Research

Snapshot: Trends in Small and Medium Healthcare and Life Sciences Businesses

The pandemic forced a rapid transformation of healthcare and life sciences (HLS) small and medium businesses (SMBs). From virtual care and clinical trials to digital-first sales and service, and new partnerships across sectors and beyond, these companies have shown remarkable resilience in the face of unprecedented change. Data from a survey conducted by the Harris Poll in the fifth edition of our “Small and Medium Business Trends Report” shows that the vast majority of these SMBs (88%) have had customer interactions change since COVID-19 began. And these changes are now becoming part of the DNA for how companies operate. A powerful example that illustrates the trend: The report shows that more than three-quarters of HLS SMBs (77%) are planning to offer contactless services in the long term.

These companies are building digital bridges to connect systems in ways that improve outcomes and protect the vitality of their businesses.

These companies are building digital bridges to connect systems in ways that improve outcomes and protect the vitality of their businesses.

Trend #1: Communities and governments gave back to healthcare and life sciences SMBs.

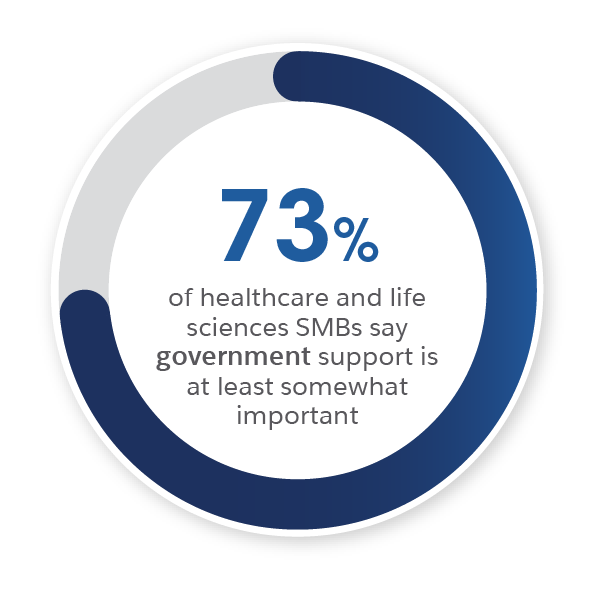

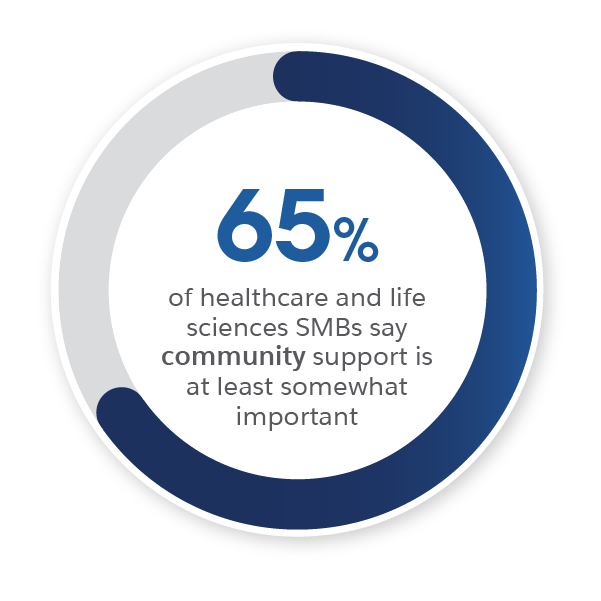

The support of governments and communities has been a vital lifeline for healthcare and life sciences SMBs. Nearly three-quarters (73%) reported that government assistance has been somewhat important to their company’s survival during the pandemic, and 65% said community support was just as important. Slightly more than one in 10 business leaders go as far as to call government and community support absolutely critical.

Most healthcare and life sciences SMBs (65%) also applied for some type of financial support during the pandemic, and many received it.

Most healthcare and life sciences SMBs (65%) also applied for some type of financial support during the pandemic, and many received it.

Seventy-three percent of healthcare and life sciences SMBs say government support is at least somewhat important

Sixty-five percent of healthcare and life sciences SMBs say community support is at least somewhat important

And while pandemic restrictions were fueling uncertainty, healthcare and life sciences SMBs were mobilizing to respond to enormous demand: More than 85% said keeping up with demand is a challenge to meeting customer expectations. Communities recognized the strain on these businesses and stepped forward to help. From donations to social media shares to positive online reviews, and much more, the majority of healthcare and life sciences SMBs in the U.S. reported receiving new levels of support from their local community.

