Built on Salesforce, recently-launched digital subscription platform Santander Navigator delivers personalized growth strategies to small and medium sized enterprises (SMEs) looking to expand internationally.

Why it’s important: SMEs are crucial to the UK economy, but they face numerous challenges when seeking to expand their services abroad, including:

- Connecting with the right buyers and sellers

- Adapting to different regulatory environments

- Incurring the cost of exporting goods abroad

- Banking

Driving the news: Zahra Bahrololoumi, CEO of Salesforce UKI, spoke to John Carroll, Head of International and Transactional Banking at Santander UK, to unpack how Salesforce technology helps Santander support UK SMEs make the leap to international sales. Companies don’t have to bank with Santander to access the support of Santander Navigator.

In-depth: Previously, Santander’s manually built ecosystems offering industry-specific content and solutions would serve between 300 and 400 companies each year.

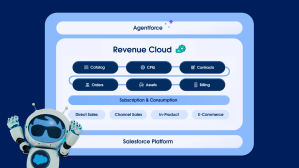

- With Salesforce technologies like Experience Cloud, Commerce Cloud, and Marketing Cloud, it has been able to completely transform its business model and scale its support to tens of thousands of companies.

- Equipped with the right insights and solutions, every banking proposition is personalized not only to every company but to every individual within that organization.

- This offering provides a clear differentiator between Santander and its competitors.

With Salesforce, we’re reimagining how we understand, serve, and engage with our UK SMEs. Our relationship directors are getting insights generated by the platform onto their dashboard on a Thursday before they see their clients on the Friday, to have transformational conversations which other banks can’t have. All of this enables our customers to grow faster, and for us to grow with them.

John Carroll, Head of International and Transactional Banking, Santander UK

The Salesforce perspective: “Supported by Salesforce technology, Santander is accelerating its transformation into a digital bank focused as much on the future as its customers,” said Bahrololoumi.

- “The Santander Navigator platform uses automation, intelligence, and real-time data to deliver smart, tailored user experiences at scale that exceed expectations and brilliantly fits Santander’s ambition for a simpler way of operating and helping their customers grow,” she continued.

What’s next: Santander plans to roll out its Navigator platform across other countries later this year.

- Transferring what has been built on Salesforce — both within the group countries of Santander and with partner banks — gives users more content and solutions to help them grow faster.

- And, partners on the platform will gain access to a broader universe of SMEs.

Go deeper: