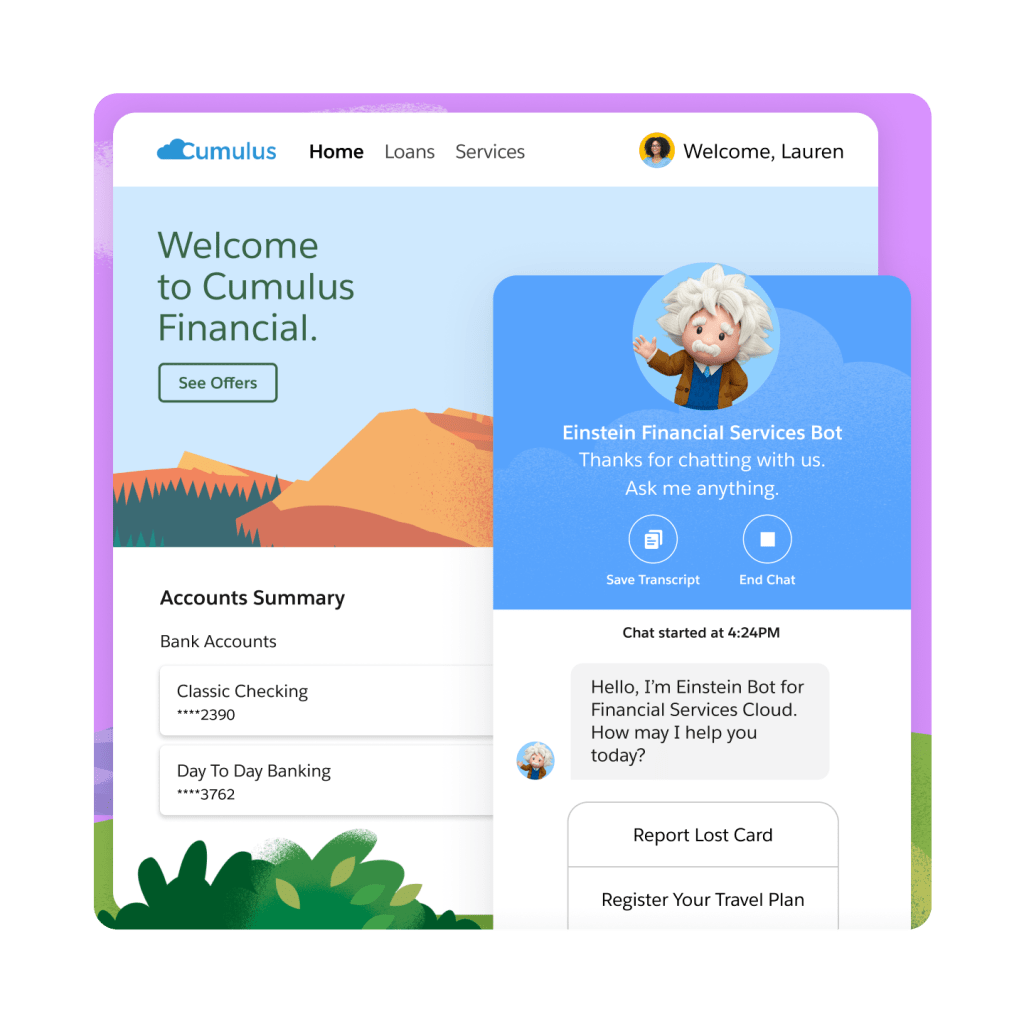

Financial Services Cloud

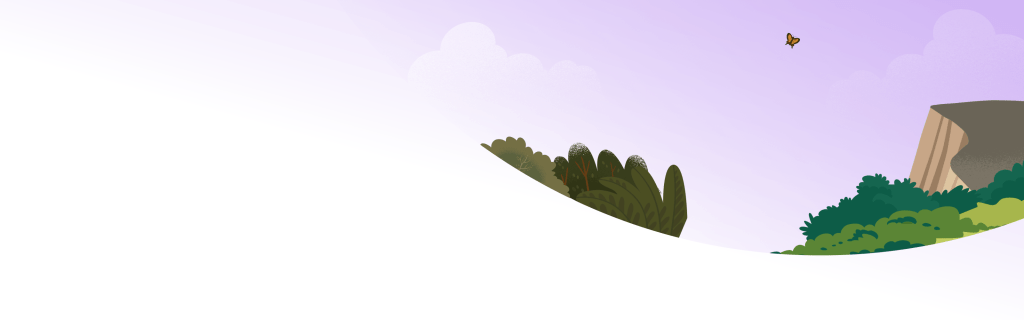

