How ESG Delivers Business Value

Discover seven ways ESG strategy delivers business value; then take action at your organization.

The demand for environmental, social, and governance (ESG) reporting has never been greater. Yet as organizations worldwide face increased pressure from growing ESG regulation and disclosure requirements, they still need to cut costs, reduce complexity, and find more efficient ways to do business. What you may not realize is that implementing an ESG strategy can have significant benefits for your organization — including cost savings, risk mitigation, expanded capital access and market value, and improved brand perception.

By proactively creating an ESG strategy, you can shift your business and operating model toward sustainable practices. Making sustainability a part of your corporate strategy will help future-proof your business model before ESG regulations require you to. This will set you on a path to ESG maturity, which can serve as an indicator for future business performance in capital market valuation and other areas.

In this article, we identify seven ways ESG strategy delivers measurable value to your organization. Then, we show you how to use this potential to create your strategy and take action.

What Are ESG and ESG Strategy?

7 Ways ESG Strategy Delivers Value to Your Organization

Sustainable business practices increase efficiency, leading to reduced costs.

By being more efficient with water usage, reducing power consumption, choosing energy-efficient equipment, and switching to renewable energy resources, organizations make big strides for both the environment and their bottom line. Research from McKinsey found that executing ESG plans effectively can impact operating profits by as much as 60% by combating rising operating costs. In the same study, McKinsey found a significant correlation between resource efficiency and financial performance.

Across all industries, recycled water and energy-efficient lighting can reduce spending overall. By using recycled water for industrial processes or landscaping, businesses can lower their water bill. Similarly, energy-efficient lighting lasts significantly longer than traditional lighting and requires less electricity to operate, reducing energy costs.

Organizations that invest in sustainable business practices and assets can also unlock potential tax benefits. For example, organizations that transition to energy-efficient buildings or electric vehicles might qualify for tax incentives or credits. While these assets require investment upfront, they improve margins in the long term.

By analyzing each link in the value chain, organizations can accurately identify sources of waste and opportunities for improvement using sustainable alternatives. Making these eco-friendly changes to business processes cuts down on unnecessary waste and boosts efficiency.

There are also cross-functional opportunities to increase efficiency in your business. For example, by connecting your Marketing CRM with an ESG management platform, you can identify which customers care most about the environment and promote greener offerings to them. With ESG data connected to all parts of the organization, you can identify both savings and revenue opportunities throughout sales, service, marketing, and commerce.

.

Accurate ESG reporting drives compliance.

On a global scale, climate disclosures and ESG reporting regulations are becoming mandatory or more stringent. Regulations such as the European Union’s (EU) Corporate Sustainability Reporting Directive (CSRD), the Security and Exchange Commission’s (SEC) climate-related disclosure rules, and California’s SB 253 and SB 261 bills all require companies to report on scope 1 and 2, or direct, emissions. CSRD and California SB 253 and SB 261 take reporting a step further, also requiring disclosures on scope 3, or indirect, emissions.

Scope 3 emissions comprise the emissions not in your company’s direct control, including those of your suppliers, distributors, partners, and customers. This can make them very challenging to track. However, scope 3 reporting is necessary for companies who need to comply with CSRD and California SB 253 and SB 261, as well as those that want to report on their full carbon footprint.

Are you prepared for CSRD?

To remain compliant, satisfy investor needs, mitigate risk, and explore opportunities for future business value, organizations must face these new regulations head-on. A robust ESG data foundation is key here. Building an accurate and transparent ESG data strategy, governance, and management is an important step in that direction.

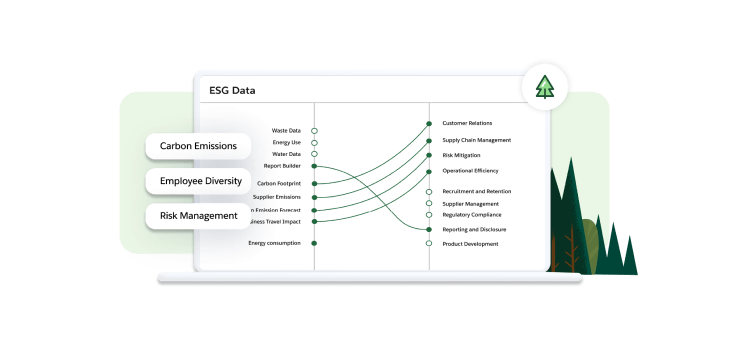

Upgrading technology can help organizations monitor ESG progress and build insightful reports quickly to align with reporting requirements. Net Zero Cloud helps organizations automate the ESG reporting process. It offers report builders that walk users through report creation for specific frameworks, including ESRS (which complies with CSRD), SASB, CDP, and GRI. As the details of additional ESG regulations become known, Net Zero Cloud will add or adapt its report builders to help organizations be compliant.