Trend #2: Customer and employee engagement take priority.

A great number of healthcare and life sciences SMBs have business models dependent on face-to-face and hands-on interactions. Yet, more than a third of them (37%) were able to provide flexible working arrangements during the pandemic. That capacity for flexibility helped these businesses earn trust with both employees and customers.

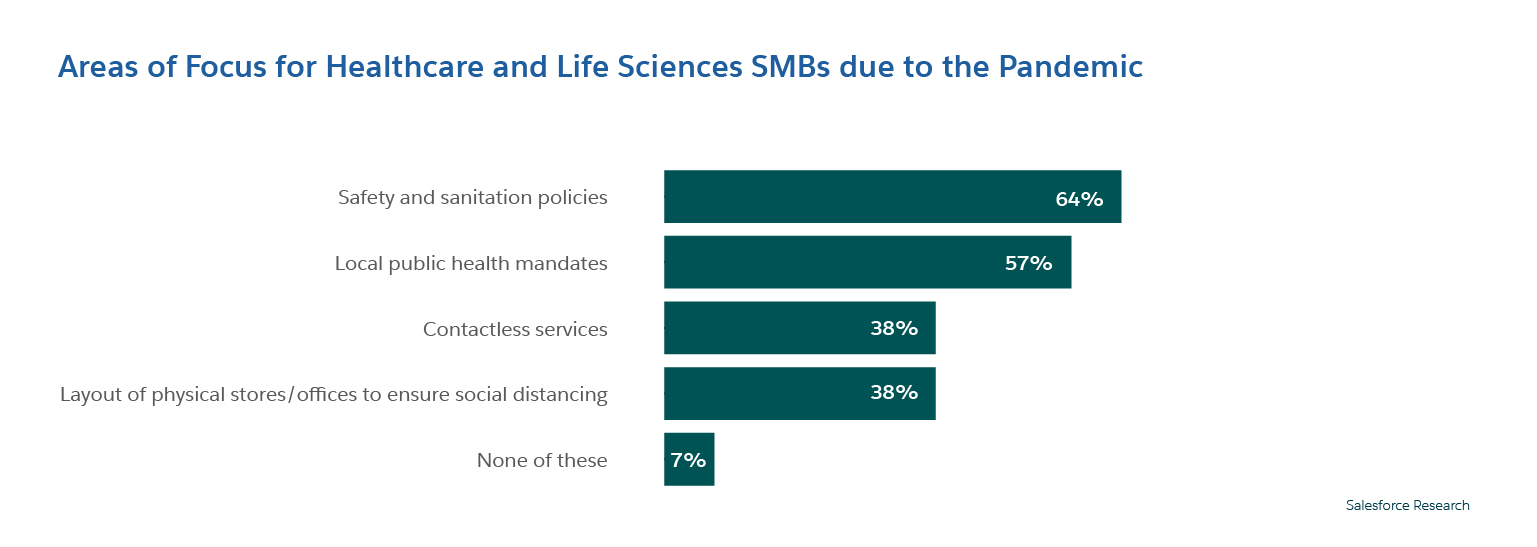

Protecting workers remains a top priority for these businesses. In fact, safety and sanitation policies top the list of focus areas, followed closely by a focus on local public health mandates.

Protecting workers remains a top priority for these businesses. In fact, safety and sanitation policies top the list of focus areas, followed closely by a focus on local public health mandates.