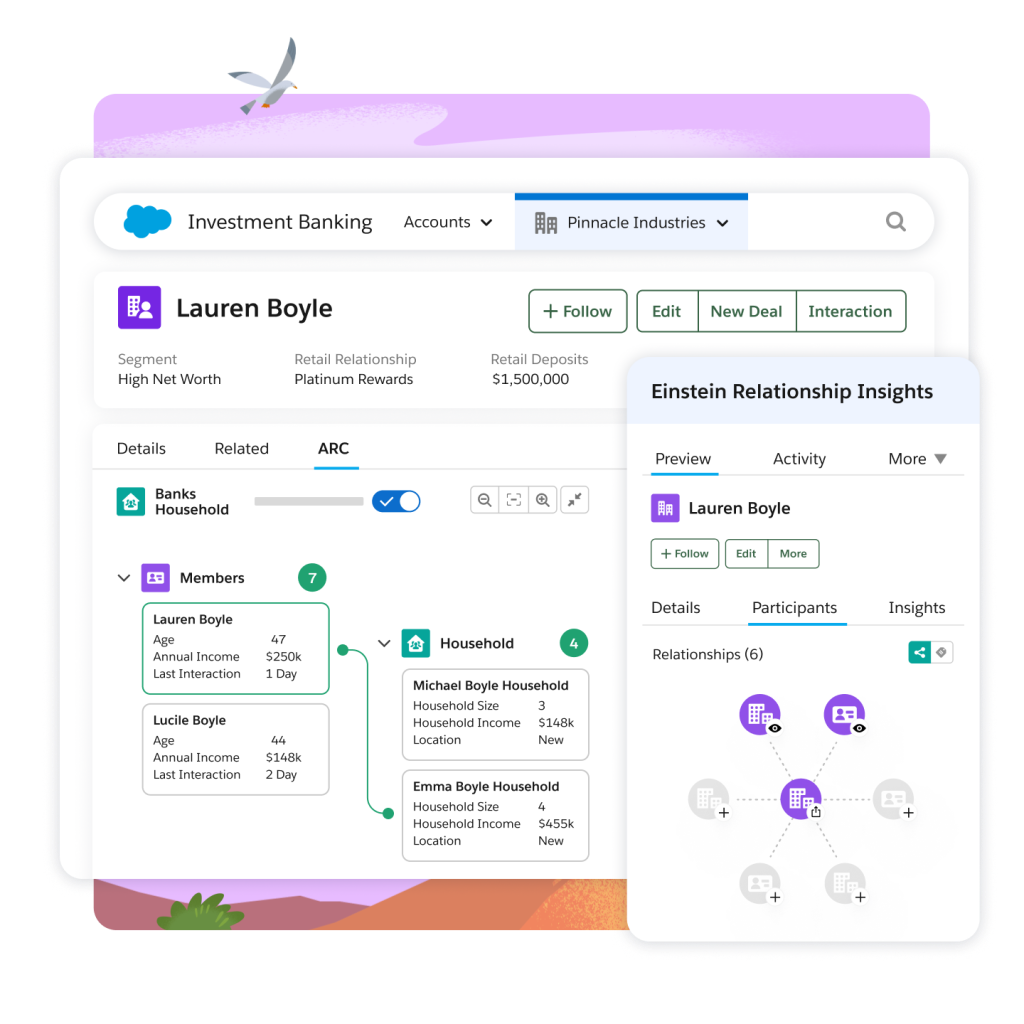

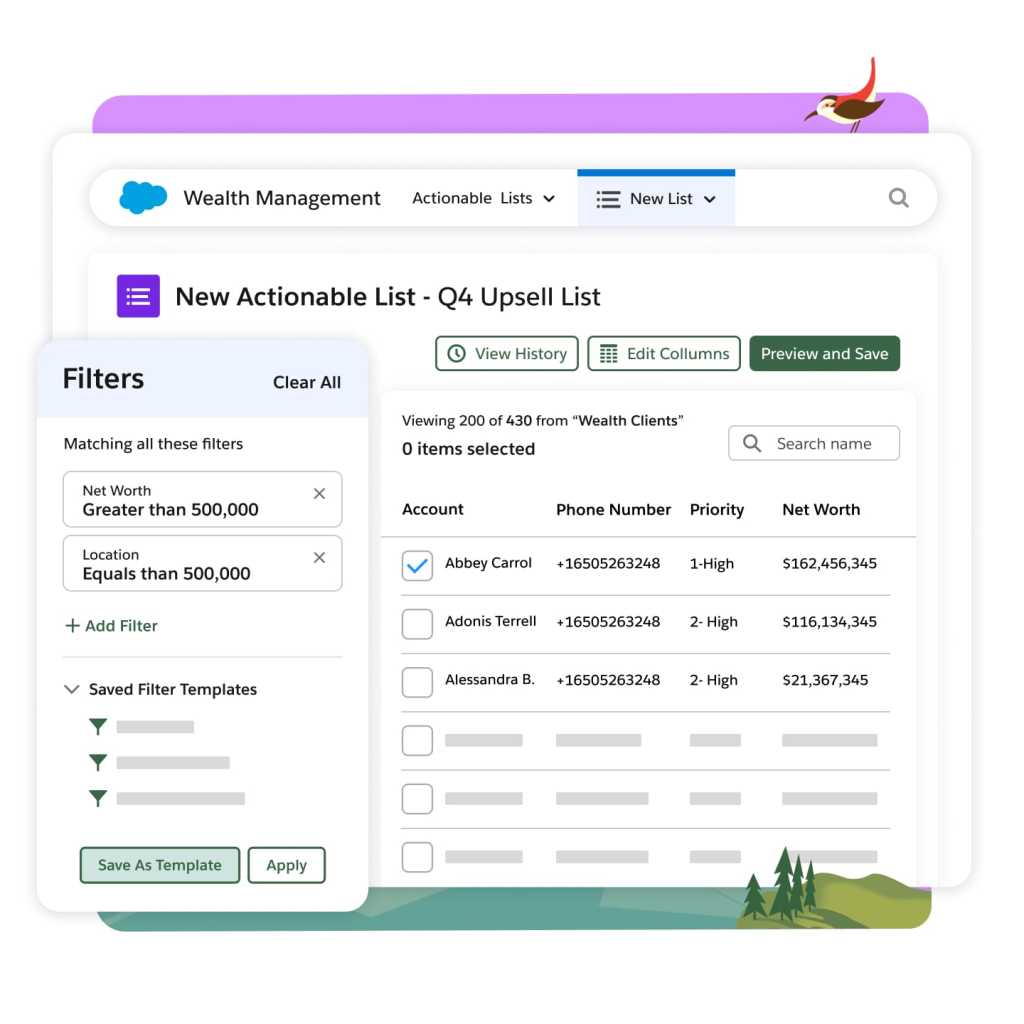

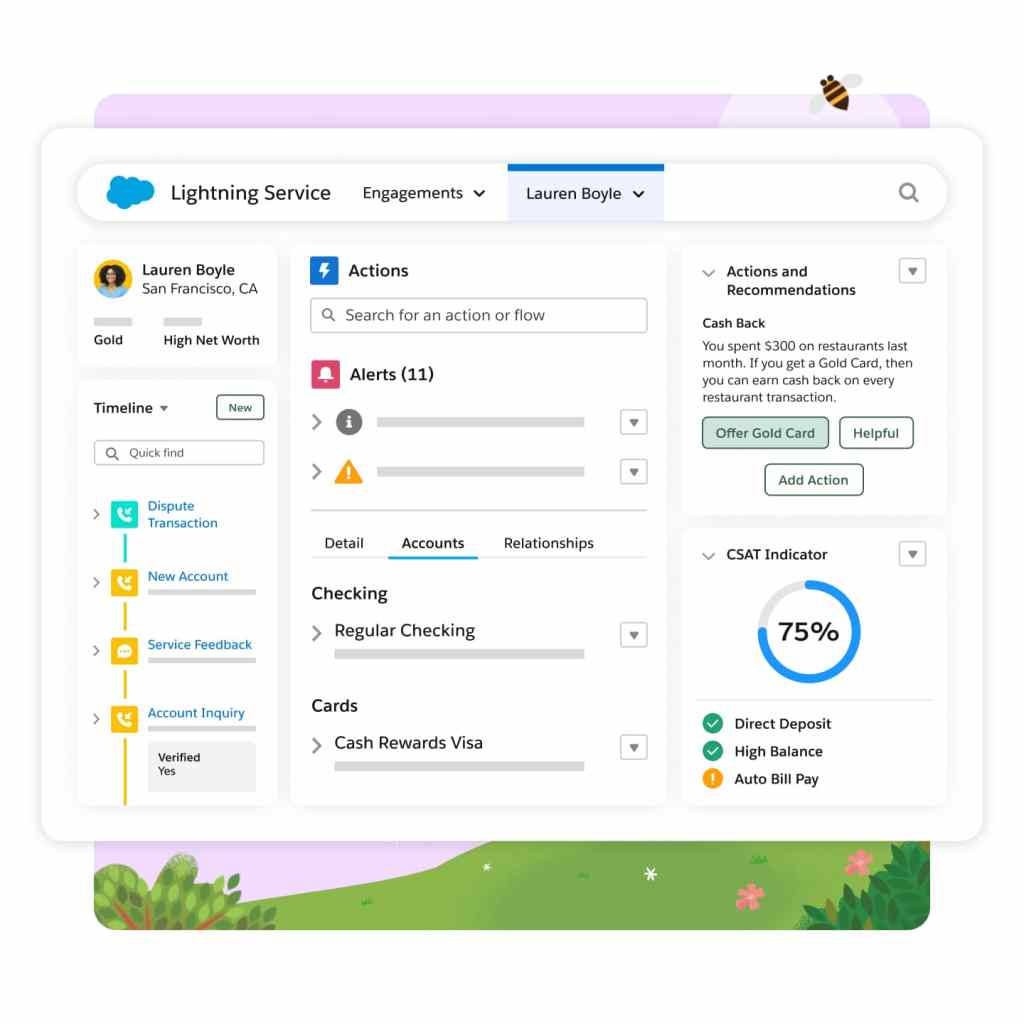

