Increase productivity for sales and account management teams with FSC for Insurance Brokerages.

Read the releasePower sales, service, and marketing on a single, AI-driven platform

Salesforce Customer 360 for insurance enables agencies and brokerages to connect and empower their entire organization spanning Marketing, Sales, Service, Data, IT and Analytics. Provide producers and account managers with Agentforce to handle manual work so they can focus on deepening trusted client relationships and growing revenue.

Agencies and brokerages are modernizing operations on a unified platform.

Our teams use automation to simplify how we handle new business, renewals, and so much more. With Salesforce, we’ve achieved millions in cost savings and saved thousands of employee hours while delivering better client experiences.

Andy Smith-JonesSalesforce Solutions Architect, Holmes Murphy

Power all of your digital marketing from one place

Consolidate your marketing tech stack, deliver out-of-the box producer marketing, and design, execute, and measure demand generation campaigns all from one platform.

How it works:

- Consolidate your marketing tech stack. Power all your marketing functions — including digital advertising, email activation, and social media — on one AI-driven platform.

- Easily deliver on-brand content, resources, and tools to your sales and marketing teams. All powered by predictive, generative, and autonomous AI.

- Design, execute, and measure demand generation campaigns. Drive ROI on a connected marketing and sales platform that leverages insights, automation, and segmentation to qualify, score, and deliver high quality leads.

Build your digital marketing solution with these Salesforce products:

Accelerate growth with AI-driven sales

Deliver Agentforce Sales Coach (ASC) to up-level training with autonomous AI, power a 360 producer desktop, and streamline your opportunity management to drive growth with #1 AI CRM.

How it works:

- Leverage Agentforce Sales Coach (ASC) — powered by your CRM data. Enhance support for producers, helping them prepare more effectively for client meetings and receive tailored feedback based on the specific deal and its current stage.

- Power a producer desktop. Unify lines of business around a 360-degree view of each client, carrier, and partner to efficiently deliver personalized engagements.

- Improve and simplify opportunity management. Streamline sales processes from lead tracking through proposal management. Implement pre-built sales stages that organize and automate client engagements to increase productivity and drive cross-sell and upsell opportunities.

Build your AI-driven sales solution with the following Salesforce products:

Drive seamless employee and client onboarding

Simply and accelerate client and employee onboarding by seamlessly transitioning new business to account management teams — while orchestrating end-to-end talent management spanning training, licensing, and career development on Salesforce.

How it works:

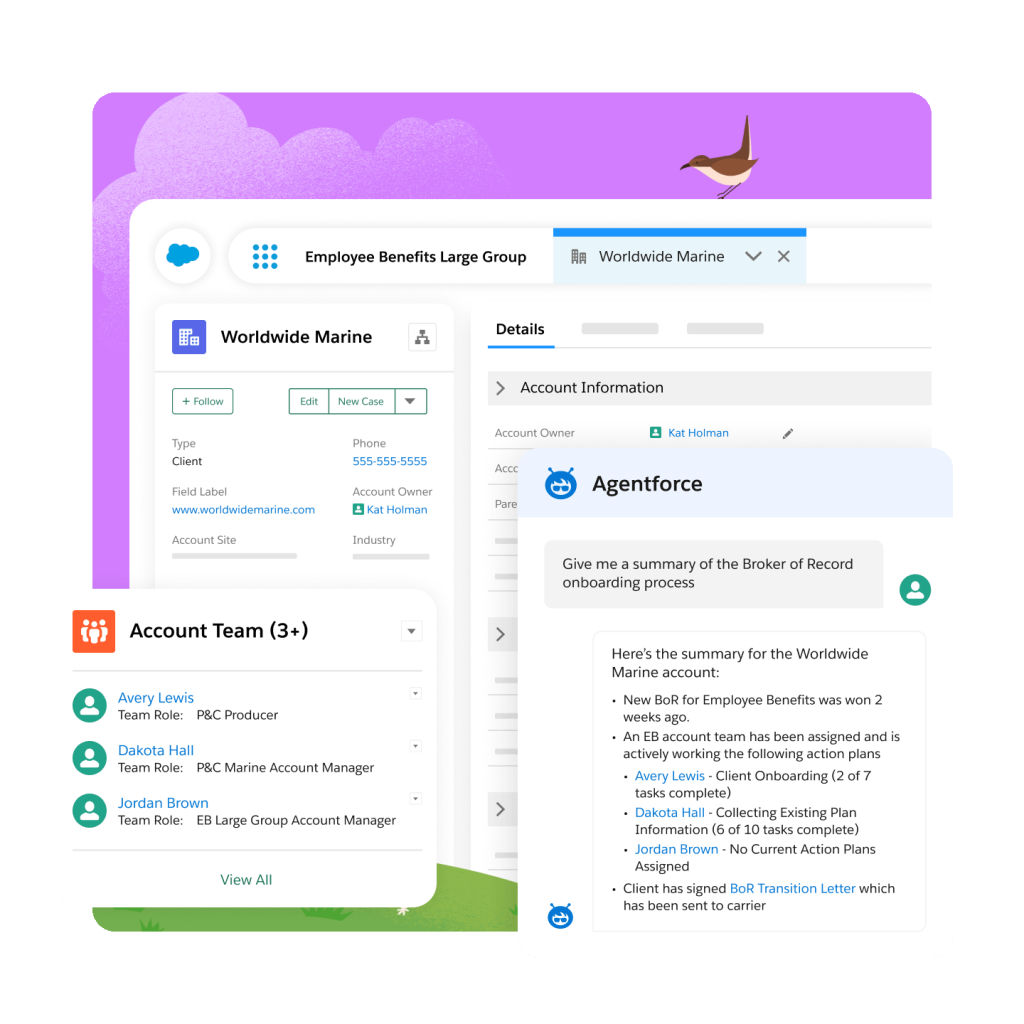

- Streamline client onboarding. Transform the broker of record (BOR) onboarding process into a connected, client-centric experience that spans documentation gathering, progress reporting, client communication, and self-service engagements — powered by our Broker of Record Tracker feature.

- Enhance employee onboarding. Recruit, appoint, and retain top agents and brokers with modern, innovative technology. Orchestrate end-to-end talent management spanning training, licensing, career development, and more.

- Enable seamless merger and acquisition data management. Use the Salesforce Customer 360 tech stack to facilitate data sharing, task management, and collaboration with your new partner agency.

Build your client and employee onboarding solution with these Salesforce products:

Scale personalized, AI-driven service

Automate retention with Agentforce, empower account teams, manage the full life cycle of policies and power renewal and RFP management on a modern, unified platform.

How it works:

- Automate retention with Agentforce. Leverage Agentforce to forecast potential lost broker of record and proactively notify account teams with client details. Empower staff with next best actions, generative AI, and automated outreach to save business at scale.

- Empower account teams. Keep relationship data and analytics in one place to better serve clients on the Insurance Service Console. Reduce handle times and make new representatives more efficient with embedded AI to create insight-driven responses.

- Manage the full life cycle of policies. Capture policy-header information and underlying line of business data including limits, coverages, deductibles, and benefits — in a purpose-built data model with lifecycle business processes for renewing and canceling policies.

- Enable claims tracking. Improve the efficiency and effectiveness of tracking when you convert email claims notifications to cases automatically and create claims.

- Power renewal and RFP management. Orchestrate the end-to-end renewal and RFP processes from one central place. Use automation to remove unnecessary steps and simplify with reusable question banks. Create complex forms from a single source of truth while maintaining the traceability of questions.

Build your insurance service solution with these Salesforce products:

Enable producer splits and revenue management with ease

Power producer split arrangements and assignments, enable direct bill commission processing and reconciliation, and track revenue to increase team productivity and make decisions faster.

How it works:

- Enable producer split arrangements and assignments. Simply and streamline tasks with a library of reusable producer split definitions for initial and renewal terms, based on named producers or roles. Easily update and reassign splits in bulk as producers or definitions change.

- Power Direct bill commission processing and reconciliation. Reconcile statements with a flexible system that ingests carrier commission statements, matches them to brokerage policy records, determines producer splits, and calculates producer commission amounts and/or production credits.

- Deliver an Expected Revenue Tracker. Track expected revenue to compare with actual commission statements and identify revenue discrepancies.

Build your producer splits and revenue management solution with these Salesforce products:

Financial Services Cloud for Insurance Brokerages

Modernize operations on a unified platform that automates processes, deepens relationships, and drives growth.

Keep up with the latest insurance trends, insights, and conversations.

Ready to take the next step with the world’s #1 AI CRM for insurance?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Agencies and Brokerages FAQ

Salesforce is the world’s #1 AI customer relationship management platform. Salesforce’s 360 approach for insurance empowers insurers and their distribution partners to manage all core operations – front, middle, and back office – from one system.

Salesforce has an open API architecture that integrates with other insurance agency management software. Salesforce is enabled with purpose-built solutions for processes from product modeling to policy and claims management. Harmonize data from multiple systems and gain insights for growth.

Contact centers face challenges with siloed systems, making CSRs navigate multiple platforms. Salesforce, an open platform, integrates with core policy and claims systems. AI capabilities like Einstein enable CSRs to anticipate customer needs, keep policyholders informed, and reduce call volumes.

Insurance agency and brokerage management software streamlines operations, automates policy administration, enhances client interactions, and ensures compliance, providing a centralized platform for efficient insurance business management and growth.

Property and casualty insurance software is crucial for insurers, optimizing policy management, claims processing, underwriting, and overall operational efficiency. It enhances accuracy, compliance, and customer satisfaction in the insurance industry.

Insurance agency and brokerage management software is crucial for optimizing operations, automating tasks, enhancing client service, ensuring compliance, and fostering growth, ultimately improving overall efficiency and profitability.

Insurance management software is vital for streamlined operations, policy handling, client relationship management, and compliance adherence. Using insurtech, Salesforce enables agencies and brokerages to connect and empower their entire organization, spanning marketing, sales, service, data, IT, and analytics.