How to Manage Accounting for Small Businesses

Small business owners thrive when they have the time to focus on the core aspects of their business. This includes customer service, product innovation, and sales. Administrative tasks such as accounting are necessary, but often have to be prioritized after other duties.

However, it’s important that entrepreneurs learn the basics of accounting for small business. This ensures that they can effectively manage cash flow, minimize their tax liability, and avoid costly penalties for accounting errors or oversights.

Consider this a resource that helps explain important or potentially confusing aspects of accounting that affect small businesses.

Accounting Basics for Small Business Owners

Some individuals only think about accounting matters once a year — before the April 15 tax return deadline. Small business owners, on the other hand, need to address their taxes quarterly and annually. This means they calculate and estimate the taxes they may owe the state and federal governments and remit payment four times a year before filing their annual returns.

On the bright side, small business owners are eligible for more tax credits and deductions than most individuals, which can lower their state and federal taxes. Some expenses, such as advertising, business meals, commercial rent and utilities, insurance, salaries, supplies, and vehicles used for company purposes, can potentially reduce your company’s taxable income.

When you make bigger purchases and apply strategic investments, amortization and depreciation come into play as well. These allow you to deduct the cost or value of an asset over a number of years. It’s how many businesses end up cash-flow positive at the end of each calendar year, but owe little in actual taxes due to earlier acquisitions.

Then there’s the question of accrual accounting versus cash basis accounting. In accrual accounting, businesses record revenue at the completion of a project or milestone, and they recognize expenses as they are incurred. While this is the more commonly used method of accounting, a disadvantage is that companies generally end up paying taxes on income they haven’t yet received from customers or vendors.

In cash-basis accounting, revenue and expenses are registered only when invoices are paid. This makes it easier for businesses to manage their tax liability when customers are delinquent on their payments, as companies only get taxed on cash received minus expenses paid. Generally, smaller businesses benefit more from cash-basis accounting while larger companies with millions in sales are more likely to take advantage of accrual accounting.

There are a few best practices every small business owner should follow to remain compliant with tax law, as well as strategies to reduce your taxable business income. Remember to follow these tips:

Keep your invoices and receipts. Between donations, vendor payments, and other purchases, it’s important that you collect and store all your receipts as original documentation.

Correctly classify contractors and employees. The government levies high fees on employers in instances where contractors meet the criteria of a regular employee but are not part of the company’s formal payroll.

Apply depreciation on large purchases. Deduct the value of larger assets over their full use period so you can spread the expense across multiple fiscal years.

Look out for tax credits and strategic deductions. Each year, federal and state governments announce incentives and programs that qualifying small businesses owners can take advantage of to reduce their tax liability.

Collect and pay all applicable sales taxes. Online purchases and software licenses are among the newest categories of products and services that are subject to sales tax. Make sure you charge your customers any required sales taxes so you can remit those fees to the government at a later date.

Overall, bookkeeping can become complicated. That’s why many entrepreneurs opt to use accounting software for small businesses while others enlist support from a licensed Certified Public Accountant (CPA).

Salesforce Resources

SMB trends report

The latest top priorities for small and medium business owners.

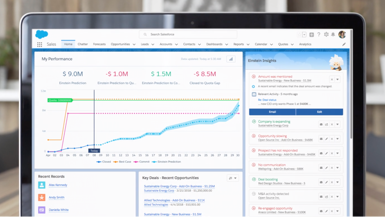

SMB overview demo

The world’s leading CRM is ready to help your small business succeed at every step.

Sales Cloud free trial

Try our Sales platform for free.

Salesforce guided tour

Take a closer look at how the world’s #1 CRM solution helps companies of all sizes grow faster.

Related Content

.

The Beginner’s Guide to Starting a Small Business.

.

6 Business Metrics that Matter for SMBs.

.

CRM Apps Help Small Businesses Grow — Here’s How

.

How to Write a Business Plan Using a Template.

.

The 5 Legal Structures of a Business: Which Is Right for You?