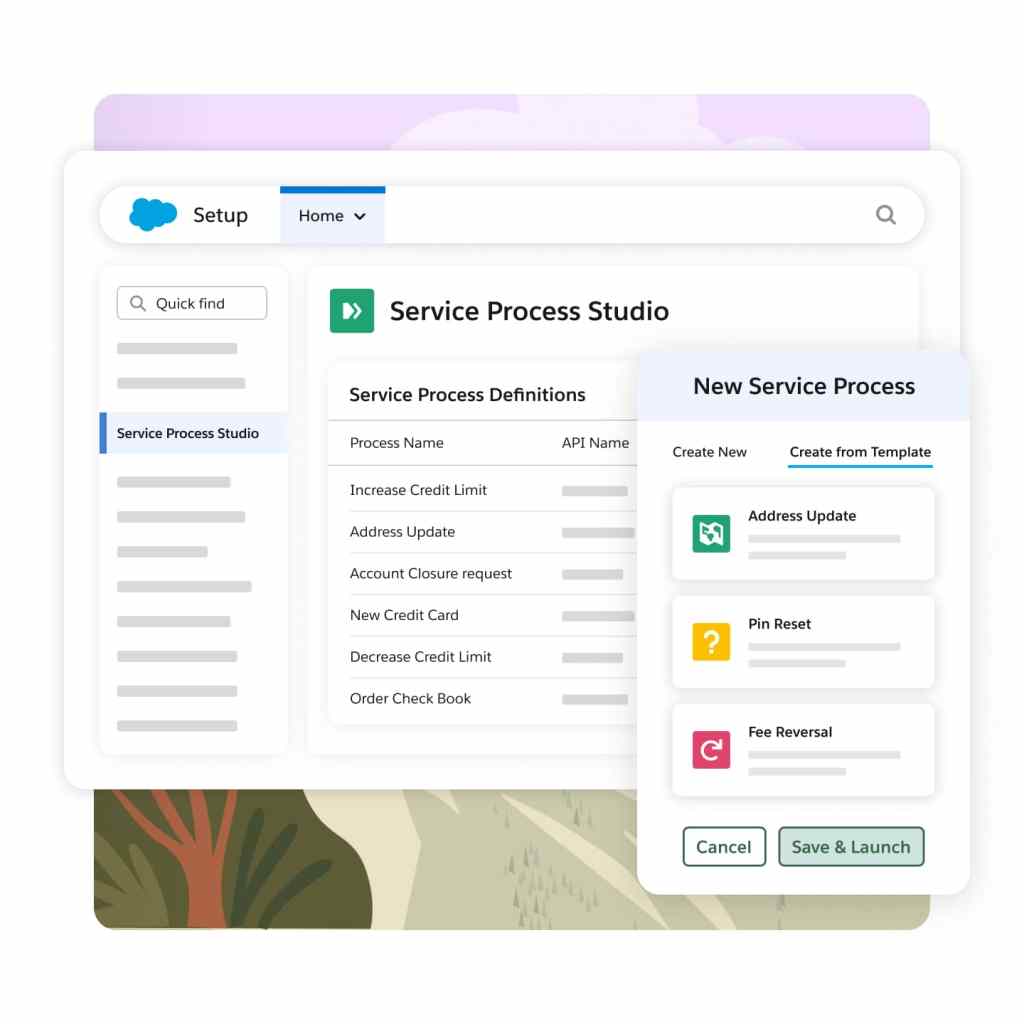

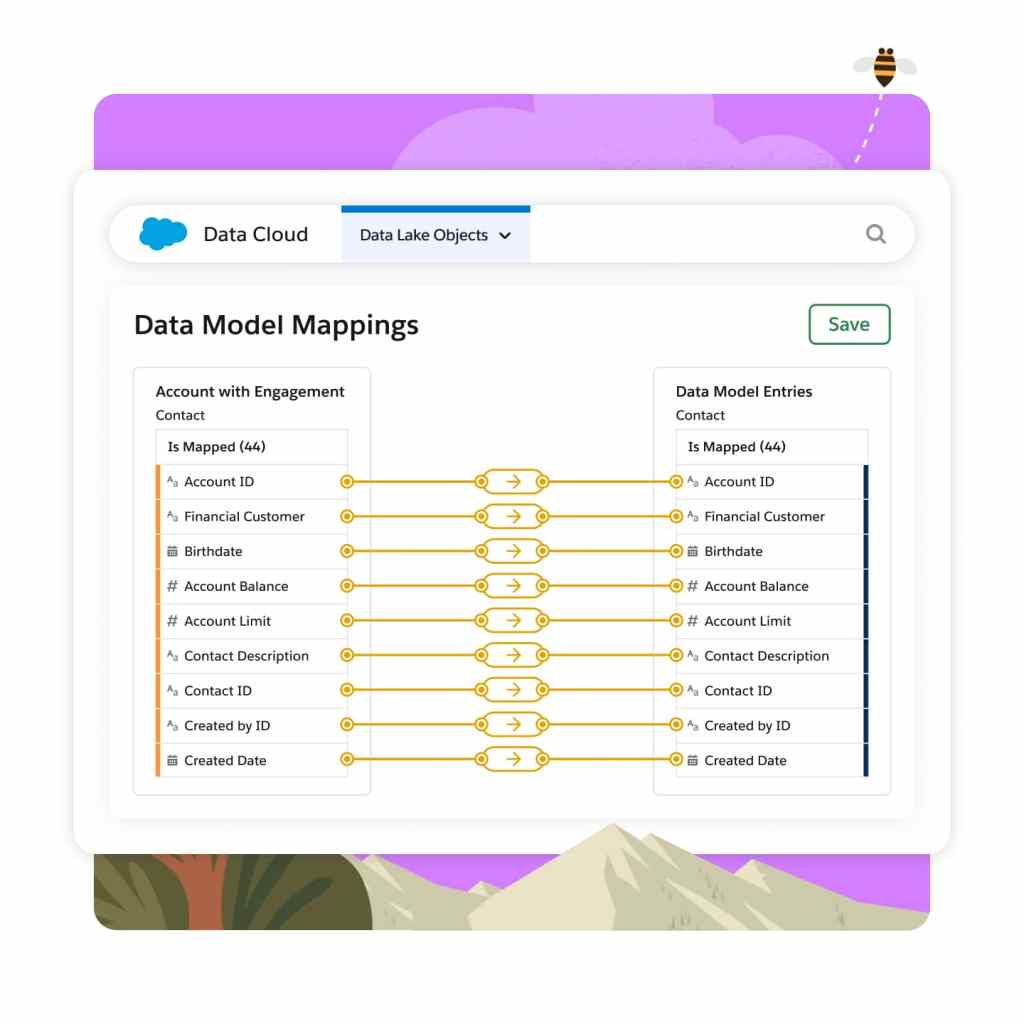

