5 Ways to Create Empathetic Insurance Customer Experiences

How Salesforce best practices support digital engagement with a human touch.

And they need to do it with digital business solutions that are built for success now, helping insurers lower costs and improve team productivity in a challenging economic climate.

Digital engagement: The new normal.

This new reality requires more robust digital capabilities for all lines of insurance, and insurance technology leaders are forecasting even more policyholder engagement to come:

89% expect an increased demand for new digital products and services.

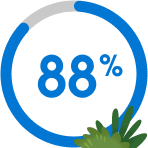

88% expect an increased use of digital channels to reach customers.

85% expect an increased use of self-service by customers.

68% expect an increased degree of customer engagement.

Yet responding to this surge in digital engagement is not just about adopting a set of technologies, but aiming to think and work differently. Insurers now have an opportunity to make technology choices that are empathetic to their policyholders and consider how and when policyholders want to engage (i.e., the insurance customer experience). Insurers that make this shift will be rewarded with loyalty and long-term, trusted relationships.

Meet The Salesforce Way.

Here are five approaches — inspired by The Salesforce Way — to help insurers create more people-centered, empathetic experiences for policyholders:

Trusted relationships: Respect policyholder data.

Companies that build trusted relationships and promote empathetic customer experience approaches with their customers, employees, and business partners outperform competitors. And this gap will only get wider in an ever-increasing digital world. Guided by The Salesforce Way, we help companies adjust their mindsets away from working alone to working together with ecosystems to build trust.

Trust is the mortar that cements long and impactful relationships with policyholders. Insurers understand that when it comes to policyholder data, there needs to be both a strategic use of policyholder data and a respectful approach to data privacy.

Policyholders are willing to share information related to major life events (for example, marriage, having a child) and household income data in exchange for personalized service — but they must believe their insurer has their best interests at heart. When you build trust and connection, you create more opportunities for information sharing.

Insurers can support security and privacy rights by transforming their digital marketing applications and systems that generate, transmit, consume, store, and dispose of consumer data. This is essential for addressing policyholder trust and meeting today’s complex privacy regulations. The Salesforce Privacy Center is an effective tool to help manage your sensitive customer data.

Alignment: One team, one vision.

Holistic alignment between your policyholders, partners, and employees doesn’t happen overnight. It requires a thoughtful, intentional approach. And when your teams have the same vision, values, and goals, your policyholders will experience tangible benefits like transparent data protection policies, faster price quotes, and frictionless claim processes.

Policyholders today expect a consistent brand experience, whether they are talking with a service agent via chat or speaking on the telephone with a sales representative. To ensure alignment, insurers need to prioritize a repeatable insurance customer experience for policyholders, regardless of how they “meet” the company and its employees.

It’s critical to spend time building alignment with all stakeholders: business, IT, internal, external, and so on. Success follows when you:

- Give teams the power to act in the policyholder's best interest

- Use Salesforce Professional Services to help drive connected insurance customer experiences

- Train customer-facing employees to be more empathetic, ask better questions, and be better listeners

Human-centricity: Promote the insurance customer experience.

Insurers are making progress with personalization, but for now, a gap remains. In a 2022 survey, only 11% of insurance customers agreed that companies anticipate their specific needs.

When in doubt, create everything — whether a new life insurance policy or a new claim process — with a human touch. When you see your policyholders, partners, and employees primarily as technology users, you can miss an opportunity to create memorable experiences.

Keep pace with expectations.

As consumers in all industries increasingly expect a device-agnostic experience, the concept of a “best” experience has become a moving target.

To keep pace, ask yourself whether your policyholders’ experience is:

- Personalized: Do I provide personalized guidance and recommendations at each stage of a policyholder's journey? These stages include obtaining a quote, buying a policy, making a claim, and so on.

- Easy to access: Am I on the channels where my policyholders are most active? Do I provide a single, connected experience where information is consistent across channels?

- Relevant: Do I care about what my policyholders care about, and is that clear from the experiences I provide them?

Platform mindset: Focus on customer journeys.

We tell our customers the key to optimal value with Salesforce is to use our platform to support entire customer journeys. The traditional, siloed way of thinking about people as marketing prospects, sales leads, or customer service cases is limiting; it prevents companies from truly delivering a Customer 360 approach that turns customers into loyal brand ambassadors. Customer 360 helps every team boost productivity, accelerate collaboration, and focus on the highest-value activities.

When you strive to connect your marketing, sales, commerce, service, and IT teams around every customer, you have a platform mindset.

Some organizations, for example, think about omni-channel and multichannel as basically the same approach. While they sound similar, they are two different strategies:

- Multichannel = Disconnected experience. Multichannel marketing supports interactions with prospective customers through various channels. Each channel operates independently from the other with its own outlined strategy and goals.

- Omni-channel = Orchestrated experience. Omni-channel focuses on delivering a multichannel engagement that provides customers with an integrated experience.

Unlike multichannel marketing, omni-channel marketing involves integrating messaging across all channels together to provide a seamless, connected experience — building trust with your customers.

Platform for policyholder preferences.

One of the great advantages of working with the Salesforce Platform is that you can create compelling experiences without having to customize the platform, while also benefiting from a 25% reduction in IT costs. Out-of-the-box insurance solutions make it easy to innovate faster without spending time on customizing the technology.

Continuous innovation: Add intelligent automation.

The key to continuous innovation in the insurance industry is automation. With AI-powered automation, for example, an agent can submit a standard policy application to underwriting and get pricing in minutes instead of days. This nimble, more focused approach to new practices helps enterprises innovate faster across the front, middle, and back office.

Digital and hybrid experiences offer a great opportunity for enterprises to enhance their adaptability and responsiveness. You can do more with less using intelligent process automation to reduce errors and improve the policyholder experience. One prime example is digital process automation, which offers low-code/no-code tools to automate repetitive activities and remove friction from the insurance customer experience.

With digital process automation, you can:

- Set up guided policyholder experiences across all of your channels

- Simplify complex rules and actions across industry use cases, like policy coverage limits and premiums or financial planning

- Create intelligent document templates (forms) and processes to ease your policyholders’ and employees’ data collection

- Build point-and-click solutions to transform data from your middle- and back-office systems and other sources

Salesforce Customer 360 increases productivity with automation; our customers experience a 26% increase in employee productivity and a 27% faster automation rate in their business processes.

Conclusion: Values are the "secret sauce.”

And while a company’s values can address a wide range of issues, the point remains: Today’s consumers — whether they are buying sneakers or insurance products — want to buy from companies that mirror their values.

Values are the “secret sauce” that underpin The Salesforce Way and guide us toward creating empathetic insurance customer experiences. Trust is our most important value, and establishing trust helps us bring out the best in one another, deliver success to our customers, and make long-lasting, empathetic connections with our employees, partners, and customers.

Businesses adopting Customer 360 see a 32% increase in customer satisfaction and a 30% increase in customer retention. And when they partner with Salesforce Professional Services, businesses benefit from a 229% return on their investment over three years.

The Salesforce Professional Services team delivers success now using The Salesforce Way, to help insurers build policyholder experiences that align values and business objectives with a cost-effective digital engagement strategy.

Related Content

Guide

Discover how to maximize your Salesforce success now.

Playbook

Transform your business by centering it around your customers.

Report

Learn how to help unhappy financial services customers.

More Resources

Video

Outrperform competitors by building customer trust and loyalty.

Professional Services

Unlock the full value of your Salesforce solutions with our help.

Blog

Three ways to transform policyholders into loyal customers.