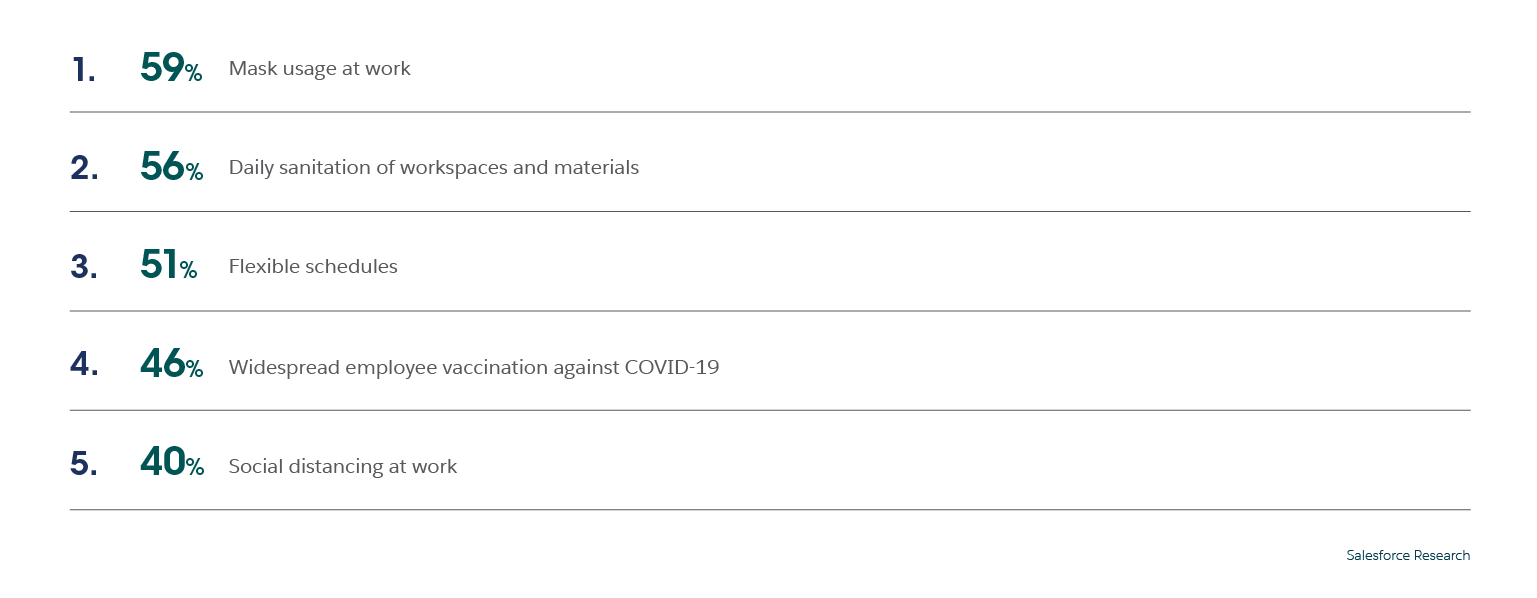

Health and safety is also top of mind for employees, dominating the top five list of employee expectations:

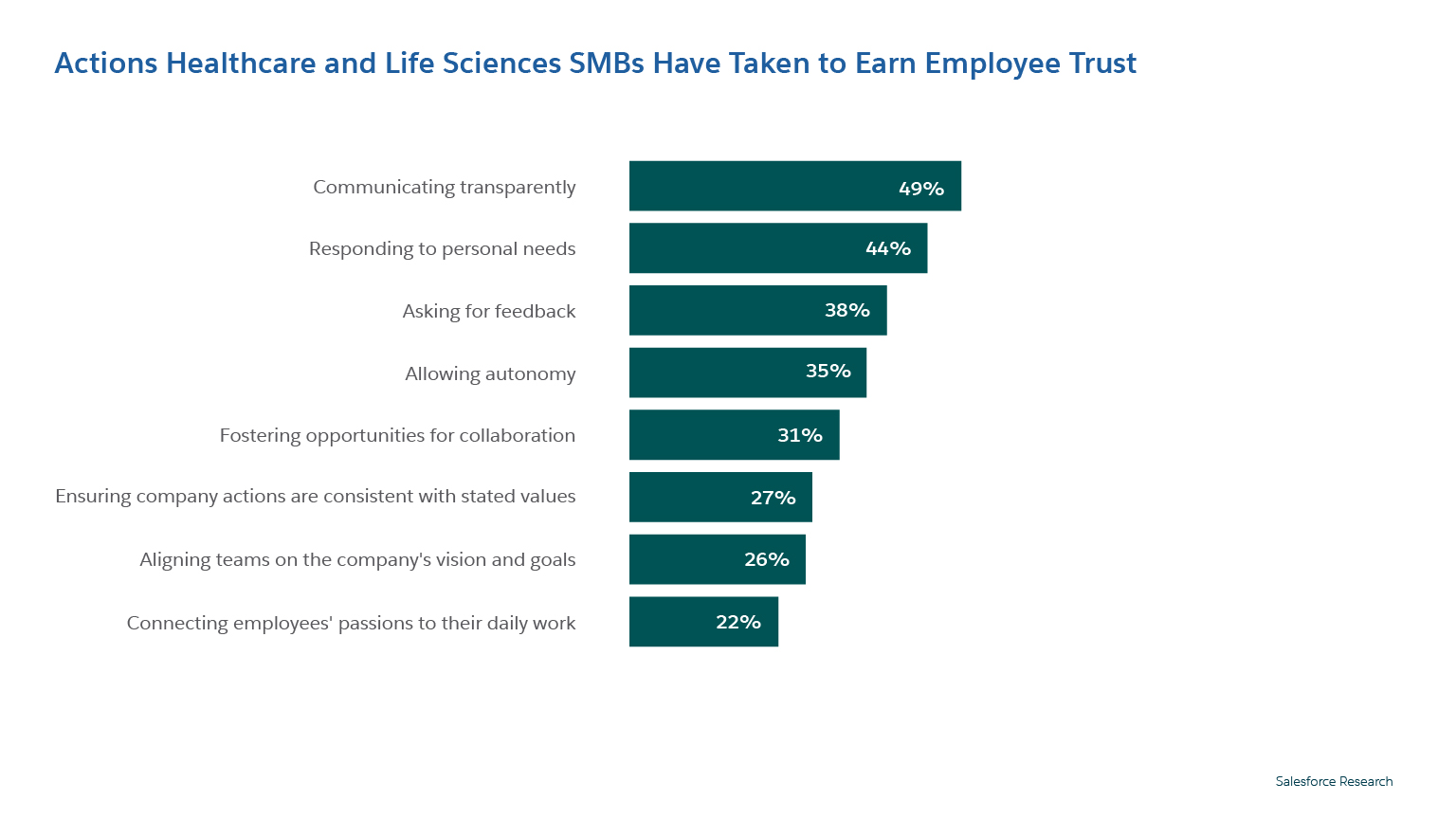

Employee engagement challenges in the HLS industry have been well documented, and SMBs in this space are especially feeling the crunch. Virtually all businesses (93%) are taking proactive steps to earn workers’ trust. They’re prioritizing communicating transparently, responding to personal needs, asking for feedback, and more.

