to-consumer (D2C) business models take hold – the ecommerce landscape remains a battlefield.

Eighty-six percent of survey respondents report shopping across a combination of retailers, brands, and online marketplaces, citing different value propositions for each. Retailers, for instance, win on return and exchange policies, brands on product authenticity or quality, and online retailers on price.

Distributions vary across regions, with the Emirati and Brazilian shoppers particularly drawn to brand websites and apps, and Japanese and German shoppers sourcing the greatest share of purchases from online marketplaces.

New Purchase Points Are Transforming eCommerce

eCommerce is moving beyond vendors’ own physical and digital properties. Increasingly, consumers are interested in purchasing from retailers and brands on their favored third-party platforms, from voice to video. Gen Z consumers are the most likely to embrace shopping apps and social media when browsing and making purchases, while millennials are more drawn to chatbots and instant messaging than other generations. Both millennials and Gen Zers share enthusiasm for mobile wallets.

Shoppers in the Asia-Pacific region are significantly more likely than those in European and North American countries to experiment with these new shopping channels.

Stores Aren’t Dying – They’re Evolving

Eighty-one percent of survey respondents still turn to brick-and-mortar stores to discover and evaluate new products. The store’s top value propositions – touching and feeling merchandise, the overall experience, and getting merchandise immediately – endure from earlier retail eras.

Yet stores are also being challenged to bridge the online and offline divide. The majority of shoppers have, for example, bought products online for in-store pickup (commonly known as click and collect) and arranged shipping of merchandise unavailable in-store. Millennials – not Gen Zers – are the most likely to have used stores in this manner.

Sustainability is a Growing Factor in Buying Decisions

The recent State of the Connected Customer report found that 61% of consumers actively seek to buy from environmentally sustainable companies. As society increasingly recognizes and confronts its environmental crises, shoppers are taking a critical look at the ecological and social footprint of their purchases across retail verticals, with consumers most concerned about their food and beverage purchases.

Brands targeting younger consumers should be especially aware of this trend. Gen Z shoppers are up to 17% more likely than those from the silent and baby boomer generations to be increasingly concerned over the sustainability of a given product category.

What to Expect from 2019 Holiday Shopping

Salesforce is forecasting a 13% year-over-year increase in digital commerce sales this holiday season, despite six fewer shopping days. Survey respondents cite sales and promo codes, in-store product availability, and free or expedited shipping as the top factors influencing their holiday purchases.

In the U.S., nearly four in 10 shoppers (39%) plan to shop online while celebrating Thanksgiving. Globally, nearly half (47%) vow not to make full-price holiday purchases, opting for sale items only.

Methodology

Data in the Connected Shoppers Report is from a double-blind survey conducted June 14–July 2, 2019 that generated responses from 10,614 individuals in Australia/New Zealand, Belgium, Brazil, Canada, France, Germany, Hong Kong, Indonesia, Israel, Italy, Japan, Mexico, the Netherlands, the Nordics, Singapore, South Africa, Spain, the United Arab Emirates, the United Kingdom/Ireland, and the United States. All respondents are third-party panelists.

Additional Resources

- For a deeper dive on the trends transforming retail, read our blog post.

- For all survey data and analysis, download the full report.