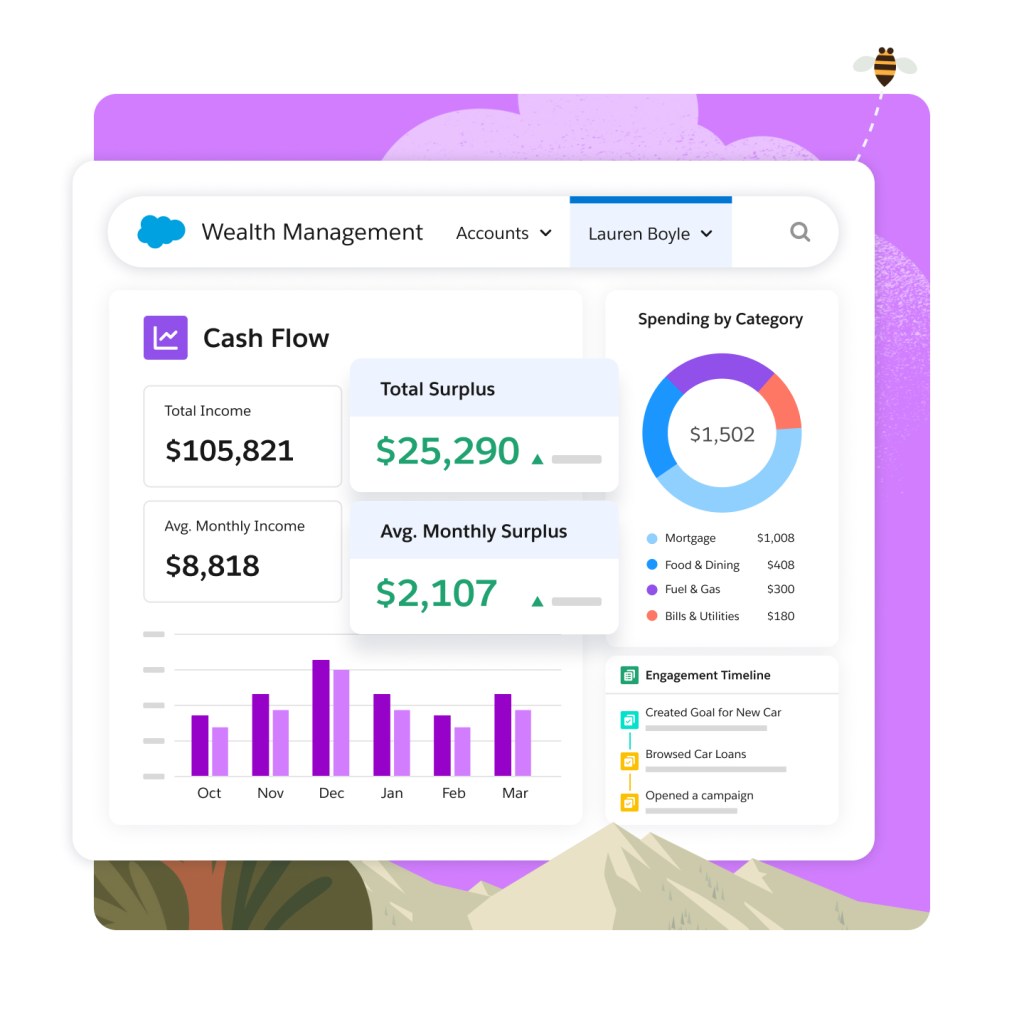

Discover the power of the world’s #1 AI CRM for financial services. Financial Services Cloud unlocks data from core banking, wealth, and insurance platforms and unifies it around the customer. Activate data to personalise engagement using purpose-built automation with industry-specific AI.