How Digital Transformation Helps Oil and Gas Businesses Thrive in a Changing Industry

For the past century, oil and gas companies have shown an inherent resilience. They have rebounded and adapted to geopolitical, social, and environmental forces while maintaining a powerful role in the global economy.

Now, the industry is at another pivotal moment: It can no longer rely on steady growth as the world seeks to reduce its carbon footprint.

Digital transformation can help oil and gas companies tackle the challenges ahead while ensuring their continued, powerful role in the global economy. The right digital tools, such as cloud platforms, artificial intelligence (AI), and the internet of things (IoT) will help them to increase efficiencies, drive operational excellence, develop more sustainable business models, and maximize profits.

To better understand the opportunity for digital transformation in oil and gas, let’s look at the benefits for four key sub-sectors.

Upstream: Optimize maintenance strategies

Upstream companies that explore potential oil and gas fields and bring the materials to the surface are likely to consolidate according to McKinsey. Large companies with strong balance sheets and hefty cash reserves are looking for undervalued or distressed assets that smaller companies are forced to divest in order to stay afloat. These larger companies are acquiring the discounted assets (and oftentimes, the struggling smaller companies too) to enrich their portfolio. At the same time, emerging competitors with more agile technology and processes, such as hybrid drilling rigs, are likely to survive based on novel offerings that place them ahead of competitors.

Technology will help upstream companies thrive by giving them the ability to reimagine operating models with shared resource pools, vendor flexibility, and maintenance campaigns. For example, routine maintenance strategies for most upstream companies were weak and lacked urgency. That has proven costly. A digital platform that aggregates information about assets, resources, and schedules — such as a customer relationship management (CRM) platform — can improve maintenance planning and coordination.

Consider the following:

Improve vendor relationships

Prevent unexpected problems

Enable remote assistance

Oilfield services: Accelerate the opportunity-to-cash

This segment has struggled since 2014 from over-capacity and collapsed profitability. Bankruptcies and restructurings are rampant. The pandemic exacerbated these longstanding issues because it curtailed production and forced the cancellation of capital projects.

Digital transformation can help these companies modulate challenges and reduce costs, innovate, and enhance value. With a CRM, oilfield services remove barriers between legacy technology systems to connect key information from the back office into the field or front office — where the highest value work often occurs. Here’s how:

- Hit the ground running. A data-driven platform helps oilfield service get up and running faster. That’s because it consolidates existing customer data from legacy technology systems. Everyone has access to the same data to improve engagement with customers, suppliers, government regulators, and local communities.

- Automate processes. Automation simplifies manual and tedious tasks with prebuilt workflows. This gives employees time back to tackle more complex challenges and achieve broader business goals and objectives.

- Optimize pricing. AI is embedded in the platform to help oilfield service companies make smarter business decisions based on data. AI analyzes data to identify the most profitable deals and help companies optimize prices during contract bidding.

- Reduce time in the sales cycle. As a thin-margin business with fixed costs, oilfield service companies carefully monitor the sales cycle. When everyone works off the same platform, they reduce the time between when a prospect is identified and when they become a paying customer. This allows them to secure more revenue and pursue more lucrative opportunities.

Midstream: Mitigate risk

This sector withstood headwinds from the health crisis because they are less susceptible to price volatility due to predetermined, long-term agreements with built-in margins. But that doesn’t mean businesses in this sector are completely immune to risk and uncertainty. Oil spills or natural disasters can disrupt pipeline operation and cost millions. Geo-political forces, macro-economic trends, and other external factors can influence customer preferences, affect regulations, and lead to innovations.

Consider that pipeline disruption due to an oil spill can capture the attention of millions and cost a company significantly in direct profits. Social perception can drive political action with new environmental policy changes that strip the company of its “social license to operate,” taking investor confidence with it.

Midstream companies need risk mitigation strategies to account for issues like this. Digital tools such as mobile apps, analytics, AI, and automated workflows help midstream businesses identify risk for early warning and detection. Here’s how:

- Ingest real-time data from inspections. When a field technician visits a site, they can use their mobile device to input data during the inspection. That data is automatically fed back into the CRM platform. The system can flag potential problems and automatically alert the customer that they need to act quickly in order to prevent an oil spill.

- Collaborate across business units and external stakeholders. By bringing every team member onto the same platform, midstream companies can accelerate processes with complete visibility, transparency, and communication. They can distribute work through a partner portal, like a reminder to schedule an inspection, or send updates to field technicians on their mobile device. A partner can also log in to a portal and easily configure, price, and quote service instantly.

- Stay one step ahead of disruptions. A midstream company may analyze social media trends using AI to learn more about public sentiment. Teams can quickly collaborate to alert stakeholders and resolve issues proactively.

Downstream: Get smart about renewables

Large downstream businesses need to prepare and adapt to a changing world. Demand for traditional oil and gas is projected to decline as alternative energy sources increase, including wind, solar, and batteries.

The pandemic delayed alternative energy projects, but renewable capacity is expected to increase, according to the International Energy Agency. This innovation will have strong support from the public.

With the increased focus on renewables and sustainability, downstream businesses will face pressure on carbon emissions. They will need to rethink their energy portfolios so that they can pivot to greener technologies and business models. In order to meet this need, downstream companies may opt to acquire other businesses to enhance their offerings, which would require a rapid and streamlined onboarding process.

The energy transition will require agile digital platforms that are flexible enough to support new business strategies. These platforms will allow downstream companies to onboard new renewable acquisitions and shift business to prepare for the future energy state. Automating workflows helps these companies quickly recognize value from new alternative energy investments. And data analysis allows leaders to make more informed decisions about processes and product portfolios.

As a result of the push for renewable energies, and expected secular changes in commuting emerge, the oil and gas industry is preparing for an extended depressed price environment — although the prices are rising in the near-term as pent-up demand for travel creates a spike. If companies continue to embrace video conference and digital communication, the oil and gas industry will need to take a close look at costs to protect profit margins.

Embark on your digital transformation in oil and gas

Learn more about digital transformation in oil and gas

- Digitizes their workplace

- Centralizes and streamlines workflows

- Manages stakeholders through asset management and portals

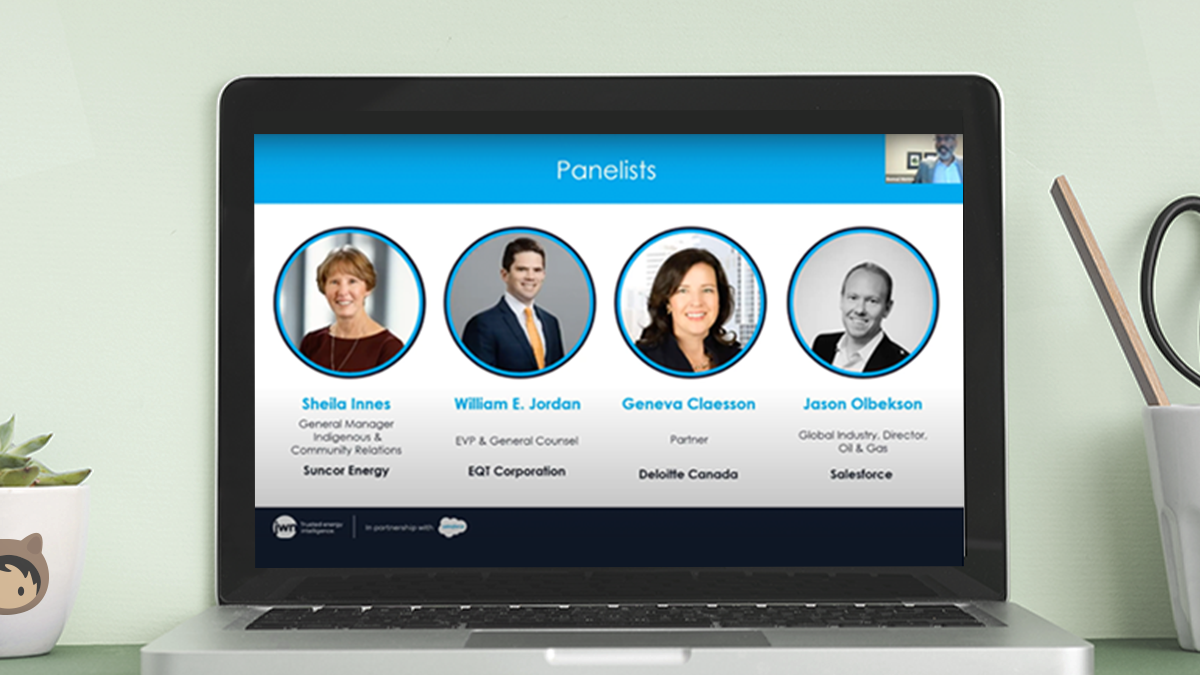

Webinar

How EQT Uses CRM in Non-Traditional Ways to Engage with Stakeholders and Suppliers

Blog

How a 61-year old family company overcame a digital deficit to serve guests

Report

Digitally Transform the Employee Experience via Single Pane of Insights in Oil & Gas

More resources

Amplify Stakeholder Engagement to Drive ESG Excellence

Keep Your Energy and Utility Projects on Track and Get Revenue Faster