Global ESG regulations aren’t expected to slow down. This is because climate-related risks are real, and they affect businesses in two ways. First, there’s the physical impact of climate-related disasters and rising sea levels, which can negatively affect supply chains, workforce, distribution channels, and more. Second, there’s the risk that comes with transitioning (or not transitioning) to a more sustainable, lower-carbon economy. As the market becomes increasingly sensitive to carbon footprints, demand for lower-carbon products and services could increase, escalating risk for companies with high-carbon offerings.

Transparency builds trust with key stakeholders.

Canadian technology company TELUS taps Net Zero Cloud for emissions reporting.

Sustainable transformation drives innovation.

Innovative thinking can manifest in various climate-related opportunities. For example, a shipping company might want to reduce the number of trips it needs to make on a particular route. After realizing it often ships with empty space in freight trucks, the company invests in a unit-load optimization tool to ensure its trucks are packed without wasted space. This reduces trips, which saves on both emissions and costs. Investing in sustainable transformation allows companies to discover more efficient ways of completing standard business processes.

Another example of this is the circular economy. The circular economy is a framework based on the principles of eliminating waste, circulating products and materials as much as possible, and to support regeneration in nature. Research from Accenture suggests the rise of the circular economy will unlock $4.5 trillion in new economic growth by 2030.

Innovation can also come from new products and services. At Salesforce, for instance, we needed an accurate and auditable single source of truth for managing our environmental footprint across scope 1, 2, and 3 emissions, so we created an app for our own use. Eventually, this became Net Zero Cloud, which provides our customers with the same level of ESG management as Salesforce. Now, it’s exciting to see other companies adopt this tool and use it — not only to see progress made on their sustainability journeys, but also to see how they’re accelerating their stakeholders’ paths to net zero.

MillerKnoll uses data to design a more environmentally conscious future.

At MillerKnoll, a collective of global design brands, two directives guide every decision the company makes: Be good stewards of the earth’s resources, and ensure each product and experience is exceptionally designed. By prioritizing eco-friendly materials and processes across its entire product portfolio, MillerKnoll brands innovate high-quality, responsibly designed products. By 2030, MillerKnoll plans to use 50% or more recycled content in its products.

Additionally, MillerKnoll works to convert spend data into total carbon dioxide output to track and manage carbon emissions. This means that the company can quantify how each product it develops directly impacts carbon output. With sustainability, commerce, and service data under one roof, MillerKnoll can rally its customers and partners to champion responsibly designed products.

Purpose-driven values help recruit and retain top talent and increase employee engagement.

Employees want to work for purpose-driven organizations, and organizational values can affect potential talent’s decision to seek a role. In fact, the Society for Human Resource Management (SHRM) found that 64% of executives at organizations with ESG strategies said they positively impacted employee recruitment.

Approximately 40% of millennials have chosen a job because the company performed well on sustainability. This same survey reported nearly 70% of respondents said that if a company had a strong sustainability plan, they would be more likely to stay with that company. Plus, according to SHRM, 60% of executives reported that ESG strategies positively impacted talent retention.

ESG can increase the engagement of current employees, too. SHRM found that 75% of U.S. executives say ESG initiatives have a positive impact on employee engagement. It has been shown that companies with highly engaged employees have 14% higher productivity and are 23% more profitable than their peers.

Research by Salesforce also revealed that roughly eight in 10 employees report being happier if they feel a sense of purpose and belonging at work.

Employee equality groups can be a great way to drive this purpose. At Salesforce, Earthforce is our employee equality group dedicated to promoting and celebrating environmental responsibility. With over 14,000 members worldwide and over 60,000 hours volunteered every year, Earthforce scales impact both at Salesforce and in the communities we serve.

Prioritizing sustainability is a highly effective way to engage employees, especially when every employee has an opportunity to help the organization achieve its ESG goals.

Sustainability leadership differentiates the brand.

At the product level, we see a similar trend. McKinsey found a clear and material link between ESG-related claims on products and how much consumers spent on them, with products making such claims averaging 28% in cumulative growth over five years, while products that made no such claims averaged only 20% growth.

One way companies make these claims is to share the carbon footprint of each product for sale. Many airlines already do this with flights, but companies can do the same with consumer goods, too. If you’ve implemented a cross-functional ESG management platform, you can tie carbon metrics to the products you sell and then feed those footprints directly to your ecommerce site for full transparency with consumers.

