Trends in Automotive.

Insights from 500 industry leaders on the digital imperatives transforming customer experience

Executive Summary

The automotive industry is in the midst of a historic digital transformation. Consider that today’s vehicles are computers on wheels that increasingly drive themselves. Customers who used to shop exclusively in the showroom can complete transactions online. Even repairs are going digital, with over-the-air updates fixing problems that used to require a mechanic’s attention.

It’s exciting to watch these innovations unfold. But for the companies that must continue to navigate steep and uncertain terrain, the pressure to maintain profitability is intense as research and development investments global competition, and environmental initiatives threaten margins.

To understand the industry’s challenges, Salesforce surveyed decision makers from original equipment manufacturers (OEMs), captive finance companies, and retailers. Here, we share what we learned about the risks and opportunities companies face as they plan for a profitable and sustainable future.

For the Trends in Automotive report, Salesforce Industries Insights surveyed 500 employees of original equipment manufacturers (OEMs), captive finance companies, and retailers worldwide to discover:

- The progress companies are making in providing digital customer experiences

- Why first-party data is important now

- The impact of electric vehicle investments on profits

Data in this report is from a double-blind survey conducted from April 20 to May 16, 2022 that generated responses from automotive director-level and above decision makers. Respondents are from North America, South America, Asia-Pacific, and Europe. All respondents are third-party panelists. Due to rounding, not all percentage totals in this report equal 100%. All comparison calculations are made from total numbers (not rounded numbers).

PART 1

Automotive customers ride a bumpy road

Perception and reality are two different experiences

Although customers were already patronising digital marketplaces like Cars.com to find and price vehicles, the pandemic, inventory shortages, and high prices are pushing them even further away from the showroom.

To keep up, OEMs, captive finance companies, and retailers are building on the digital experiences offered in other industries, such as retail. In this vision, customers can do more than browse available inventory. They can also choose their own options and trim, apply for financing, and schedule delivery (and even returns). The post-purchase experience looks different, too, as customers do everything virtually, from managing their loans to purchasing additional miles on their leases to downloading service updates.

Customers want price transparency and streamlined lending, but companies aren’t delivering

For many customers, buying a car starts with figuring out what they can afford. Online tools like loan calculators help them do this, but only 27% of captive finance companies rated their online automobile financing tools as far above average.

Even worse, only 24% of those surveyed report that the prices on their website consistently match what customers actually pay. That’s a problem, given that 74% of consumers say communicating honestly and transparently is more important now than before the pandemic.

A complex path-to-purchase is challenging ecommerce capabilities

Automotive’s path-to-purchase is complicated. As a result, digital experiences are lagging behind industries with simpler ecommerce transactions, such as apparel. Our research reflects this complexity: Less than one in five OEMs and retailers believe their digital storefronts are engaging and mobile-friendly. The same number also report inventory accuracy problems online.

Customers who want to use online channels to customise the options on a brand new vehicle also face challenges, according to retailers. For example, 79% report that customising trim and colour options online isn’t easy. The amount of time it takes to complete a transaction also leaves much to be desired, with only 21% of OEMs and retailers believing they offer a fast buying experience.

The post-purchase experience needs work

Next: Part 2: Automotive companies can build better customer experiences with the right data strategy.

Find out:

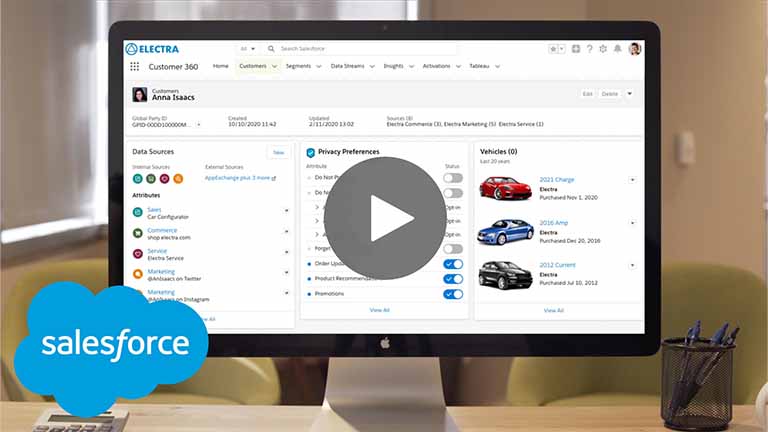

- Why companies need zero- and first-party data

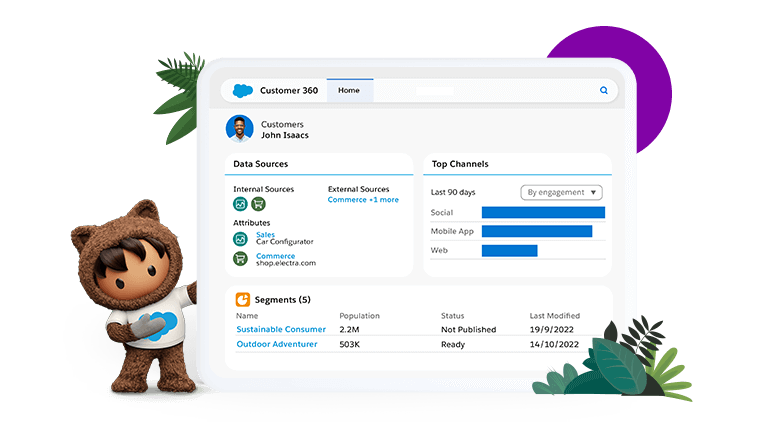

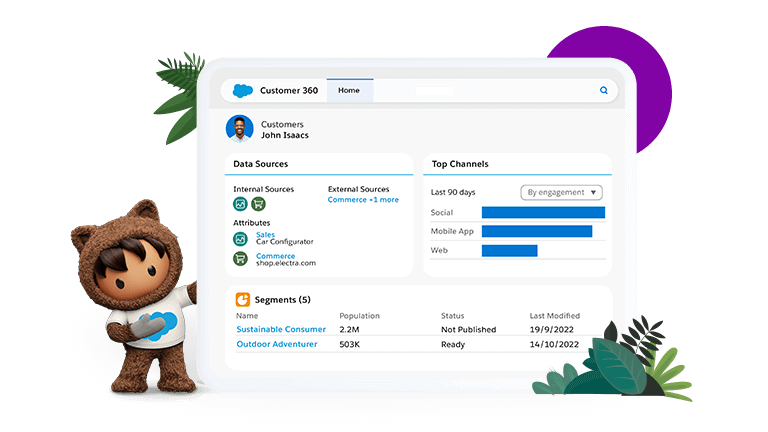

- Why unifying customer data is key to personalising communications

- How connected vehicle data is lighting the path forward