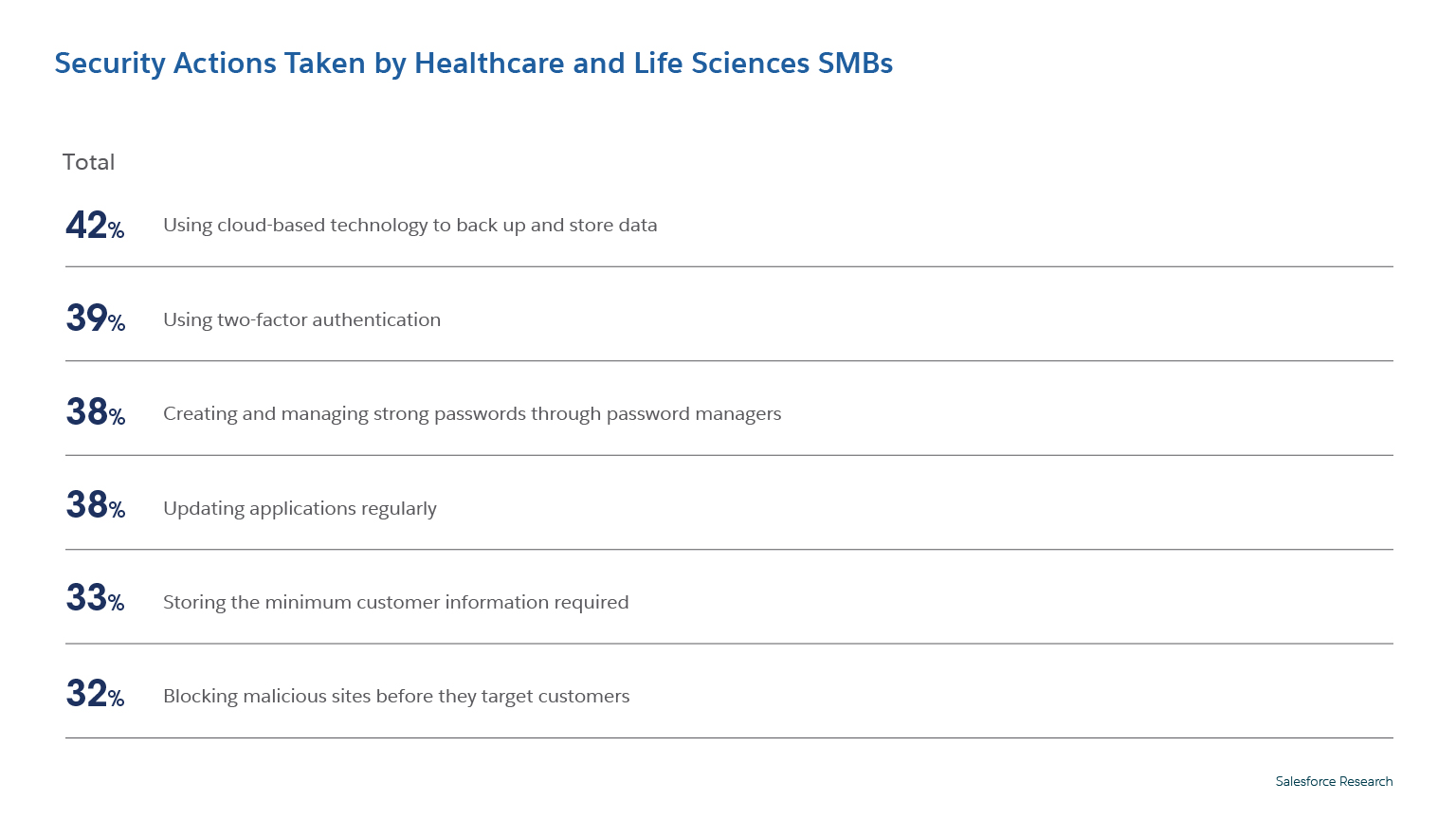

They are also taking steps to earn customers’ trust. The vast majority of healthcare and life sciences SMBs (91%) are implementing at least one of these practices to keep customers’ information safe:

Today’s businesses also have to live up to greater expectations. Our fourth edition “State of the Connected Customer” report found that 90% of customers say that how a company acts during a crisis demonstrates its trustworthiness. And the report shows that customers are anticipating swift responses: 83% expect to engage with someone immediately when contacting a company, up from 78% in 2019.

Trend #3: Human interactions in a digital-first world.

HLS is an industry established around human interactions, and the pandemic forced a rapid acceleration to a digital-first world.

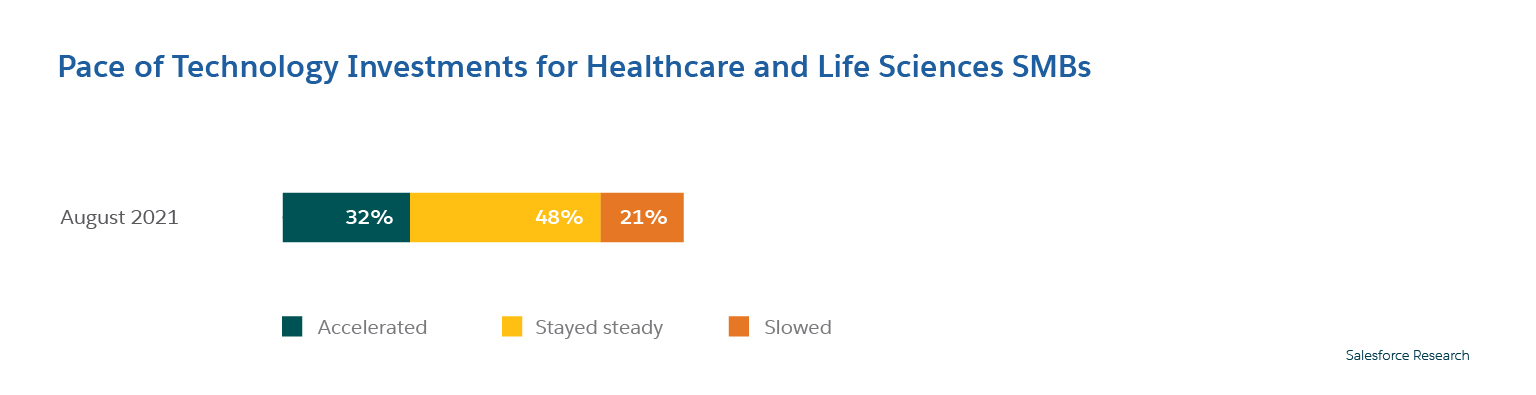

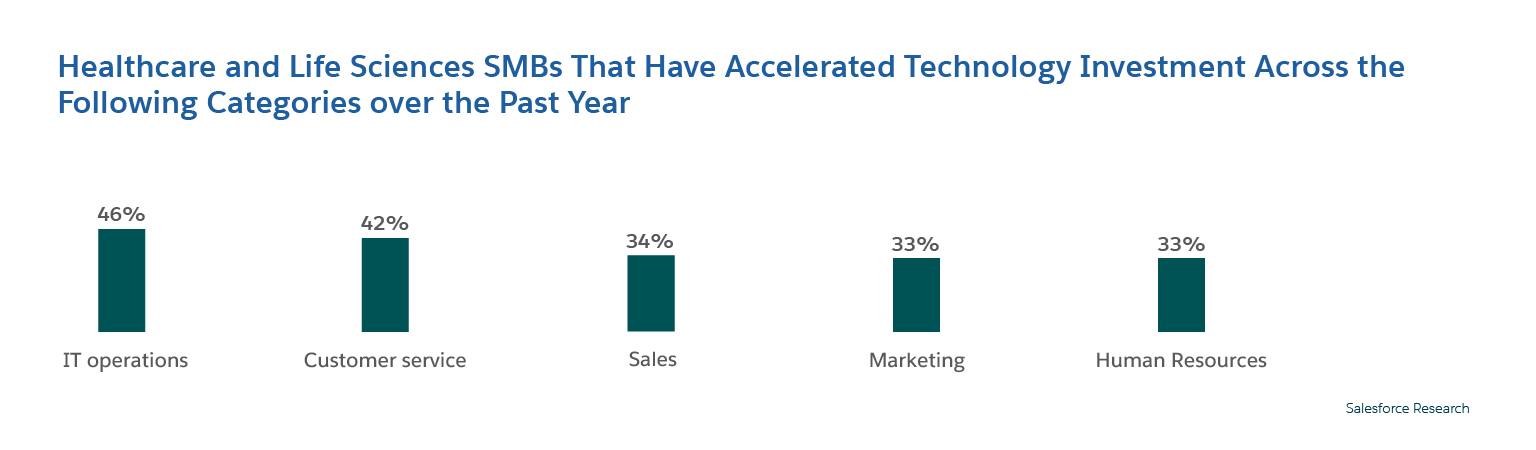

To make the leap, around a third of healthcare and life sciences SMBs (32%) dialed up their spend on investing in technology in the past year. Nearly half (48%) of these businesses cited personalizing customer interactions as a motivator. Rounding out the top five list of motivators for making the technology investments: improving business agility (54%), increasing productivity (52%), increasing data security (46%), and getting a competitive advantage (38%).

These investments in the latest technology were crucial: 60% of healthcare and life sciences SMBs say their business survived during the pandemic because of digitization. More than half (58%) report that they could not have survived the pandemic using technology from a decade ago.

Trend #4: Key pandemic-era changes are here to stay.

The shifts made to business operations in response to pandemic-era challenges will be enduring. More than two-thirds of HLS business leaders (69%) say the changes they’ve made over the past year will pay long-term benefits. Customer expectations also appear to be changing permanently, with 64% of businesses reporting that their customers expect transactions online.

Sixty-nine percent of healthcare and life sciences SMB leaders believe the changes they've made over the past year will benefit them long term