Avoiding greenwashing is critical when referencing sustainability around a product, service, or brand. Greenwashing is a marketing tactic used to convince customers that an organization’s offerings and actions are environmentally friendly when they actually aren’t. To combat accusations of greenwashing, companies must be transparent in how they measure product carbon footprints and post reports annually.

.png)

ESG initiatives can increase capital access and market value.

Investors are also becoming more proactive around ESG. Capital Group found that 40% of investment professionals surveyed said they are conducting proprietary ESG analysis or scoring. The majority also identified ESG analysis as a way to help uncover attractive investment opportunities.

Investors, lenders, insurers, regulators, and consumers are increasingly attuned to ESG performance. Organizations that are not yet transparent in their ESG strategy and reporting can pose a greater long-term risk than those who do, as ESG tends to drive long-term financial health and ensures compliance with regulations.

It’s clear that ESG metrics will increasingly influence both investment decisions and business performance.

Make the Case for Your Company to Create an ESG Strategy

Now that you understand the value of ESG, it’s time to make the case for your company to build an ESG strategy.

Whether you're part of a small business or a multinational corporation, an ESG strategy can both increase value and reduce costs for your organization. By using the seven benefits outlined above, you can offer ways for every leader, function, and team in your organization to benefit from tangible sustainable business practices. This will lead to additional buy-in for your vision.

First, you’ll need to connect ESG to your corporate vision and values. This means being clear on your ESG goals and performance, as well as how you’d like your strategy to be perceived.

At Salesforce, our values create value. Our vision is to use the full power of our business to make the world a better place for all of our stakeholders. This includes our shareholders, customers, employees, partners, the planet, and the communities in which we work and live.

With a clear vision in mind, you can then translate it into a strategy. You should identify the key stakeholders in your organization who will benefit the most from ESG and make the case to them. While these stakeholders will vary across organizations, leaders in finance and information technology (IT) are likely a good place to start.

Make the Case for ESG Strategy to Leaders in Finance

“For any executive, but particularly for a CFO, there’s a growing recognition that ESG isn’t just nice to have, or something that’s simply going to make employees happy — it’s critical to building a strong, durable company. Investors are now using ESG as a way to measure companies. They’re looking to see what your commitment is, and that’s because they know that there is a connection between ESG and long-term value creation.”

Make the Case for ESG Strategy to Leaders in IT

“Sustainability is not a topic that should just stay within the boardroom. Sustainability is a topic that all of us are responsible for, and certainly CIOs are in a great position to drive the sustainability initiatives for our companies.”

Guiding Principles for Your ESG Strategy

Understand where you’re starting.

Set targets and make a plan.

Global systemic issues — such as poverty, human rights, and climate change — can’t be solved overnight. This can be daunting, but the most important step is to set targets and make an improvement plan over time; don’t just look for a quick fix. It might take a few years to publish a comprehensive ESG report.

Start small. Break it down, put what you believe out there, listen to your stakeholders, and stay consistent. This transparency will earn the trust of your stakeholders

Leverage technology.

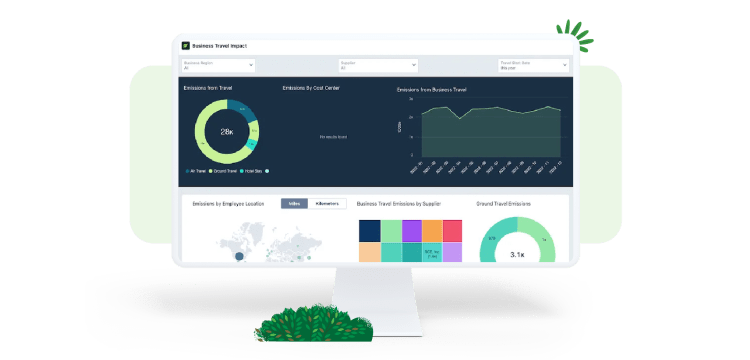

One way to do this is with Net Zero Cloud. Built on the #1 AI CRM, Net Zero Cloud connects ESG data with every corner of your business — including your suppliers, partners, and customers — and automates reporting with Einstein. You can reduce financial and compliance risk while seizing opportunities to increase revenue, savings, investment, and social and environmental impact. By managing all ESG data in one platform, you can connect it with your entire value chain for maximum returns while ensuring you align to global standards for ESG reporting and disclosures.

The time to act is now. Seize the moment for ESG strategy, address compliance and reporting needs, and grow your value — all while doing good for the planet.

ESG readiness start here.

More Resources

Guide

Check out the 5-step guide to sustainable business travel.

DEMO

ESG readiness starts here.

Guide

Get started with carbon accounting.