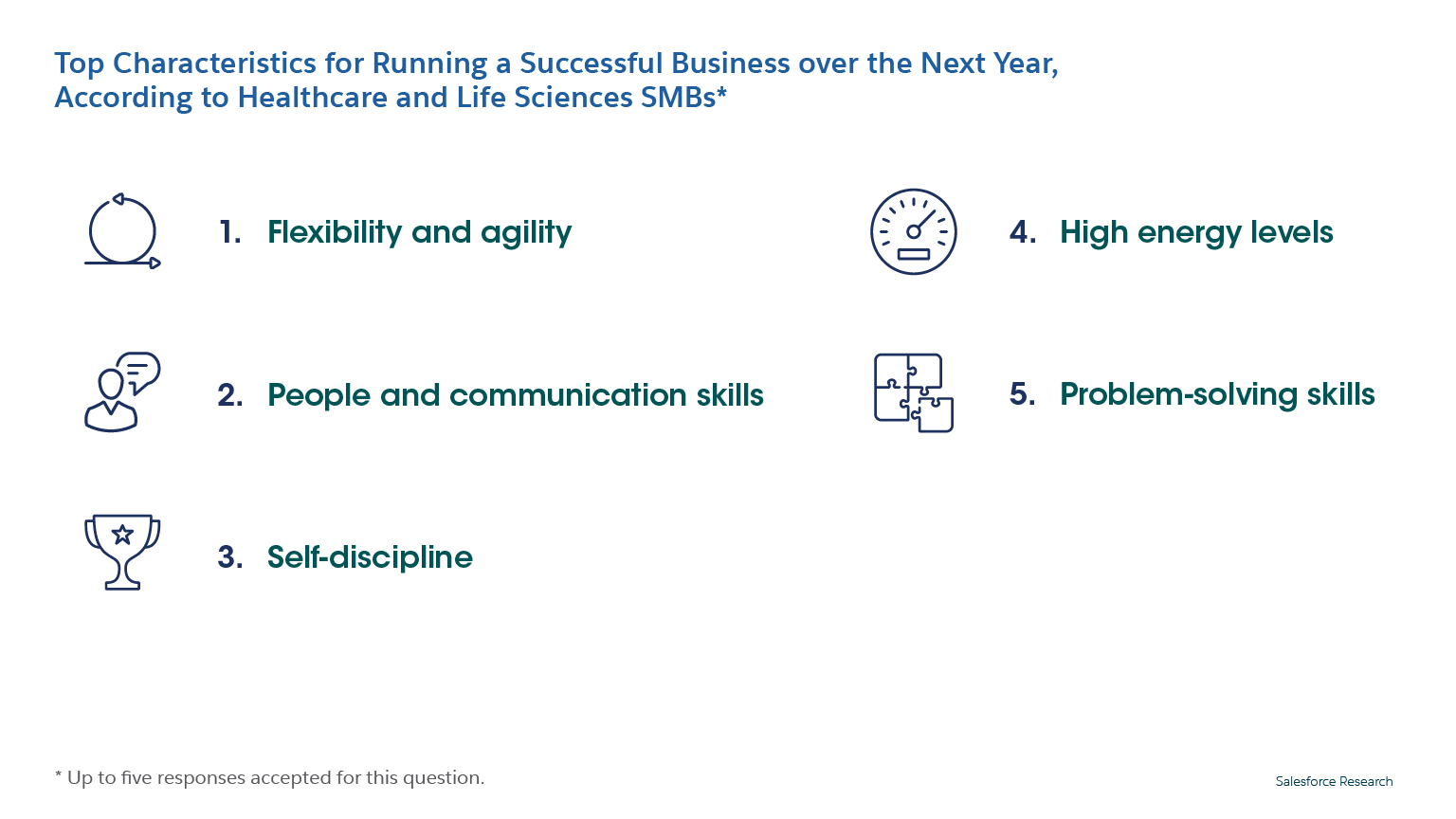

As the demands of the market continue to shift, healthcare and life sciences SMBs are keeping pace by evolving with it. In doing so, they are developing deep market knowledge and new core muscles in flexibility, agility, and problem-solving. Combine these traits with an innovative mindset and it appears that many of these SMBs are equipped for the year ahead.

Looking for more insights? Download the full “Small and Medium Business Trends Report” for a deeper look at the current perceptions of SMB leaders and how they’ve changed during the pandemic.

About the survey:

The survey was conducted online by the Harris Poll on behalf of Salesforce between June 21 and July 12, 2021, among 2,534 SMB owners and leaders in North America, South America, Europe, and Asia Pacific. The sample included 148 SMBs in the healthcare and life sciences/biotech industries. Respondents are 18 years of age or older; employed full-time, part-time, or self-employed; and owners or senior executives at businesses with 2–200 employees and annual revenue of less than $1 billion U.S. or the local equivalent. Data points were weighted by number of employees to bring them into line with actual company-size proportions in the population.

More Resources

Research

Fifth Edition: Small & Medium Business Trends Report

Demo